Climate change policy critical to US energy, economic security

This article is based on studies sponsored by the American Council of Capital Formation's Center for Policy Research and on testimony by ACCF Chief Economist Margo Thorning to the US Senate Committee on Energy and Natural Resources (Mar. 30, 2000) and the Senate's Governmental Affairs Committee (July 18, 2001). Summaries of the studies and complete bibliography are available at www.accf.org.

The Kyoto Protocol to the United Nations Framework Convention on Climate Change, negotiated in Decem ber 1997, calls for industrial economies such as the US, Canada, Europe, and Japan (Annex B countries) to reduce their collective emissions of six greenhouse gases by an average of 5.2% from 1990 levels by 2008-12.

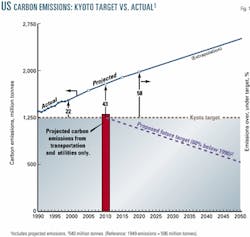

The US target under the protocol, which was rejected by the Bush Administration in March, is a 7% reduction from 1990 levels (or 1.251 billion tonnes). This amounts to a projected 536 million tonne cutback in carbon emissions relative to the projected amount in 2010, growing to a 728 million tonne cutback by 2020 (Fig. 1).

In 1999, US emissions were 1.527 billion tonnes, or 22% above the Kyoto target. By 2010, the US Department of Energy's Energy Information Adminis tration projects that emissions will be 43% more than the target, and the gap will grow to 58% by 2020. In 2010, carbon emissions from the transportation and utility sectors alone are pro jected to be 1.300 billion tonnes (Fig. 1).

The emissions cap would ration US energy use and require steep taxes, either directly or indirectly through purchase of "permits," to restrain energy demand. The "multipollutant" approach would have the same effect.

Research that climate policy scholars have conducted within the past decade for the American Council for Capital Formation's (ACCF) Center for Policy Research (CPR) concludes that the cost of reducing carbon emissions in the near term would impose a heavy burden on US households, industry, and agriculture by reducing economic growth.

Impact on US GDP

Many climate policy experts believe that the emission reductions called for in the Kyoto agreement have potentially serious consequences for all Americans. Predicting the economic impact of reducing carbon emissions depends on the manner in which an economic forecasting model handles several factors, including how rapidly industry and consumers respond to higher energy prices by substituting less carbon- intensive production methods and reducing the consumption of carbon-intensive goods and services.

Other factors that can affect a model's results are the rate of technological change, the projected baseline greenhouse gas emissions, the amount of emissions trading, and the use of carbon sinks and sequestration.

The rate of technological improvement for energy production and con- sumption assumed by most models under their base line forecasts is moderately rapid. For example, EIA's ref - erence case assumes continued improvements in new and existing buildings, transportation, coal production, oil and gas exploration, and electric power generation technologies.

In fact, it assumes that total energy intensity-defined as the ratio of primary energy consumption per dollar of gross domestic product-will decline at an average rate of 1.1% annually during 1998-2020. The faster the rate of economic growth, the faster energy intensity declines in the EIA reference cases due to the more rapid turnover of the capital stock.

Recent model results show that, as carbon emissions are capped or constrained, economic growth slows due to lost output as new energy taxes are imposed, and prices rise for carbon-intensive goods-those goods that must be produced using less carbon or more expensive processes.

In addition, the capital stock accumulates more slowly, reflecting the premature obsolescence of capital equipment due to the sharp energy price increases required to meet the carbon emission reductions mandated under the protocol. It takes 20-30 years to replace the entire US capital stock. Thus, meeting the protocol's 2008-12 timetable for emission reductions would mean either continuing to utilize plant and equipment designed to use much lower-cost (pre-Kyoto) fuels, or replacing the capital stock much more rapidly than its owners had planned.

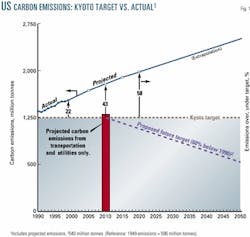

The wide range of model results by climate policy experts show that complying with the Kyoto Protocol would reduce US GDP by 1-4%/year (Fig. 2).

This translates into annual losses of $100-400 billion (in inflation-adjusted dollars) in US GDP each year compared with the baseline forecast for energy use. These studies, as well as the EIA report released in October 1998, stand in sharp contrast to the optimistic projections contained in the economic analysis prepared by former President Bill Clinton's Council of Economic Advisers (CEA) and released in July 1998.

