PP industry will benefit

Unprecedented producer consolidations and technological changes will continue to change competition in the polypropylene industry.

Technological shifts include new and improved single-site catalysts (SSC) and unique combinations of monomers to make new materials.

With these changes, the industry has also weathered complex legal issues. Major industry expenditures, time, and resources will begin to pay off when producers use industry restructuring and technology to their advantage.

In terms of production volume, polypropylene was and is one of the fastest growing polymers in history. During the past 5 years (from first quarter 1995 to first quarter 2000), world production capacity for polypropylene has increased by more than 50%-a rate of 10%/year. By the end of 2003, polypropylene-production capability will increase by yet another 35%, bringing global polypropylene capacity to about 42 million tonnes/year (tpy).

Technology helps margins

Despite this impressive growth and continued consolidation, the industry remains long in polypropylene supply; monomer prices continue to increase alongside energy costs.

As a result, producers will likely see lower than desired margins and earnings for at least the next couple of years. Technology in the form of new catalysts and processes, however, may enable companies to recapture lost margin.

Benefits from the introduction of SSC (metallocene and others) have not yet been fully reflected. While SSC have been proven, commercial development has been slow. This delay is a result of slower than expected market acceptance and concerns over legal impediments.

Legal issues are now being resolved, however, and markets are learning to benefit from the new technologies. Thus, the new and improved polypropylene products are in a position to be more readily accepted.

Improved SSC permit the precision tailoring of polymers to give specific structures, which gives rise to new and better properties. Beyond homopolymer polypropylene, these new catalysts will allow the development of functionalized (in situ) polypropylene copolymers and terpolymers, making polypropylene a "technology vehicle" for higher performance and value added grades of resin.

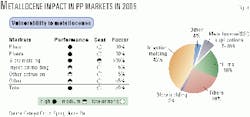

Because of new SSC, Catalyst Group is projecting substantial market growth for new polypropylene products, including for functionalized copolymers, during the next several years (Fig. 1). Understanding these technology changes and positioning businesses accordingly are essential to sustaining competitive advantage.

The range of new catalysts includes higher activity Ziegler-Natta, traditional bis-cyclopentadienyl (bis-Cp) metallocenes, ligand variations on the bis-Cp theme, mono-Cp structures and analogues, and late transition metal SSC, including diimines and biphosphines. Fig. 2 presents several exemplary structures.

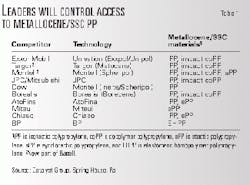

Owners of the intellectual property control access to these and other technologies. Although others continue to develop new technology, it is always a concern that the original innovators may still control rights to practice even the more newly developed technologies.

Some of the new SSC are also capable of copolymerizing ethylene or propylene with functional polar monomers such as methyl methacrylate (MMA). An example is the use of catalysts based on late transitional metals and di-imine ligands.

The physical and performance properties of polypropylene will be the key criteria for end-use selection. In addition, the economic tradeoff between current materials and the substitution of polypropylene grades is most relevant.

Fig. 3 shows projections for market vulnerability of traditional polypropylene markets by new polypropylene products in 2005 as a result of performance and cost benefits for metallocene technology. The new technologies will penetrate the respective markets by the factors noted in Fig. 3. The scenario would be different for nonmetallocene SSC systems.

Consolidations; tech access

While poised for major technological innovation, the players in the polypropylene industry are changing.

With restructuring and consolidations, the numbers are shrinking. Fewer companies are now controlling ever larger and increasing capacities.

The new company Basell NV (a joint venture of BASF AG and Shell polyolefin businesses, including holdings in Elenac, Targor, and Montell) will create the largest polypropylene entity ever formed.

The optimum capacity for major producers in North America and Western Europe 5 years ago was 1 million tpy, and the minimum size of a world-scale plant was 220,000 tpy.

Today, the optimum capacity for a major producer has risen to close to 2 million tpy. Some new polypropylene plants approach 440,000 tpy in size.

Despite these larger companies, small regional producers may still be considered attractive for product integration and strategic reasons. Two examples are Sunoco Inc.'s acquisition of Epsilon Products Co. in the northeast US in 1999 and Sunoco's purchase of Aristech Chemical Corp. at the beginning of this year.

