Attacks on US aftereffects on gas demand uncertain

While the Sept. 11 attacks on the US will add some uncertainty to the nation's projected demand for natural gas, Arlington, Va.-based Energy Ventures Analysts Inc. (EVA) expects heating season demand to be relatively flat compared with last year.

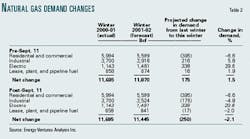

During the upcoming heating season, EVA estimates year-to-year natural gas demand changes will range from a decrease of 2.1%, or 250 bcf, to an increase of 1.5%, or 175 bcf.

The firm reckons that last month's events will have the greatest impact on the industrial sector's demand for natural gas: "Before Sept. 11, we estimated an increase in industrial demand of 5.8% (216 bcf) as industrial operators fuel-switched back to natural gas and increased their output," EVA noted. "But in light of these events, it appears that industrial demand could decrease as much as 4.8% (176 bcf) from last year due to sluggish economic growth."

In addition, residential and commercial demand is expected to decline by 6.6%, or 395 bcf, compared with last winter, EVA said. This projection, however, is based on a weather forecast for normal weather patterns and therefore could change, "as more accurate forecasts are available."

Offsetting these projected decreases in gas demand is an expected increase in demand from the electric sector of 29.6%, or 338 bcf, EVA reported. "This increase in demand is due, in large part, to electric generators switching from residual fuel and distillates back to natural gas because of low prices and environmental compliance," it said.

"Overall, the combination of storage levels [estimated at 500 bcf higher than last year at the beginning of the winter season], a modest increase in production, and flat growth in natural gas demand should ensure downward pressure on natural gas prices compared with last year," EVA said.

Last winter season

Many have described last winter as a "perfect storm" for tight energy supplies, EVA observed. "Following several years of below-average commodity prices, the natural gas industry was seeing decreasing production numbers, decreasing drilling activity, and a deep recession in the exploration and production industry," the firm noted. "At the same time, the rest of the US economy was experiencing the largest economic expansion in a generation. Even though there was a rise in natural gas use by the electric sector, total demand remained flat due to several warm winters that decreased residential and commercial demand," it said.

There were several factors that came into play to create a tight natural gas market in 2000, EVA observed. "One contributing factor was the energy situation in California, which accounted for 17% of the increase in demand in 2000. In addition, drought conditions early in 2000 throughout the Pacific Northwest decreased hydroelectric output. To meet the energy needs of the West, natural gas peaking units were brought on line and used continuously throughout the summer," EVA said.

The drought, which continued into the winter season, placed a strain on peaking plants. These plants, in turn, used more natural gas, EVA observed. "By November [2000], natural gas prices had already increased 100% and storage levels were at the lowest level since 1996," EVA said. "And when winter started, it started cold."

By late in 2000, natural gas prices escalated by 350% over the previous year, EVA noted.

"These high prices became a market signal for industrial operators and electric generators to switch fuels, if pos- sible, and for many industrial operators to shut down. Industrial demand dropped significantly. Only recently has industrial demand started to return.

"...There was a net increase in electric sector demand-despite large amounts of fuel-switching-and an overall industrial demand decline of 161 bcf, which equates to 1.07 bcfd in lost demand for the winter period (Table 1)."

Upcoming winter season

EVA's outlook for natural gas demand is similar to that of last year, "but the composition of that demand will be distinctly different," the firm noted. "Because the country has little experience with events like Sept. 11, determining their effect on economic recovery of the US and on natural gas demand is difficult. The impact of Sept. 11 will likely postpone an economic recovery through the winter, and overall we anticipate that demand for natural gas will be about the same as last winter."

Before the attacks, EVA had anticipated lower natural gas prices would likely "kick-start" the economic recovery within the US, thus rekindling natural gas demand for both the industrial and electric sectors. "This rise would have been offset largely by a decline in the residential and commercial sectors, based on the forecast of a normal weather pattern this winter (Table 2).

"Overall, the combination of storage levels being about 500 bcf higher than last year at the beginning of the winter season and a modest increase in production should have more than offset this anticipated increase in winter demand," EVA said.

"However, the events of Sept. 11 will have an impact on our economy and natural gas demand this winter and is the largest source of uncertainty for this winter's demand projections. Our pre-Sept. 11 analysis assumed that an economic recovery would start in the first quarter of 2002. This assumption is now in question.

"If the economic recovery is delayed, then the increased demand from the industrial sector identified in Table 2 is likely not to materialize. No one knows exactly how the events of Sept. 11 will impact our economy, but assuming a 10% decline in industrial output, overall natural gas demand will be 2.1% lower than last year."