Starting earlier to reduce carbon emissions (in 2000 rather than 2005) only worsens the overall impact, according to an EIA report released in July 1999. The EIA results show that the discounted present value of US GDP falls by $1.430 trillion 1992 dollars during the 2000-20 period compared with $1.285 trillion under the 2005 start date.

Additional impact

The economic costs of the Kyoto Protocol described above do not reflect the additional economic impact of emission reductions beyond the Kyoto target. Kyoto supporters contemplate substantial future carbon emission reductions well below 1990 levels. At least one model has analyzed this scenario. A study using the Charles River Associates model (MS-MRT) shows that the cost of going beyond the carbon emission reductions required by the Kyoto Protocol is high. For example, a target of 21% below 1990 emission levels (or three times the Kyoto target) would reduce US GDP by 2.4% annually in 2020 with Annex B emission trading and by 3% with domestic abatement alone.

Budget surplus impact

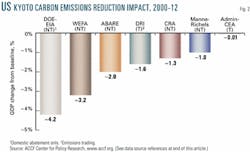

One method of assessing the impact of the Kyoto Protocol is to examine how slower economic growth would affect projected US federal tax receipts and federal budget surpluses.

Policy-makers must consider the potentially large negative impact of the protocol on GDP growth and federal budget receipts, because both Conress and the administration of President George W. Bush are already chipping away at the federal budget surpluses to finance spending initiatives and tax cuts for fiscal year 2001 and beyond.

Using a simple calculation based on the relationship of increases in GDP to federal tax receipts, if GDP is 3% lower annually, the on-budget surplus in 2010 would decline by $156 billion dollars, from $471 billion to $315 billion (Fig. 3). If, as the EIA model predicts, the Kyoto Protocol reduces GDP by 4% in 2010, the budget surplus would drop to only $261 billion dollars.

Emissions trading

Numerous studies show that a major determinant of the cost of curbing emissions is whether the US can purchase permits from abroad where emissions can be reduced at a lower cost than in the US. In the absence of an unfettered international trading system, the US would be forced to curb its own carbon emissions by about 30% within 10 years.

Due to population growth and increases in output, the gap between projected emissions and the Kyoto target will continue to grow (Fig. 1). Kyoto advocates have addressed neither this growing gap nor the impact of additional reductions beyond the Kyoto targets.

Impact on wage growth

Under carbon stabilization policies, US consumers suffer declines in wage growth, and the distribution of income worsens. Wesleyan University professor Gary Yohe estimates that reducing emissions to 1990 levels would reduce wage growth by 5-10%/year, with that of the lowest quintile of the population shrinking by about 10%.

Texas A&M University professor John Moroney estimates that US living standards would fall by 15% under Kyoto compared with the base case energy forecast.

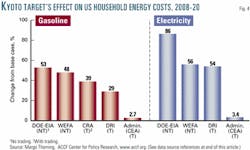

US households also face much higher prices for energy under near-term reductions. Estimates by various experts conclude that gasoline prices would rise 30-50% and electricity prices would soar by 50-80% (Fig. 4), eclipsing predictions by the Clinton administration CEA of 2.7% increase in gasoline prices and 3.4% rise in electricity prices.

US competitiveness

Studies conducted by economists at the Australian Bureau of Agricultural and Resource Economics (ABARE), the University of Colorado, Data Resources Inc. (DRI), WEFA Inc., and others have concluded that near-term emission reductions would result in "carbon leakage," the migration of energy-intensive industry from the US to non-Annex B countries.

Alan S. Manne of Stanford University and Richard Richels of Electric Power Research Institute, in a 1999 study, suggested that the Kyoto Protocol could lead to serious competitive problems for energy-intensive sector (EIS) producers in the US, Japan, and the Organization for Economic Coopera tion and Development nations in Europe.

Meeting Kyoto emission targets would lead to significant reductions in output and employment among EIS producers, and there would be offsetting increases in countries with low energy costs. By 2020, US output of energy-intensive products could be 15% less than output under the reference case.

In contrast, countries such as China, India, and Mexico would increase output of energy-intensive products. In its present form, the protocol could lead to acrimonious conflicts between those who advocate free international trade and those who advocate a low-carbon environment, Manne and Richels concluded.

US agriculture would also lose competitiveness if the US complied with the Kyoto Protocol. Another study based on the DRI model and conducted by Terry Francl of the American Farm Bureau Federation, Richard Nadler of KC Jones Monthly, and Joseph Bast of the Heartland Institute predicts that implementation of the protocol would cause higher fuel oil, motor oil, fertilizer, and other farm operating costs. This would mean higher consumer food prices and greater demand for public assistance.

