Industry needs standardization of precious-metals management

The formation of an industry group can help develop standards for the processing industry better to manage the reclamation of precious metals from catalysts.

Existing methods of managing these metals vary in accuracy and reproducibility.

Petroleum refiners and petrochemical producers need to understand the common errors involved in witnessing, sampling, and assaying reclaimed precious-metal catalysts to avoid large losses.

The role of precious metals in the refining and petrochemical industry will increase as environmental regulations become more stringent and fuel-cell technology becomes more prominent.

In recent months, petroleum refiners and petrochemical producers watched in dismay as the price of platinum and palladium rose steeply. Those who sold off their inventory and leased it back found that renewal meant paying as much as the purchase price of the metal at the end of the lease term.

Role of precious-metals catalysts

Precious-metals catalysts are essential for refining transportation-fuel products. As environmental regulations become tighter, the role of precious-metals catalysts and consequently precious metals become more important.

In the automotive industry, their role is even greater as catalysts reduce emissions by helping to clean the combustion products from the internal combustion engines.

As fuel-cell technologies take hold, the role of precious metals will widen, going beyond the transportation related markets to those such as housing and office buildings.

Precious-metals catalysts generally use platinum-group metals (ruthenium, rhodium, palladium, osmium, iridium and platinum) as activators. Of the six platinum-group metals, the refining industry uses palladium and platinum most often.

Key processes that use precious-metals catalysts in the refineries are reforming, isomerization, and hydroprocessing.

In reforming, the catalyst activator is platinum. Rhenium, iridium or germanium are co-activators. In isomerization, the activator is platinum, and in hydroprocessing, platinum or palladium, or a combination of both, are activators.

Metals demand

Although platinum and palladium are used in jewelry and dental applications, these metals are primarily industrial elements. Their supplies and demands are tightly balanced.

The precious-metals refining industry refers to platinum as "high-octane gold." Its strong price movement is a barometer for the worldwide economic growth. Strong and steady demand generally governs the price of platinum.

The price of palladium, on the other hand, appears to be governed by Russian export constraints.

Platinum catalyst is an octane booster in the refining industry. Platinum catalysts in reformer and isomerization units help refiners convert low-octane, light straight run (LSR) and naphtha fractions of crude to higher octane reformulated gasoline.

Reforming units produce hydrogen, whose production is essential for hydroprocessing naphtha and distillates to remove sulfur in gasoline and diesel.

Palladium is essential for the auto industry in meeting emission standards mandated by the governments. Strong demand and forecasted short supply have taken the prices of these two strategic members of the platinum-group metals to a higher plateau.1

According to Britannica's website, about 42% of all platinum produced in the western world is used for catalyst. Of this, 90% is used in automotive exhaust systems.2 The demand for platinum was about 5.35 million troy ounces (ozt) in 1998.3

If the demand growth for catalysts is 6.5%/year,4 the demand for platinum for refinery and petrochemical applications will be 255,000 ozt in 2000 or $153 million/year.

The portion for refining is about 60%, or 150,000 ozt, and stays fairly flat. Refiners consider this amount of platinum as metal that they need to buy or lease.

Use in refining and petrochemical plants represents about 15% of the total precious-metals catalysts in the world. In other words, about 1.7 million ozt of platinum will be processed in 2000 to recover platinum in the metals refining industries, representing a business value of $1.2 billion.

Management of catalysts

In refining and petrochemical plants, precious-metals catalysts have a finite life of between 1 to 10 years. Certain hydroprocessing units have 1-year lives, and semi-regenerative reforming units can use the same catalyst for 10 years.

At the end of the cycle, the refinery dumps the spent catalyst from the reactors and loads fresh catalyst.5 The plant then sends out the spent catalyst for precious-metals reclamation. The unit downtime is usually 1-4 weeks.

For purchase of fresh catalysts, precious metals must be available to the manufacturer 1-2 months in advance. Precious metals from the recovery operation are unavailable for 3-6 months, depending on the contractual arrangement between the petroleum refiner and the precious-metals refiner.

This period of 4-8 months is called the bridging period when refiners will either lease precious metals or buy and carry precious metals in their inventory pool.

