OPEC eyes another output hike to cut oil prices

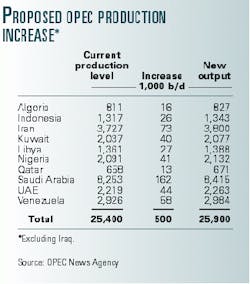

The Organization of Petroleum Exporting Countries has signaled its intention to raise output levels from 10 of its member countries to 25.9 million b/d by the end of the month if world oil prices remained at "current levels."

Oil futures prices fell last week by more than $2/bbl to less than $30/bbl for New York Mercantile Exchange (NYMEX) crude for August delivery in response to reports of the imminent production increase, and some analysts are suggesting a fall to as low as $20/bbl is possible.

OPEC notification

In a statement issued through OPEC News Agency, Alí Rodríguez Araque, Venezuela's minister of energy and mines and the organization's current president, was said to have "notified" OPEC oil ministers that "they should be prepared to take the necessary steps to raise output" by about 500,000 b/d if the OPEC basket of crude stays above $28/bbl.

"Other things being equal, it is expected that this will happen before the end of the current month," he said.

Under the newly proposed scheme, Saudi Arabia would carry almost one third of the overall production increase-about 162,000 b/d (see table). The remaining 338,000 b/d would be made up by other OPEC members, including Iran (73,000 b/d) and Venezuela (58,000 b/d). Iraq is sidelined from involvement in the plan due to continuing United Nations sanctions.

Although the move is in keeping with the decision made at the organization's meeting in June-where it was agreed OPEC would raise or lower its production in 500,000 b/d increments if oil prices remained outside a price band of $22-28/bbl for a basket of OPEC crudes for more than 20 days-it follows weeks of lobbying by Saudi Arabia that hinged on the suggestion it would hike its own output by the prescribed total volume if OPEC failed to do so.

The average price for the OPEC basket of seven crudes dropped 66¢ to $28.83/bbl on July 14. That basket price averaged $28.83/bbl for the week of July 10, down from an average $29.49/bbl during the first week of July.

So far this year, the OPEC basket has averaged $26.45/bbl, including an average $29.12/bbl in June. That compares with the 1999 average of $17.47/bbl.

Oil price drop

The move to boost production likely will trigger a scramble for markets that could cause a tumble of oil prices back to $20/bbl, said Fred Leuffer, senior managing partner and oil analyst at Bear, Sterns & Co.

The proposed increase would boost OPEC's total production to 25.9 million b/d from the 25.4 million b/d that group members agreed to in June when they raised production by 708,000 b/d.

Saudi officials had earlier indicated that they would undertake an increase of 500,000 b/d-unilaterally, if necessary-in an attempt to drive down high prices. Under the quotas proposed by Rodríguez, the Saudis would bear the brunt by adding 162,000 b/d of production to a total 8.4 million b/d.

"The flood gates are now open. Saudi Arabia's decision to produce more oil means OPEC unity is out the window. The race is on to see which countries can capitalize on these high oil prices while they last," said Leuffer in a report issued last week.

He said every OPEC member except Nigeria has cheated on its new production quota in the last 2 months.

Saudi officials would like to push back world oil prices to a level of $25/bbl to prevent the US from increasing domestic oil exploration and development of alternative energy sources.

But it is difficult to engineer a market price reduction, as other nations try to cash in before oil prices drop, Leuffer warned. "Once oil prices start to fall, it will be hard to stop them," he said.

OPEC's next move

Last week, traders were still waiting for a clear indication whether OPEC would again boost production ahead of the next scheduled ministers' meeting in Caracas at the end of September.

But following a meeting early in the week with Abdalla Salem El-Badri, Libya's energy minister, Rodríguez again blamed speculators for the run-up in international oil prices.

A separate meeting between Rodríguez and Iranian petroleum minister Bijan Namdar Zangeneh over the weekend produced a joint denial that OPEC can solve all market problems. They said demand is growing for light petroleum products, while additional crude supplies from OPEC members "will continue to be on the side of heavy and sour. This has resulted in the widening of the differential between sweet and sour crude, a problem that can not be solved by OPEC."

In a separate statement, Iranian Pres. Mohammad Khatami called for solidarity among OPEC members to keep production and prices at "justifiable" levels.

In a not-too-veiled reference to lobbying by US officials, Khatami said OPEC members should be wary of "political" influences from outsiders. "I believe there are hands at work to prepare the ground for tilting the balance between supply and demand, hence inflicting irreparable damage on oil producers through sudden falls in price," he said.