In addition, increasing the energy costs of farm production in the US while leaving them unchanged in developing countries would cause US food exports to decline and imports to rise. Reduced efficiency of the world food system could add to a political backlash against free trade policies at home and abroad.

The Francl-Nadler-Bast analysis, which concludes that the Kyoto Protocol would adversely affect US agriculture, stands in sharp contrast with the May 1999 report by the US Department of Agriculture, which found that the Kyoto Protocol would have "relatively modest" impacts on US agriculture.

A recent analysis by Francl indicates serious flaws in the USDA report: It relies on unrealistic assumptions contained in the Clinton administration's 1998 CEA analysis, and it assumes that US farmers will have unrestricted access to carbon credit trading.

Flawed CEA analysis

The Clinton CEA's July 1998 economic analysis of the impact of reducing carbon emissions to 7% below 1990 levels is flawed for three reasons:

- CEA cost estimates assume full global trading in tradable emission permits, including with China and India. Most top climate policy experts conclude that this assumption is unrealistic because the protocol does not require developing nations-which will be responsible for most of the growth in future carbon emissions-to reduce their emissions, and many have stated that they will not do so.

- The CEA's cost estimates assume that an international carbon emissions trading system can be developed and operating by 2008-12. This is unrealistic, according to analysis by Massachu setts Institute of Technology (MIT) professor A. Denny Ellerman.

- The cost estimates are based on the Second Generation Model (SGM) developed by Battelle Memorial Institute (BMI). The SGM, which appears to assume costless, instantaneous adjustments in all markets, is not appropriate for analyzing the protocol's near-term economic impacts, according to W. David Montgomery of Charles River Associates.

As MIT professor Henry Jacoby observes, no short-term technical changes will significantly lower US carbon emissions. - In a USA Today article (June 12, 2001), a former Clinton administration official acknowledged that CEA estimates understated the cost of the Kyoto Protocol by a factor of 10.

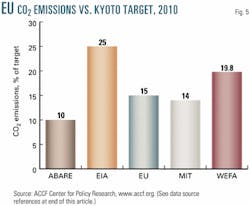

EU won't meet targets

A number of recent studies document that the European Union will not be able to achieve its Kyoto carbon dioxide emission reduction targets by 2008-12 (Fig. 5). These studies include:

- The European Commission, "Towards a European Strategy for the Security of Energy Supply," Nov. 28, 2000. The European Union's own report shows that EU CO2 emissions will be 15% above their Kyoto target by 2010, rising to almost 20% above by 2020. While stressing the need to reduce CO2 emissions, the EU report cautions that climate change policy should not be allowed to "endanger economic development."

- The Pew Center on Global Climate Change, "The European Union & Global Climate Change," June 2000. In an analysis of five major EU member states (Germany, the UK, the Nether lands, Austria, and Spain) responsible for 60% of CO2 emissions in 1990, Pew concludes that only the UK has a good chance of meeting its targets, and Germany will find it "difficult." The other three countries "are not on track." Emissions in the Netherlands currently exceed 1990 levels by 17%, Austria has no plans in place to meet its target, and Spain is already close to reaching its allowed growth in CO2 emissions-a concession to its relative poverty-meaning that Spain is likely to be well above its emissions target by 2010.

- MIT Joint Program on the Science and Policy of Global Change, "Carbon Emissions and the Kyoto Commitment in the European Union," February 2001. According to the results of the MIT Emissions Prediction and Policy Analysis model, CO2 emissions in the EU will rise by 14% above the 1990 levels in 2010 instead of decreasing by 8% as required by the Kyoto Protocol.

- ABARE,"Climate Change Policy and the European Union," September 2000. ABARE's report concludes that CO2 emissions in the EU will increase by an average of 0.3%/year during 1990-2010, unless stringent new measures are undertaken. Emissions will rise by 10% rather than fall to 8% below 1990 levels.

- EIA, International Energy Outlook, March 2001. The EIA analysis predicts that, by 2010, emissions in Western Europe will be almost 25% higher than they were in 1990, falling far short of Kyoto targets for those countries.

- WEFA Energy Services, "The Kyoto Protocol: Can Annex B Countries Meet Their Commitments?" October 1999. WEFA surveys five other government reports, including an EU study, as well as its own analysis and concludes that Western Europe is unlikely to meet its targets. Emissions must fall by 15-30%, which would constrain economic growth in politically unacceptable terms.

A new European Commission report from the European Climate Change Program (June 2001) analyzed measures affecting all sectors of their economy, and it concluded, "The poten tial of cost-effective options is twice the size of the EU's required emission reductions."

