US gas-processing profitability statistics begin in this issue

Beginning in this issue, Oil & Gas Journal will report several profitability measures for gas processing.

Muse, Stancil & Co., Dallas, a downstream consulting firm, will provide the calculated values monthly. Muse routinely tracks gas processing activity and profitability.

This article provides an overview of the gas processing industry and describes the framework for the new statistical series.

The profitability of gas processing in the US is highly variable, fluctuating with the relative prices of natural gas and NGL. A gas plant's profitability on a standalone basis depends on the quantity and quality of the gas available, the processing technology employed, the relative price of gas and liquids, and the terms of the processing contracts negotiated between the gas producers and the plant owners.

Gas processing

Produced natural gas is primarily methane, but it also contains water vapor, contaminants such as CO2 and H2S, and heavier hydrocarbons consisting of ethane, propane, butane, and natural gasoline.

Fig. 1 shows a schematic of the typical gas handling process from wellhead to end user.

Facilities owned by either the gas producer or a third party treat the produced gas to remove H2S and CO2 and then dehydrate it. These gas-conditioning services are typically not discretionary because the contaminants and water must be removed before gas processing or distribution. Providers of gas-conditioning services often charge fees based on the volume processed or the amount of contaminants removed.

After conditioning, gas processing extracts the heavier hydrocarbon components of the gas for economic and safety reasons. There can be an economic incentive to recover the NGLs, which have a market value as purity products.

A portion of the NGLs must be removed in some cases to avoid the unsafe formation of liquids in gas transmission pipelines and local gas distribution systems and at the burner tip.

The NGL content of produced natural gas varies by geographic location and producing formation. It can even vary among wells within the same producing field.

A gas analysis measures the NGL content in the gas in gallons per Mcf (GPM). GPM is an indication of the potential recoverable NGLs contained in the gas stream. The NGL content of produced gas can vary from 0.2 GPM for very dry gas to 20 GPM for very rich gas.

The economic incentive to recover NGLs varies based on the market pricing of both the gas and the NGLs. Regardless of the economic incentive, however, gas usually must be conditioned or processed, or both, to meet the specifications for safe delivery and combustion. Thus, NGL recovery profitability is not the only factor in determining the degree of NGL extraction.

As with gas conditioning, NGL removal may be performed in facilities owned by the gas producer. It is more common, however, for a third party or a joint venture consortium of companies with gas production in the geographic area to own and operate gas processing facilities.

Fractionation of the NGLs to produce purity products such as petrochemical grade ethane feedstock or fuel grade propane may take place in a gas processing facility but more commonly occurs at another location, usually a regional market center.

The NGL production from a gas processing plant is typically commingled and is referred to as raw mix. In the US, the raw mix often goes to large NGL storage and fractionation facilities at Conway, Kan., and Mont Belvieu, Tex.

Companies that own fractionation facilities typically facilitate a bundled-fee structure to offer transportation and fractionation of the raw mix on a per-gallon basis.

Technologies

There are three common NGL extraction technologies used in gas processing plants:

- Lean oil absorption or refrigerated lean oil absorption.

- Refrigeration processes.

- Cryogenic processes.

Lean oil absorption is the oldest and least efficient process. Cryogenic processes are generally the most technically advanced and achieve the highest level of NGL recovery. Almost one-half of the plants in the US are cryogenic, and about one third use refrigeration technology to recover NGLs.

Although the exact capabilities vary with the specific design of a plant and the quality of the gas feed, the liquid recovery possible in a lean oil plant is typically 99% of the butane and natural gasoline, 65-75% of the propane, and 15-25% of the ethane contained in the gas.

Typical recoveries in refrigeration processes tend to be higher: 100% of the butane and natural gasoline, 98% of the propane, and 50% of the ethane.

Cryogenic processes offer the highest liquid recoveries, typically allowing full recovery of all of the propane and heavier NGLs and recovery of 50% to more than 90% of the ethane.

US facilities

As of July 2000, there were about 580 gas plants operating in the US, excluding Alaska, with an average capacity of about 100 MMscfd. Actual plant throughput averaged 70 MMscfd with NGL production averaging 72 million gpd (1.7 million b/d).

Gas plant sizes range from less than 1 MMscfd of processing capacity to the massive Central Gas facility on Alaska's North Slope, which cycles 8.7 bscfd.

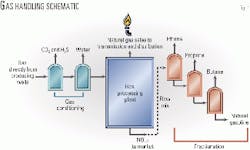

As shown in Fig. 2a, gas processing in the US is heavily concentrated within a few states. On the basis of gas throughput, 70% of the total US gas processing takes place in plants in Louisiana, Texas, and Alaska.

The plants in Louisiana and Alaska are some of the largest in the industry. Throughput in these two states represents 46% of total US throughput but only 14% of the total number of plants operated in the US.

Much smaller plants are the norm in other gas processing states (Fig. 2b).