At the end of each recovery, the refinery pays off the lessor. Any deficit (lease minus return from reclamation) is either purchased or becomes a write off from the inventory. In some cases, the deficit becomes a long-term lease.

Whether to lease or to buy is an issue that the refiners need to deal with based on their individual economic situations and the prevailing economic conditions at the time. They should consider capital availability, metal price, and the lease rate. Lease rates can vary between 3 to 97% based on the projected forward pricing of the metal.

In a large operation with multiple refineries, the precious-metals assets are usually managed centrally, while base catalyst is managed locally as a part of the local unit or area-team budget.

Hydroprocessing and reforming specialists usually manage precious metals by themselves or through a contractor. If the specialists manage precious metals by themselves, they get the full appreciation of the catalyst life cycle.

If they deal with more than two or three catalyst change-outs per year, the task becomes onerous and they often hire a contractor or a consultant knowledgable in technology and the business.

In a large corporation, the specialist or the consultant links up with supply chain, accounting, finance, and risk management to successfully manage precious-metals catalysts.

Precious-metals cycle

When a decision is made to purchase precious-metals catalyst, the engineer or manager responsible for the precious-metals pool examines his or her inventory and releases the metal to the catalyst manufacturer.

The metal must be converted to a corresponding salt solution for the manufacturer to absorb it on the porous surface of a catalyst base and calcine it. For example, platinum needs to be converted to dihydrogen hexachloroplatinate, that is, chloroplatinic acid (CPA) or tetramineplatinumchloride (TPC); palladium to tetraminepalladiumnitrate (TPN), and rhenium to ammoniumperrhenate (APR).

The catalyst manufacturer usually supplies specifications and batch sizes so that a precise amount of precious metals can be added to a precise batch of the catalyst. The specification is typically 0-1 wt % metals on catalyst.

In some cases, the catalyst manufacturer even handles conversion of the metal sponge to salt so that he or she maintains propriety. Some suppliers charge the manufacturing loss for precious metals separately, others bury it in the purchase price of the catalyst. The sloppier the operation (that is, the poorer the material-balance closure), the higher the loss and thus the higher the catalyst cost.

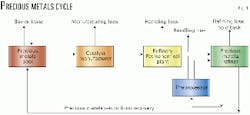

While the catalyst undergoes changes in the refinery process by building up coke, its precious-metals activator remains intact except for physical losses from handling. Fig. 1 shows the involved parties associated with precious-metals handling.

Diligent and secure handling drastically reduces or eliminates losses at each step. Preprocessing is normally not required unless the process or production area teams cut corners in bringing the unit down to reduce down time. In that case, the spent catalyst contains hydrocarbons and requires pretreatment.

Excessive carbon on catalyst such as heel catalyst from UOP CCR (Continuous Catalyst Reforming) units usually requires preprocessing. Depending on the reclaimer, preprocessing can be costly and should be avoided if possible.

Precious-metals recovery process

There are two categories of precious-metals catalysts in refining and petrochemicals applications, classified according to their recovery processes.

All soluble catalysts can be processed either by hydrometallurgy or by pyrometallurgy, whereas insoluble catalysts can only be treated by pyrometallurgy. The percent recovery of metals is usually higher by hydrometallurgical process.

There are few players in this business. For soluble catalysts, well-known names are:

- Degussa AG, Frankfurt.

- W C. Heraeus GmbH & Co. KG, Hanau, Germany.

- PGP Industries, Santa Fe Springs, Calif. (recently acquired by Heraeus).

- Gemini Industries Inc., Santa Ana, Calif.

For insoluble catalysts, better-known names are:

It is important to make a distinction between what percent recovery means to a precious-metals refiner compared to what it means to a petroleum refiner. To a precious-metals refiner, recovery is the percent difference between the net precious metals he recovered from the spent catalyst in his process and the net precious metals he had to pay out to his customer based on assay exchange and final settlement.

To a petroleum refiner, recovery means the percentage difference between the net precious metals he received from the reclaimer for his spent catalyst and the net precious metals he had to give out to the catalyst manufacturer for the fresh catalyst based on assay exchange and final settlement.

A precious-metals refiner usually retains a percentage of metal to cover for the margin of error in his assay and in his recovery process. The metals refiner can claim the entire retained metal from the customer if he gets a good material-balance closure for the process. A near perfect material-balance closure requires meticulous handling, precise analysis, and quality control.