The EU's new report is flawed in several ways. "Cost-effective" is defined as policies that cost no more than 20 euros/tonne of avoided CO2 emissions, or $62/tonne. Most experts consider $62/tonne of carbon "expensive," and some of the suggested policies cost as much as $312/tonne of carbon to implement.

The policy yielding the largest impact affects buildings. The costs of these policies were calculated with a very low discount rate (4%), a rate of return that no private investor would accept.

Thus, the new EU study is actually a "wish list" of policies the EU environmental ministry "wishes" that businesses and households would adopt but that are not likely to be undertaken voluntarily because of their high costs.

Premature emission targets

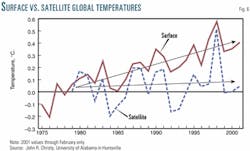

According to scholars such as Brookings Institution (BI) economist Robert Crandall, setting targets and timetables for US greenhouse gas emissions is premature for two reasons:

- Uncertainty about whether global warming is occurring (Fig. 6). New data from climatologist and UN Intergovernmental Panel on Climate Change author John Christy of the University of Alabama demonstrate that, while surface-based measures show warming, satellite data shows little warming.

- The high cost of foregone investment if the US sacrifices economic growth to reduce emissions.

In a 1999 report, Crandall observes that the economic costs-benefits estimates of reducing emissions to 1990 levels are not supportive of going ahead with any policy of abatement.

For example, as an analysis by BI fellows Warwick McKibben and Peter Wilcoxen point out, cost estimates for capping emissions at 1990 levels are generally 1-2%/year of GDP, while the benefits, estimated at most to be 1.3% of GDP, will not arise for 30-50 years.

Moreover, the climate models generally forecast that it would require far greater reductions than a return to 1990 emissions to stabilize the climate. Crandall concludes, "We cannot justify a return to 1990 emissions based on the average estimates in the literature, no matter how efficiently it is done."

It is clear that the marginal costs of abatement in low-income societies such as China and India are substantially below those in developing countries, Crandall notes. Economists envision a marketable permits program as being global in scope.

The US, France, Japan, and Germany, for example, would buy permits from China, India, or Bangladesh. The latter would reduce their CO2 or other greenhouse gas emissions by this amount over levels that would have occurred without the permits policy in all future years.

The difficulties involved in such a future program would be immense: measuring emissions from millions of sources, forecasting emission levels for the uncontrolled scenario, and enforcing the reductions from all these sources.

If enforcing nuclear nonproliferation treaties is difficult, enforcing a global greenhouse gases trading program would be incomparably more complicated.

Yale University Prof. William D. Nordhaus also analyzed the costs and benefits of CO2 emission limits. His research shows that the costs of even an efficiently designed emissions reduction program exceed the value of environmental benefits by 7:1 and that the US would bear almost two-thirds of the global cost.

Targets and timetables for emissions reductions would also tend to discourage businesses and households from investing now in new equipment and processes that would reduce greenhouse gas emissions.

This is because tax depreciation schedules for many types of investments that could reduce CO2 emissions are very slow. Slow capital cost recovery means that investments that are deemed "risky" because of possible future emission caps face a much higher hurdle to gain acceptance than would an investment whose cost could be recouped immediately through a first-year write-off.

The prospect of future emission constraints will retard the very type of capital expenditures that many believe would facilitate emission reductions without curtailing economic growth.

Tax policy

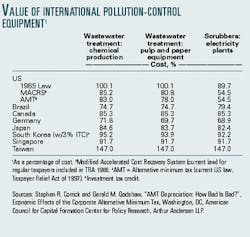

Current US tax policy treats capital formation-including investments that increase energy efficiency and reduce pollution-harshly compared with other industrialized countries and with the nation's own recent past.

Before the 1986 Tax Reform Act (TRA '86), the US had one of the best capital cost-recovery systems in the world. Under the strongly proinvestment tax regime in effect during 1981-85, the present value of cost-recovery allowances for wastewater treatment facilities used in pulp and paper production was about 100%, meaning that the deductions were the equivalent of an immediate write-off of the entire cost of the equipment, according to an analysis by Arthur Andersen LLP (see table).

Under TRA '86, the present value for wastewater treatment facilities fell to 81% for pulp and paper, dropping the US capital cost recovery system to near the bottom ranking of an eight-country international survey.

Allowances for scrubbers used in the production of electric power were 90% before TRA '86; the present value fell to 55% after TRA '86, ranking the US at the bottom of the survey.