Processing economics

As described, the level of NGL extraction from natural gas is somewhat discretionary. Safety issues dictate the minimum extraction level, whereas a balance between the technology and the relative value of the NGLs (as a gas vs. a liquid product) determines the maximum extraction level.

If the NGLs remain in the gas, they are sold based on the amount of energy they contain, measured by the amount of heat produced when the components burn.

As the relative prices of natural gas and NGLs fluctuate, the relative incentive to extract the NGLs from the gas changes. For example, if the price of gas increases and the price of ethane does not change, the incentive to extract the ethane from the gas diminishes. At times, it is more economically attractive to leave as much of the ethane in the gas as possible within safe operating limits.

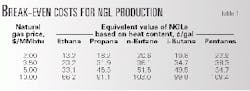

Table 1 shows the energy or heating value equivalency for NGL components at various gas prices. This table allows comparison of the price of the sales gas from a plant to the equivalent value of the gas liquids if they were not extracted and instead sold as gas based on their heat content.

These NGL values represent the market price that must be realized at the plant tailgate to allow the plant owner to at least break even on the extraction of the NGL. The values, however, do not consider the cost of operating the plant or allow for any profit from the plant operations.

For example, if the residue gas from the plant can be sold into the sales pipeline at the tailgate of the plant for $2.00/MMbtu, the price of ethane must be at least 13.2¢/gal plus the plant operating costs to break even on recovering ethane. If the market price that can be realized at the plant tailgate for ethane is less than 13.2¢/gal plus the operating cost, the overall plant economics favor leaving the ethane in the natural gas.

When plants seek to maximize the amount of ethane sold as residue gas, the industry refers to this process as ethane rejection.

Contractual arrangements

Besides the market prices of natural gas and NGLs, specific contract terms also determine the incentive for standalone plants to recover NGLs from natural gas.

Operators and equity gas owners individually negotiate specific terms of each contract for each plant, which vary with the quality and quantity of the gas and the type of processing facility.

While there are typical terms, each contract is unique. It is common for various contract structures to exist within the contract portfolios of the same plant or the same company. There are only a few basic contract structures typically used, however, in processing agreements: fixed-fee contracts, percent-of-proceeds (POP) contracts, and keep-whole contracts.

- Fixed-fee contracts. Fixed-fee contracts are the simplest form of processing agreements.

The producer pays the gas plant owner a fixed processing fee, usually in ¢/Mcf of gas feed. The fee tends to be in the range of 10¢/Mcf to 30¢/Mcf, depending on the complexity of the operation and the gas quality. The owner may annually adjust the fixed fee for inflation.

In fixed-fee arrangements, the producer retains ownership of the gas and the NGL produced. The processing plant profitability is not subject to market price risk.

- POP contracts. In POP contracts, the gas plant owner receives a portion of the recovered product or of the proceeds from the sale of plant products as compensation for processing the gas.

When POP contracts are employed, the plant owner shares the overall market price risk with the gas producer. The owner may have different recovery incentives than the gas producer, however, depending on the contract structure.

For example, if the contract is structured so that the plant operator receives a portion of the NGL recovered in exchange for gas processing, the plant owner will seek to maximize liquid recoveries.

On the other hand, if the plant owner receives both NGLs and gas as compensation for processing, the economic incentive for the plant owner is aligned with the gas producer. In this case, payment to both parties depends on the products saved and sold, not just on a portion of the recovered liquids.

In either of these scenarios, the processing margin achieved may not be sufficient to cover plant operating costs.

- Keep-whole contracts. Under a keep-whole contract, the plant owner receives all of the revenue realized from the sale of the NGL product from the plant. The plant owner compensates the producer by delivering processed gas at the plant tailgate with an energy value equivalent to the energy value of the extracted NGLs.

Under some contracts, the plant owner may compensate the producer with cash rather than the delivery of the additional gas volumes for the energy contained in the NGLs extracted. The producer receives full value in some form for the energy content of the gas that he possessed prior to processing, therefore, being "kept whole."

The makeup gas volume (or its heating value equivalent of energy) required to keep the producer whole is commonly referred to as the "gas shrinkage" incurred in gas processing. In this situation, the plant owner bears all of the market price risk.

These contracts typically become unprofitable when NGL price increases do not keep pace with increases in gas price.

Assumptions

Muse tracks average gas processing economics in several gas producing regions based on publicly available production and pricing data as well as its experience in the valuation and assessment of gas plants worldwide.

For the monthly statistical section, Muse has selected two hypothetical gas processing configurations, one in the US Midcontinent and the other on the US Gulf Coast. It has also defined profitability parameters as benchmarks to monitor gas-processing trends.

For the Midcontinent region (Oklahoma, Kansas, and the Texas Panhandle), Muse assumes that a cryogenic gas plant is processing a gas stream with an inlet gas NGL content of 4.0 GPM. The capacity of the hypothetical plant is 50 MMscfd, with liquid-recovery efficiencies of 55% for ethane, 98% for propane, and 100% for butanes and heavier hydrocarbons.