Hygroscospic, sampling, and assaying errors for catalyst material usually favor the reclaimer. The refiner needs to be smart and vigilant to point this out and make necessary corrections.

For a petroleum refiner, the time period between the release of precious metals to the catalyst manufacturer and the recovery of precious metals from the reclaimer for a given reactor load of catalyst can be long. Catalyst movement during this period is difficult to track for some units, such as a semi-regenerative reformer.

In a semi-regenerative reformer, the catalyst is usually regenerated, dumped, and screened at least three or four times in its 10+ years of life. The refinery adds make up catalyst before the spent catalyst is finally sent out for metals recovery. Fig. 2 diagrams a reformer's platinum-recovery cycle.

Refinery personnel sometimes increase handling losses by inadvertently throwing out the fines generated from the screening operation without the knowledge of the area engineer. Implementing careful tracking procedures with the help of materials management can reduce such losses.

Precious-metal catalyst contract

Whether it is working with a fresh catalyst supplier or a metals reclaimer, a petroleum refiner needs to understand the process surrounding the precious-metals catalyst to draw up a proper contract.

The contract must consider precious-metals reconciliation both in the front end (fresh catalyst purchase) and at the back end (reclamation). Failing to do so may cost the refiner millions of dollars, depending on the size of the unit.

For reconciliation, the focus is usually on calibration of the weigh scale and the accuracy of weights. Consistent sampling in proportion of the lot weights, preparation of composite sample for assay, and use of a dry box are also important.

The refiner should determine the lot size based on the metal price. Use of appropriate shipping containers and securing the containers with proper supplier seals should be included in the contract.

For spent catalyst, the refiner needs to specify the net weight, type of precious metals, precious-metals content range, carbon and hydrocarbon content, and any impurities that may affect the reclamation process, such as insolubility and loss on ignition (LOI).

The usual three bids and a buy based on quoted reclamation price can be misleading and costly. One needs to work through all-inclusive cost of precious-metals return and return period to factor in the cost of the lease.

One item frequently overlooked is the treatment charge often quoted to include materials as received. If this is accepted, the petroleum refiner pays for inert material, which does not go through the treatment process.

In some cases, it is well worth separating support material at source rather than sending it to the reclaimer. Spherical 1/8-in. support material is very difficult to remove from extrudate and causes sampling inconsistency and inaccuracy.

As stated, when negotiating a contract with either a catalyst manufacturer or a precious-metals refiner, a petroleum refiner needs to consider overall cost rather than just the cost per pound alone.

The overall cost analysis may include the precious-metals requirement date (or precious-metals return date), lease rates, turnaround days for precious metal, witnessing sampling, use of such facilities as dry-box, unnecessary grinding or time delay in sampling, and use of proper procedures if LOI is done at the time of sampling on the reclaimer's site.

What sets precious-metal catalyst suppliers or reclaimers apart is the percentage recovery number. Refiners need to examine the history of recovery based on the past experiences, which can be used as benchmark.

If a refiner achieves a consistently low percentage recovery or an unexplained change in the percentage recovery, it should investigate. If the task becomes complicated and difficult to resolve, it is worth calling in an expert in this area.

Savings can be significant because a 1% difference in recovery may mean $1 million for a large refinery if the precious-metals price is high. High prices are expected for some time to come.

Sampling and witnessing

Generally, the sampling system used in the precious-metals refining industry is designed for low-grade, non-uniform, and non-hygroscopic material. The precious-metals content from particle to particle varies significantly in these materials.

Therefore, the system is designed to blend, reblend, and grind.6-7 The time element is of less concern.

On the other hand, catalyst used in the petroleum refining industry is high-grade, uniform, but hygroscopic. If the same sampling system were used for both precious metals and catalysts, without factoring in the moisture pickup during the sampling period, a considerable error can be introduced in favor of the reclaimer.

The purpose of sampling and witnessing is to collect and secure an accurate reproducible sample that represents the precious-metals content of each lot of the entire load of catalyst. Too small a lot size means too many lot samples and thus a high assay cost; too large a lot size means too few lots that reduces accuracy and reproducibility.

