EIA lowers 2001 world oil demand growth forecast

Although the US Energy Information Administration cut its forecast for world oil demand growth this year to 1 million b/d for 2001 from its previously predicted 1.2 million b/d, it said that prospects for world demand growth will not be as dim as some had earlier predicted.

The agency said that the Organization of Petroleum Exporting Countries will need to increase production well above the group's new quotas by yearend, even after allowing for current levels of quota-breaking.

"Despite this revision, the prospects for growth in world oil demand are not as unlikely as some estimates have suggested, and excess oil supplies, not disappearing demand, were largely responsible for rising inventories and weakening oil prices during the first half of 2001," it said.

Meanwhile, US gasoline demand jumped 2.3% in July to 8.839 million b/d, likely a response to a 20¢/gal drop in gasoline prices from June-the biggest monthly drop since spring 1986, says American Petroleum Institute.

EIA outlook

EIA predicted world oil prices will strengthen by $2/bbl in the fourth quarter. It cites the loss of United Nations-sanctioned Iraqi oil exports in June and the 1 million b/d OPEC quota cut taking effect Sept. 1 that will reduce swollen commercial stocks over the next few months.

Economic factors that support demand growth are somewhat weaker than normal this year, EIA said, including 2% growth in world gross domestic product vs. 3% during 1991-2000. But there have been weaker economic scenarios in the last decade, the agency observed: "World demand has grown by at least 1 million b/d during times of comparable or weaker economic growth during the past decade."

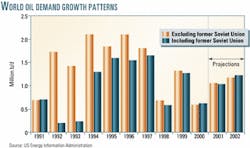

"Except during periods of serious international financial distress (1998), rapid increases in oil prices (1991 and 2000), and the dissolving of a nation-state (the former Soviet Union in the early 1990s), world demand has generally grown by 1-2 million b/d [annually] over the last decade," EIA said(see chart).

EIA said oil demand in Organization for Economic Cooperation and Develop- ment countries, which account for slightly more than half of world demand, grew by 540,000 b/d during the first quarter vs. a year earlier.

"That data is consistent with a total world oil demand growth estimate of 1 million b/d," EIA said.

The agency projected a 7-10% decrease in oil prices this year. It does not anticipate continued weakness in demand growth.

EIA also predicted short-term increases in US demand for petroleum products, including gasoline. US gasoline demand will increase 1.7% this year, it said.

It said demand growth in the first half was 1.4%, but the second half-buoyed by modest economic growth from tax rebates and lower withholding rates-will register growth of 1.9%.

In 2002, US gasoline demand will climb 2.2%, as disposable income increases and retail gasoline prices continue a slow, steady decline.

By the end of July, as inventories swelled, gasoline prices fell to less than $1.40/gal from a peak of $1.70/gal. EIA predicted an average gasoline price of $1.40/gal for the third quarter-11¢ less than the same period last year.

Natural gas

EIA predicts that third quarter spot prices for natural gas will be 30% lower than a year ago and that still lower prices are possible within the next few months.

In third quarter 2000, spot prices for natural gas were nearly $4/Mcf. The winter's average spot prices jumped to more than $6/Mcf. Wellhead prices will be 40% lower than that if weather this winter is normal, the agency said.

It said that concern for low gas storage levels spiked gas prices last year-culminating in a January monthly average wellhead price of more than $8/Mcf. Mild weather then reduced gas demand.

EIA said, "Now we believe that, though unlikely, very low natural gas prices within the next several months are possible. Temperate weather through the end of the year-combined with economic stagnation-along with gains in gas production could result in a collapse in prices."

But, the agency said, "Relatively stable world oil prices, increased gas use at electric utilities, and the assumption of normal weather are likely to keep wellhead price levels above $3 on an annual average basis for the near term."

EIA predicted that the average wellhead price in 2002 will be less than $3.20/Mcf, with the price dipping below $3/Mcf during several months of the year.

API report

Compared with July 2000, the average retail price of US self-serve regular gasoline dropped more than 12%, the largest year-to-year decline in more than 2 years.

Total July petroleum product deliveries were up 1.2% since January and 0.4% vs. July 2000.

Distillate deliveries last month totaled 3.592 million b/d, a 6.6% increase over July 2000. API said the large increase, unusual in midsummer, was partly due to electric utilities' burning distillate to meet demand surges caused by weather that was 7% warmer than a year ago.

US crude oil production was 5.818 million b/d, up 1.4% from July 2000, and the sharpest jump since January. Alaska's production grew 5.5% from a year ago, the strongest growth rate in 10 years, thanks to startup of the North Slope's Alpine field.

Crude oil imports fell 3.5% to 9.053 million b/d. Gasoline and blending stocks imports were up 5.9% at 628,000 b/d.

Petroleum inputs to refineries, mostly crude, were 15.734 million b/d in July, 1.5% less than a year ago. US refinery utilization fell to 94.6% last month vs. 96.8% in July 2000.