Consolidation not only impacts scale and size, but also influences the control of and access to technology (Table 1). As an example, one outcome of Basell is the sale of the BASF/Targor polypropylene technology (Novolen) to a new joint venture (JV) consisting of ABB Lummus Global (80%) and Equistar Chemicals LP (20%), with Engelhard Corp. owning and operating the Ziegler-Natta catalyst plant.

No doubt, this is a business model that will promote access to this technology. Basell will retain the metallocene technology from Targor, controlling access for its own competitive advantage. It is also possible that Basell may offer selective parts of the technology via Montell's Spheripol process.

Since 1997, the merger and acquisition frenzy has been intensely gathering pace all over the world. In Europe, the 17 polypropylene producers that existed in 1993 have now been whittled down to 12 companies. Among these, the huge Basell corporate entity may be the most potent.

BP's acquisition of Amoco also represents a powerful new polypropylene force, especially when teamed with BP's strength in polyethylene.

The merger of TotalFina with French oil and chemicals major Elf Aquitaine, previous parent of Atochem, has also created a stronger propylene position for the resulting merged group, called AtoFina, in both the US and Europe.

Other major oil sector deals, such as the Repsol (Spain) acquisition of YPF (Argentina), have had significant impacts on the polypropylene industry.

Exxon Corp.'s acquisition of Mobil Corp., although primarily impacting polyethylene, will likely have global carryover to polypropylene. In 1998, Dow Chemical Co. entered polypropylene by the commissioning of a new plant in Germany.

Japan has seen marked restructuring and consolidation in its polypropylene production base. During the period 1995-97, it has combined 14 manufacturers to form 7 companies. Japan Polyolefin Co. (a JV of Showa Denko KK and Nippon Petrochemical Co. Ltd.) was formed in mid-1999. A JV between Mitsubishi Chemical Corp. and Tonen Chemical Corp. formed Japan Polychem Corp.

Further reduction in numbers in Japan is likely as smaller polypropylene operations come under intense competitive pressures. For example, Mitsui Chemicals Inc. will likely acquire Sumitomo Chemical Co. Ltd. in 2001.

In Asia and the Middle East, three new polypropylene-producing countries are entering the fray: Saudi Arabia, Iran, and India. The Asia-Pacific region's polypropylene capacity (excluding Japan) represents about 28% of global capacity. While polypropylene growth has slowed as a result of the financial crisis in Asia, India has come back strong with major projects and new plants from Reliance Industries Ltd., Haldia Petrochemicals Ltd., and the Montell JV.

Even China has not escaped the consolidation trend. Numerous semi-independent operators in China have consolidated into two polypropylene groups to make the industry more competitive.

China has announced new polypropylene capacity that will move it ahead of South Korea as the largest Asian polypropylene manufacturer.

Success factors

The success of industry restructuring is linked to the success of the new technologies. In addition to market acceptability, the future of new polypropylene technology will be driven by the robustness of the technology and the producer's implementation of it.

A technology owner's size and scope and its willingness to license the technology will have a strong impact on technology success.

The critical requirements for producer success include:

- Technology scalability and implementation.

- Market requirements and unmet needs.

- Overall resin cost and performance balance.

- Producer's technological experience and reputation.

- Producer's market history and credibility.

As a result of new catalyst technology developments in the preparation of polyolefins, certain novel copolymers and terpolymers may become cost-competitive in new markets, such as engineering thermoplastics and elastomers.

In many cases, the new materials based on monomer systems had formerly been difficult, if not impossible, to combine, for both scientific and economic reasons. These include:

- Previously incompatible comonomers.

- Polar monomers.

- Comonomers containing functional groups.

- Homopolymers of large and sterically hindered materials.

Overcoming these hurdles will permit the entry of newly competitive resins that are certain to change the polymer industry landscape.

The authors

Howard R. Blum is a vice-president of Catalyst Group. Prior to Catalyst Group, he was a partner at Chem Systems Inc., Tarrytown, NY, and worked for Conoco Chemicals in Houston. Blum holds BA and BS degrees in chemistry and biological sciences from Miami University in Oxford, Ohio, and an MBA from Fairleigh Dickinson University, Teaneck, NJ.

David M. Schwartz is a vice-president at Catalyst Group, Spring House, Pa. Previously, he worked for UOP, Des Plains, Ill., and Sun Oil, Philadelphia. Schwartz holds a BS in chemical engineering from City College of New York and an MS in chemical engineering from Cleveland State University, Ohio.