The size and frequency of a sample as the material drops through the sampling system is usually fixed for each type of sampling system.

The lot size depends on the value of the contained precious metal. Usually, the lot size is set at $1 million. The witness needs to be aware of the most common areas of inadvertent error that may affect a win-win settlement when the final results are returned.

Each catalyst manufacturer and reclaimer has his own sample container for LOI determination and precious-metals assay. Usually, the catalyst manufacturers are more vigilant about LOI than reclaimers.

Some catalyst manufacturers use a dry box and a humidity-controlled atmosphere for preparing composite samples; others do not.

No petroleum refining industry standard for precious-metals witnessing and sampling exists. As the precious-metal price rises, the importance of a standard set by an independent organization for the industry becomes more important.

The secrecy surrounding the catalyst manufacture prevents the witness from carrying out his job properly. A secrecy agreement between witness and manufacturer allows a witness to examine freely the variables that are involved in proper sampling and witnessing.

Precious-metals assay

The normal practice in the industry is to have samples collected at the time of witnessing and assayed by an independent assayer.

The witness, acting on behalf of the refiner, collects two sets of samples. The reclaimer also collects two sets of samples.

Each party gets one set of sample assayed and exchanges results by cross mail system so that each will receive the other's assay at the same time. The other set of samples is set aside for umpire assaying, if necessary.

If the difference between the net metal content determined by the refiner and the reclaimer in the lots is more than 1%, the reclaimer or the refiner, or both, must send their second set of samples to the umpire.

Most refiners either do not have their own assay laboratory or their laboratory may be backlogged. There are very few commercial independent assayers in the business. Of note are:

- Ledoux & Co., Teaneck, N.J.

- Inspectorate, Witham, UK.

- Alfred H. Knight International Ltd., St. Helens, UK.

- Alex Stewart (Assayers) Ltd., Knowsley, UK.

A refinery cannot use the same assayer for an umpire as the assayer who did the initial assay. The reclaimer usually reports the assay results with a margin of safety. The usual turnaround time for a metal assay is 6 weeks, which should be taken into account for bridge leasing.

Although the assayers carry out round-robin tests, there is significant deviation between assay results on same-lot samples done at different laboratories (Fig. 3). Deviations are likely the result of an assay laboratory having a consistent positive bias rather than scatter expected in random error.

The refining industry as a group should investigate this deviation among laboratories with the help of an independent organization.

Precious-metals reconciliation

Once the assay is complete by both the refiner and the reclaimer, the assay results are exchanged by cross mail system.

Each then calculates the total metal contained by lots and if the percentage difference is over the contracted number, usually 1%, a predetermined umpire is used as a referee. A splitting limit of 0.5% is sometimes used and that usually guarantees going to the umpire.

For a refiner, going to an umpire should be avoided because the sample containers are not standardized and pick up moisture over time. The moisture results in a lower metals analysis number, giving the refiners a lower-than-actual metals return. In addition, the refiner must pay for the umpire assay as the losing party.

Here again, a refinery user group led by an independent organization can set standards for the industry.

References

- 1. www.kitco.com

- 2. www.britannica.com

- 3. www.expressindia.com

- 4. www.freedoniagroup.com

- 5. Clifford, Roger K., "Spent Catalyst Management," Petroleum Technology Quarterly, Spring 1997.

- 6. Anderson, Corby G., Baily, Barry, and Helm, Steven P., "Guidelines for Particulate Sampling," International Proceedings of the 19th International Precious Metals Institute Conference, June 1995.

- 7. Hageluken, Cristian, "Precious Metals Catalysts in Petroleum Refining," AIChE 1997 Spring National Meeting, Technical Session 129, Houston, March 1997.

The author

Prad Mitra Chaudhuri is an engineering specialist for process and technology at Petro-Canada's Oakville, Ont., refinery. He has managed various petroleum refining technologies nationally for Petro-Canada for the past 17 years. Most recently, Chauduri has managed reforming, hydroprocessing, and isomerization technologies. Before working at Petro-Canada, he had 14 years' experience at Petrostar (Nova) and Polysar (Bayer). Chaudhuri holds an MASc in chemical engineering from the University of Windsor and a BChE in chemical engineering from Jadavpur University, India. He is a registered professional engineer in Ontario.