Study sees good prospects for some N. Sea service providers

As 2000 opens, the North Sea's "easy" production growth during the 1990s faces the reality of higher depletion and declining field sizes.

In a study published as 2000 approached, Simmons & Co. International, Houston, said opportunities for significant growth remain in the deep water, Atlantic margin, Norwegian Sea, and Barents Sea regions. The core continental shelf region, however, is going to see a tougher fight with the reality of oil depletion at hand, Simmons forecasts.

Simmons' report, written by Roger D. Read and Daniel R. Pickering, highlights the changes occurring in the North Sea and how those swings will affect the oil-service industry.

"We believe the oil-service industry will be a long-term beneficiary of this changing market," the authors said. Simply to stabilize production at current levels, exploration and production companies' demand for oil services will have to grow substantially.

Oil-service company winners and losers will not be evenly distributed. Companies that focus on underwater completions, floating production, extended reach drilling, seismic, and other production-enhancement products and services will be the winners.

The research firm expects that fabrication companies that rely on the development of large fixed and floating platforms are unlikely to experience the growth rates they have enjoyed in the past.

Update

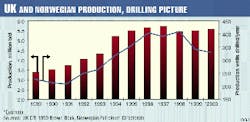

During 1990-97, the North Sea accounted for more than 70% of production growth for non-Organization of Petroleum Exporting Countries nations and more than 30% of worldwide production growth, the Simmons report noted (Fig. 1).

"However," it said, "we believe that significant North Sea production growth is unlikely in the future without a step-function increase in drilling activity." Particularly in the UK, reserves of the largest fields are significantly depleted, and the newer fields are considerably smaller.

The recent decline in North Sea activity is due mainly to the collapse in crude oil prices from late in 1997 through the early part of 1999. The failure of the market to rebound quickly stems from several factors:

- A change in economic budgeting and required rates of return.

- Long project lead times.

- The high-cost reputation of the North Sea.

- Lack of conviction in OPEC's ability to restrain its production.

- Recent E&P company mergers.

"We expect North Sea spending to decline by about 15% in fiscal year 2000, with the UK sector up 10% and the Norwegian sector down 35%," Simmons said (Fig. 2).

Overall activity is likely to remain weak at least through second-quarter 2000. Until E&P companies are convinced that the fundamentals of supply and demand are in balance and that OPEC is not going to flood the market with oil, they are unlikely to ramp up spending, said Simmons.

It estimates that the region's rig count should bottom at 34 rigs in first-quarter 2000 before rebounding and averaging 42 rigs for the year, up 5% from 1999.

Current scene

While the industry experienced its seventh month of improved oil prices in November 1999, the previous 16 months of low oil prices and resulting low cash flow took their toll on E&P outlays.

In the current market, Simmons said, the following factors hold back oil-service activity in the North Sea:

- New hurdle rates. As a direct reaction to record low oil prices, many North Sea E&P operators took a step back to evaluate the economics of their current and future projects. As a result, they significantly raised the economic hurdles that future projects must clear.

This was done by reducing the budgeted price of oil while maintaining or increasing the required rate of return. The minimum estimated price of oil at which a 15% rate of return is generated was reduced to $10-12/bbl from $13-15/bbl.

Even though oil prices have returned to levels where most conventional North Sea projects would be profitable, these rebudgeted projects remain based on $10-12/bbl. This is a continuing drag on drilling activity, which is likely to lag until budgeted oil prices are raised, there is optimism about future oil prices, or production declines force E&P companies to go back to the drillbit for production growth, Simmons said.

- High-cost reputation. Even after the cost-reduction initiative for the new era-which, according to industry sources, reduced capital and operating costs by about 30%-the North Sea remains a high-cost exploration and production region.

E&P companies are loath to invest in a higher-cost region with record-low oil prices and cost-cutting measures still fresh in their minds.

- Attractiveness of other regions. Other regions such as deepwater Gulf of Mexico, West Africa, and Brazil, with their larger reserves and higher production potential, are siphoning away the interest and capital-spending of E&P companies from the North Sea, particularly in the capital-constrained environment.

Longer term, the prospect of participating in Middle East projects is also likely to compete with North Sea spending.

- E&P mergers. Recent mergers or merger attempts by BP Amoco PLC, ExxonMobil Corp., Norsk Hydro AS-Saga Petroleum AS, and others, combined with restructuring at Royal Dutch/Shell, have all resulted in deferred projects and slower oil field activity, especially in the UK sector.