The second hypothetical plant is on the Louisiana Gulf Coast. Here, the gas tends to be drier and the plants are typically much larger. The gas processing profitability statistics assume a cryogenic gas plant is operating with an inlet capacity of 200 MMscfd, running at full rate on a raw gas feed stream with an NGL content of 1.2 GPM. The recoveries assumed are 80% ethane, 98% propane, and 100% of the butanes and heavier components.

Net operating margin

Fig. 3 shows the potential value of processing the specified regional gas in each of the two hypothetical plants during the past 10 years. This assessment accounts for the overall margin available for the plants. It is defined as the net value of the recovered NGL at the plant tailgate, less plant fuel, direct operating costs, and gas shrinkage. Muse adjusted the product prices to represent plant tailgate realizations based on typical regional transportation and fractionation fees.

The operating margin represents the plant owner's perspective in a keep-whole arrangement, where the gas shrinkage is valued at the sales gas price on an MMbtu basis. It also mimics a measure of processing plant profitability in situations where one party owns both the plant and the gas production.

Processing decision

Given the current level of gas market price volatility, gas producers are continuously evaluating the alternatives for gas processing. Obviously, producers will seek to maximize the value for their gas, whether it is processed for NGL removal or not.

Fig. 4a shows the profitability of a Gulf Coast gas producer when he elects to process gas for NGL recovery. The alternative is bypassing the plant and selling the gas directly into the gas transmission system.

This analysis includes the direct operating costs for gas conditioning and NGL recovery. The differential between the two alternatives reflects the incremental gross operating profit that a producer can achieve when he elects to process the gas for NGLs instead of selling the gas directly.

In early 2001, the analysis shows that the producer would have earned almost $0.20/Mcf more if he bypassed the plant in lieu of processing the gas for NGL recovery. In many other instances since mid-1994, the producer would have been at least indifferent to processing vs. bypassing the gas directly to sale.

Fig. 4b summarizes the results realized by a similar analysis for the Midcontinent producer. Since the Midcontinent gas has a higher NGL content, the producer cannot bypass all gas processing. Instead, the producer minimizes NGL recovery by removing only enough NGL to meet the specifications of the mainline transmission systems (ethane rejection).

The incentive to bypass the processing plant here is more limited, primarily because a portion of the NGLs must be removed to meet safety requirements. This eliminates the possibility that all of the gas components can be sold when natural gas prices jump to extraordinarily high levels.

Fig. 5 illustrates the calculated break-even percent of liquids proceeds for the hypothetical plants. This figure allows gauging the relative profitability of third-party gas plants.

These analyses assume that the gas producer receives 100% of the residue gas from the plants, and the plant owners receive only a portion of the NGL production. Typically, plant owners receive 20-50% of the NGL revenue under these contracts, which implies that the gas producer receives 50-80% of the NGL product revenues.

The break-even calculation considers the amount of NGL that the gas producer must retain to break even on the processing of the gas before capital recovery. A producer must retain at least this much to make processing the gas an economic alternative to bypassing the plant and selling unprocessed gas.

When the break-even percentage climbs to levels above 50-80%, producers will be inclined to bypass plants, limiting the NGL extraction to the extent possible because liquids extraction economics are poor.

Profitability trends

Historically, the prices for NGLs depend on supply and demand factors in their end-use markets, which may or may not coincide with changes in gas market fundamentals.

Ethane's primary disposition is the petrochemical manufacturing industry. Propane is both a fuel and used in the petrochemical industry. Butanes and heavier NGLs typically find their way into gasoline blending or other refinery processes for ultimate use in gasoline production.

Fig. 6 compares the price movements for crude, natural gas, and ethane during the past 10 years. Although the macro trends influencing the market prices for these commodities are similar, the specific end-use markets significantly influence the short-term price fluctuations.

As a practical matter, the producer does not usually receive more than 80% of the plant proceeds; the plant owner typically requires a minimum of 20% to cover operating and other costs. These percentages vary with the quality and plant configuration.

If the producer requires 90% or more of the proceeds, gas processing is clearly uneconomical in terms of the relative value of gas vs. liquids. In these situations, safety issues, plant configuration, and contract terms become the determinants in the level of NGL recovery from the gas production.

The authors

Kathy G. Spletter is a vice-president and director of Muse, Stancil & Co. She leads the valuation services practice area for the firm. She worked for Mobil Corp. before joining Muse in 1987 and has more than 20 years' experience in the energy industry. She holds a BS in chemical engineering from Texas A&M University, College Station, and is a registered professional engineer in Texas. Spletter is also an accredited senior appraiser of the American Society of Appraisers.

b>Lesa Adair is a vice-president and director of Muse. She consults on valuation, damage assessment, market evaluation, and due diligence in the energy sector. Since joining the firm in 1992, she has participated in mergers, acquisitions, divestitures, and project assessment and development for clients in the transportation, processing, refining, marketing, and electrical generation sectors. Adair holds a BS in chemical engineering from Oklahoma State University, Stillwater, and an MBA from Southern Methodist University, Dallas.