As is true in the case of productive equipment, both the loss of the investment tax credit and the lengthening of depreciable lives enacted in TRA '86 raised effective tax rates on new investment in pollution-control and energy-efficient equipment. Slower capital cost recovery means that equipment embodying new technology and energy efficiency will not be put into place as rapidly as it would be under a more favorable tax code.

More effective than the "credit for early action" regulatory framework proposal or the proposed multi-pollutant approach would be tax incentives such as expensing, accelerated depreciation, tax-exempt bond financing, or more-generous loss carry-backs that reduce the cost of capital for voluntary efforts to reduce greenhouse gas emissions.

Policy change, energy security

If, as knowledge of the climate system increases, it becomes necessary to change policy to reduce carbon emissions, these changes should be imple- mented in a way that minimizes damage to the US economy.

Above all, experts agree that voluntary measures clearly and cost-effectively reduce the growth in greenhouse gas emissions, as the US Second National Commu nication to the Framework Convention on Climate Change noted in 1997. A US strategy for reducing CO2 emissions and providing energy security should include a number of actions:

- Modify the US tax code. Providing expensing (first-year write-off) or faster depreciation for new investments that reduce CO2 can reduce the cost of capital by 20-30%.

- Expand the use of nuclear energy. Nuclear power expansion has a vital role in managing CO2 emissions while strengthening US energy security.

- Expand bilateral cooperation with developing countries. Promoting the use of existing and emerging technology in developing countries for clean coal, natural gas, and hydroelectricity production could substantially slow global CO2 emissions growth.

- Expand incentives for landfill methane and biomass, including ethanol from cellulose. The EIA's April 2000 Climate Change Technology Initiative report shows that these programs are the most efficient use of tax incentives for reducing CO2 emissions.

- Implement a multiyear plan for improving coal technology. In the short term, focus on new clean-coal technology, cofiring with biomass, and coal-to-gas; in the long term, institute a capture target of 50% (converts coal emissions to the equivalent of natural gas).

- Remove regulatory barriers. New Source Review is impeding the retrofitting and expansion of US electric power generation, refining, and manufacturing capacity and making it more difficult to put into place the kinds of changes that would reduce CO2 for each unit produced.

- Avoid caps on CO2 emissions by US industry. Caps have a negative im pact on the willingness of industry to invest in new technologies in the US because of the concern that "voluntary" emission cuts will become mandatory. Allowing industry to recover its costs faster will spur the kinds of investments that reduce CO2 and expand output of energy as well as other products and services.

- Avoid setting targets of 550 ppm for global CO2 concentrations within the next 75-100 years. Such targets would require the developed countries' CO2 emissions to fall to zero by 2050 and likely would constrain US economic growth.

Models such as the SGM used by Jae Edmonds at Battelle Memorial Institute, which show that their targets can be achieved at low cost, are seriously flawed. The SGM model assumes costless, instantaneous adjustments in all markets and does not specify how the new technology required to move off carbon-based fuels is to be developed.

The consensus of the noted climate policy scholars whose work is discussed in this article is clear. Given the need to maintain strong US economic growth and address a growing population, a persistent trade deficit, and the retirement of the baby boom generation, policy-makers need to weigh carefully the Kyoto Protocol's negative economic impacts and its failure to engage developing nations in full participation.

If growing scientific understanding indicates that such a policy is needed, it is essential to global economic growth and to the stabilization of carbon concentrations in the atmosphere that the US adopt a carefully timed climate change policy. It should be based on accurate science, improved climate models, global participation, tax incentives to accelerate investment in energy efficiency and sequestration, and new technology.

Acknowledgment

The author thanks the following sources for data used in Figs. 2 and 4: US Department of Energy, Energy Infor mation Administration; WEFA Energy Services; Australian Bureau of Agricul tural and Resource Economics; Data Resources Inc.; Charles River Associates; Alan S. Manne and Richard G. Richels; American Council for Capital Formation Center for Policy Research; Council of Economic Advisers, administration of former President Bill Clinton.

The author

Margo Thorning is senior vice-president and chief economist of the American Council for Capital Formation, a business lobby and think tank that focuses on pro-capital formation tax and environmental policies. She also serves as director of research for ACCF's education and research affiliate, Center for Policy Research, and is coeditor of numerous books on tax policy and environmental policy. Previously, Thorning served in the US Department of Energy and the US Department of Commerce and on the Federal Trade Commission. She received a BA from Texas Christian University, an MA in economics from the University of Texas, and a PhD in economics from the University of Georgia.