Venezuela's energy opportunities rest on political climate, new legislation

In December 1922, a huge blowout in the Los Barrosos-2 well in one of Venezuela's Bolivar Coast oil fields became an economic watershed for that nation. A steady high column of oil bursting skyward for 10 consecutive days, at an estimated rate of 100,000 b/d, attracted the attention of the entire world.

International oil companies flocked to the country to access and buy into a portion of the newly discovered resources. This activity jump-started a major transformation within the country. In the years to come, Venezuela would shift from a society built around rudimentary agricultural activities-with a population affected by epidemic diseases, and education the privilege of only a small elite-into a modern industrialized society with a strong middle class.

Nevertheless, despite generating revenues that the government required for that transformation, oil for a long time remained an enclave-an industry linked to society solely through fiscal transactions. Because producing oil was a specialized activity with low manpower requirements, and because the extracted oil was expeditiously piped and shipped to markets, the Venezuelans felt that oil was something very important, but, at the same time, quite remote from their lives.

For several decades following the early 1960s, the country developed its industrial platform based on substitution of imports, tariffs, subsidies, price controls and an overvalued currency supported by the strength of oil exports.

A heavily centralized government dominated the social and political landscape. The government joined the Organization of Petroleum Exporting Countries to pursue high oil prices and, later on, it nationalized the oil industry and created the national oil company Petroleos de Venezuela SA (PDVSA). Although consolidating a native oil cadre, these policies contributed to deepen the remoteness with which Venezuelans regarded their oil.

Decentralization

After the collapse of the protectionist economic model in the early 1980s, the country was forced to undertake a sizable macroeconomic adjustment and to open up its industry to the global world of international trade and capital flows.

As an important part of the new condition, it was natural that the oil industry would invite private international participation. After several investments downstream in the US and Europe, the first steps were taken to welcome international oil companies to Venezuelan soil in the early 1990s, initially through the "Apertura" model, which would eventually be followed by several other exploration and production opportunities.

During 1994-99, Venezuela's entire oil and gas sector went through the largest transformation in its contemporary history. Everything from gas and oil production to transportation, processing, refining, and marketing was reformed to face the challenges of a more decentralized, competitive energy sector.

The underlying force of the opening-up process has been a major change in the nature of the link between oil and society. Implicit in this metamorphosis is the transformation of oil from simply a source of official rent to a strong economic "engine," maximizing its ability to expand the country's industrial activities.

In economic terms, oil in Venezuela directly represents more than 20% of gross domestic product, and when adding indirect effects stemming from government expenditures financed by oil revenues, that figure can be in the order of 40-50%.

Within that context, many initiatives were undertaken:

- Strategic associations for integrated developments of extra-heavy crude from the Orinoco belt.

- Operational agreements for increasing production in old fields.

- Exploration and production profit-sharing joint ventures.

- Participation of national and international private companies in the retail market.

- Privatization of petrochemical activities.

- Democratization of capital in oil and gas joint ventures.

During the election campaign of 1998, the oil industry became a subject of political discussion for the first time in the history of the Venezuelan democracy. During the year, many people, including the eventual winner of the presidential contest, Hugo Chávez, made ardent statements threatening to reverse the "apertura."

Despite the rhetorical excesses of the presidential race, it is important to keep in mind that, during election campaigns throughout Latin America, speeches easily turn radical, and candidates offer up many populist concessions designed to counter "imperialist" policies. Frequently the terms "sovereignty" and "patriotism" are employed for maximum effect. Nonetheless, pragmatism tends to resurface once the leaders take office.

Venezuela's energy future

The previous considerations constitute an adequate backdrop for analyzing both Venezuela's current oil industry situation and possible future scenarios.

The general national and international opinion is that, since taking office, the current Venezuelan government has neglected the serious economic problems affecting the country by placing excessive emphasis on the political agenda.

That agenda is concentrated around a comprehensive transformation of every institution in the country. In the process, the government has progressively increased its grasp on almost all those institutions, which undoubtedly poses great risks to the separation of powers imperative for a properly functioning democracy.

The manner in which many institutional debates are being conducted inevitably leads to the discussion of the difference between the legitimacy of origin and the legitimacy of action. This political process is supported by heavy official spending-bolstered by high oil prices and the expectation of their continuance-and it represents a major risk for the medium-term health of the Venezuelan society.