"If management's eyes are focused on cost cutting, a merger, or any other diversions, then the actual day-to-day management of the business is likely to suffer," Simmons said. "This is what we are seeing in the North Sea and worldwide today."

Near-term oil service outlook

The UK and Norwegian sectors of the North Sea are likely to experience continued declines in activity in the near term.

"At this point, we do not expect to see improvement in activity levels before second-half 2000," Simmons said.

How did it arrive at that conclusion? By looking at:

- Capital expenditures. "We estimate that worldwide capital expenditures fell 20-25% in fiscal 1999," said Simmons. The North Sea has followed this trend, especially during second-half 1999.

"Through first-half 2000, we expect North Sea E&P companies to maintain reduced spending due to seasonal issues and the uncertainty around OPEC's return to the oil markets."

- Seasonal factors. The weather and sea conditions are at their worst in the winter months, encompassing the fourth and first quarters. And drilling activity tends to be highest in the summer months.

In the current environment, the sense of urgency needed to accelerate drilling activity into first quarter does not exist.

- E&P budgeting process. E&P companies during November 1999 were just beginning their budgeting process for fiscal 2000. Higher oil prices should encourage and allow higher spending budgets.

E&P companies' managements, however, remain nervous about OPEC compliance issues. "Although we do not share their concern, that does not change the reality of the situation," Simmons said.

- Reaction times. Large E&P companies dominate the North Sea. They are project-driven, and it takes time for them to adjust to new market conditions. Just as their project-driven focus was slow to react to lower oil prices, it will be slow to react to higher oil prices.

This is a direct contrast to the shallow-water Gulf of Mexico, which is becoming dominated by quicker-reacting independent E&P companies.

- Long lease periods. The UK sector of the North Sea allows lengthy lease terms. Historically, lease rounds allowed 30-40 years of ownership.

The first of these leases expire in 2010 and the last by 2023. The E&P companies that hold these leases face little pressure to develop them in an uncertain environment, and thus are in no rush to develop them currently.

The five factors listed above will obviously have a negative near-term impact on oil-service companies, Simmons said. "We believe activity will fall through early 2000 as current projects wind down and few new ones are started.

"This activity decline will likely lead to a continuing decline in oil-service revenue, margin pressure, and little ability for pricing improvements over the next several quarters.

"North Sea oil-service companies will be faced with temporary overcapacity and the possible need to make additional cuts in assets and head count beyond those already completed," Simmons concluded.

N. Sea activity facing projected 19% plummet in 2000 spending

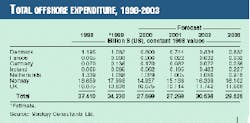

Combined North Sea exploration, production, and development spending is projected to plunge downward 19% in 2000 to $27.6 billion from 1999's estimated level.

The steep dip in outlays will stem from the oil price decline of 1998.

This forecast decrease in expenditure comes from Mackay Consultants Ltd., Inverness, UK, which said there will be no return to the high levels of activity experienced in the last few years.

"The main reason for the very large downturn in North Sea activity and expenditure is the oil price fall in 1998," said Mackay. Although prices rose again in 1999, the fall put a stop to most development activity. It will take 18 months for that to recover. By then North Sea oil and gas production will be dropping.

Mackay says its best indicator of activity is offshore expenditure (see table). Total North Sea spending was pegged at $37.4 billion in 1998 and is expected to drop to an estimated $34.2 billion in 1999.

After the anticipated fall in 2000, the total is predicted to decrease slightly more in 2001, rise in 2002, and end the forecast period in a downturn.

Production, market picture

North Sea oil production volume reached 283.4 million tonnes in 1998 and is expected to total an estimated 308 million tonnes for 1999. The totals for the 4 years 2000-03 are forecast to be 331.6, 331.5, 321.6, and 300 million tonnes, respectively.

Gas output was 176.8 billion cu m in 1998 and is expected to reach an estimated 182.8 billion cu m for 1999. Production volume for the 4 years during 2000-03 are forecast by Mackay to be 192.2, 201.6, 199.7, and 199.8 billion cu m, respectively.

In another segment of Mackay's study, Norway ranks as the largest market in the North Sea region, accounting for 49.9% of spending during 1999. This share is expected to rise to 54.4% in 2003 because Norway has a number of significant field developments in prospect.

The UK's share of activity is expected to decline from 43% of spending to 39.2% during 1998-2003, with a corresponding blight on the UK's platform fabrication industry in particular.

Tony Mackay, director of Mackay Consultants, said, "There will still be an important North Sea oil industry in 20 years, but there is little doubt that we are now close to the peak. I expect a slow but sustained decline in the future."