Several important considerations concerning the oil industry need to be addressed:

- Despite the continued aggressive rhetoric by the government and Chávez himself, there has been total respect for all the agreements signed within the "apertura" process. The one exception is the outsourcing contract of an oil terminal in the Jose area in eastern Venezuela that PDVSA reversed. The dispute was resolved amicably, however, after a few months of discussions between PDVSA officials and the counterpart in the deal, a Williams-Enbridge Inc. consortium.

The various oil companies operating in the country are continuing to undertake their contracted programs and making the best of what they have. Most of them have doubts and concerns about the future and will be cautious about new commitments until a few important issues are clarified.

- Within the scope of a new and very recent "enabling" law that will allow the president to legislate by decree, a new hydrocarbon law has been included. It is intended to consolidate into one comprehensive law five separate laws that rule different aspects of the oil and gas activities.

Although the initiative is positive in itself, it includes changes in the tax and royalties structure that are not yet clear and have become a source of concern.

The most likely result will be a royalty increase to 20% from 16.7% and a reduction of income tax to 34% from 67.7%. Because royalty is paid up front, while income tax is accrued only if a profit is posted, this is seen as an attempt by the government to increase its take from the oil sector and, more specifically, from the foreign participants in the sector.

This shift of emphasis to the government's financial needs tends to affect the perception of risk by the oil companies, especially as a lower price environment emerges.

- The new hydrocarbon law, coming less than 2 years after the approval of a new gas law, raises other questions such as taxes for LNG, municipal tax regimes, possible compulsory domestic participation in new oil and gas projects, and partial tax transfer to private partners in operating agreements. The answers to these questions and others that may yet surface are of paramount importance for all future developments.

- Under Chávez, oil policy has changed from developing aggressive production targets to production restraint aimed at supporting prices through agreements within OPEC. Undoubtedly, those agreements, combined with the resumption of the demand growth during 1999-2000, have turned into a highly successful increase in revenues.

However, in the process of implementing that policy, the level of activity has been reduced significantly, and, consequently, Venezuela has lost substantial production capacity. In fact, its current level of production is slightly shy of its quota.

The ability to resume the levels of activity required for the country to seize the increasing opportunities arising from strongly growing energy demand represents another important issue to consider.

Political challenges

In summary, the current Venezuelan government has elected to keep the economy growing-or booming, according to several of their statements-on the basis of massive amounts of official spending.

This approach has been predicated upon continued high oil prices for the foreseeable future, which is clearly a risky proposition.

That kind of strategy tends to fail unless sustainable spending by business and individuals eventually replaces government spending.

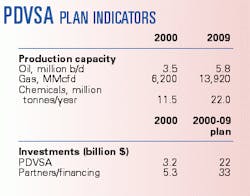

Venezuela has an excellent opportunity to achieve massive private investment in the oil and gas sector, which would allow the country to resume its oil expansion path (see table). For several years, the foundations have been laid for that to happen. The "apertura" process, which enabled more than 50 different energy companies to be settled today in the country, constitutes an excellent platform for new oil and gas developments.

In addition, Venezuela offers important comparative and competitive advantages, such as highly prolific basins, a privileged geographic location, and a first-class international oil and gas network.

Nevertheless, in order to succeed in engaging private investment, it is necessary to recognize the factors that are informally affecting the perception of risks that investors quantify before making decisions about new projects. Among these are many uncertainties brought about by the potential changes in the rules of the game as a result of the new hydrocarbon law. It is even more important to abate the aggressive rhetoric that keeps potential investors cautious about new commitments in Venezuela.

The author

Luis E. Giusti, a director of Shell Transport & Trading, is also a private consultant and a senior adviser to the Washington-based Center for Strategic and International Studies. He has authored many publications and is a frequent lecturer on energy, oil, and Latin America. Giusti graduated as a petroleum engineer from the University of Zulia (Maracaibo) in 1966 and received his MS in petroleum engineering from the University of Tulsa in 1971. He was employed by Shell Oil Co. of Venezuela during 1966-75. In 1976, Giusti joined the staff of Maraven SA, an operating affiliate of the newly established state oil company, Petroleos de Venezuela SA (PDVSA). He served in exploration, production, refining, corporate planning, and marketing, and was chairman and CEO of PDVSA during 1994-99.