LNG UPDATE: LNG trade growth to drive vessel demand, set trading patterns

Increased growth in LNG trade within the next 10 years will directly affect both vessel demand and traditional trading patterns for natural gas worldwide.

Ocean Shipping Consultants Ltd. (OSC), Chertsey, Surrey, UK, in a recent LNG trade and shipping study, identified five key growth issues that will affect expanding worldwide LNG trade.

Continuing pressure to lower costs, in both LNG production and shipping, will most certainly impact growth, OSC said. And a need will be established for increased flexibility in vessel employment integrating short-term contracts.

Short-to-medium-term supply will expand from production developments planned in Trinidad and Tobago, Nigeria, Qatar, Oman, Australia, Indonesia, and Malaysia, the report stated, and longer-term expansion prospects will arise in the US, Yemen, Iran, Egypt, and Venezuela.

In addition, there will be renewed growth in Asian LNG import demand, both in established markets such as South Korea and Taiwan and in emerging markets in India and China.

Lower costs

Lower costs associated with both new production capacity and shipping will create a foundation for more extensive LNG transport developments.

New vessel costs for large LNG carriers have fallen sharply, to $145-160 million from about $240 million during the early 1990s.

At the beginning of 2000, the world LNG fleet consisted of 114 ships totaling 12.4 million cu m of carrying capacity. Twenty-eight additional LNG vessels currently are on order at nine shipyards. These will add slightly less than one-third more capacity to the current total fleet capacity.

The drop in vessel construction costs has prompted a number of speculative orders, including contracts from Exmar and Bergesen and proposals by BP Amoco PLC. Exmar's signing of an additional 25-year LNG transport agreement with Enron Corp. reflects a continuing preference for secure, long-term contracts.

LNG trade growth

During 1999-2010, the OSC forecast period, LNG trade will expand by slightly less than 117 billion cu m under the study's "most likely" (base) case scenario.

Under the base case, total LNG trade will increase by 35% (46.6 billion cu m/year) in 2000-05, reaching nearly 180 billion cu m/year, and rise by another 39.4% (61.7 billion cu m/year) in 2005-10 to exceed 241 billion cu m/year (Table 1).

Expansions in the Middle East will dominate long-term supply, OSC said. This area will account for 44% of all LNG trade growth during 1999-2010.

Within the next 5 years, exports from the Middle East will increase by nearly 70% to 36.5 billion cu m/year, accounting for a third of overall LNG trade growth in that period.

Short-term exports

The buildup of contract volumes emanating from new LNG export facilities in Qatar and Oman in the Middle East, along with Trinidad and Nigeria in the Atlantic Basin, will dominate short-term LNG trade developments, OSC concluded.

Overall LNG export capacity in Qatar reached 18.6 billion cu m/year by early 2000. The Qatargas LNG facility was responsible for exporting 6.1 billion cu m/year (two trains), which grew to 9.1 billion cu m/year in 1998 when a third train was added to the Qatargas plant.

RasGas commenced operations of its first LNG train in 1999, and its second started up in early 2000.

Oman joined the ranks of exporters in 2000, shipping out 9.1 billion cu m/year when two LNG export trains began operating early in the year.

Asian, other exports

Asian LNG exports will represent about 28% of the total world LNG trade growth within the coming decade, according to OSC. Exports will rise by about 19% during 2000-05, reaching volumes of 91.5 billion cu m/year.

Large-scale expansion plans include the Malaysian Tiga LNG project-5.2 billion cu m/year due in 2002, followed by an additional 2.8 billion cu m/year in 2003-and Indonesia's Tangguh project, which is designed to provide 4.1 billion cu m/year of capacity during 2004-05.

Tangguh follows the recent expansion at Bontang, which involved the start-up of the 4.1-billion cu m/year H train in 1999.

A fourth train also is planned at Australia's North West Shelf LNG facility over the near term, which will add another 3.5 billion cu m/year to its exports.

Short-term West African LNG exports from the buildup of Nigerian shipments that will reach 10.8 billion cu m/year by 2005, compared with 0.7 billion cu m in 1999.

The successful completion of Trinidad's Point Fortin one-train facility also has prompted plans to expand in the short term. A second train, producing 4.5 billion cu m/year, will be constructed in 2002, and a third train (4.5 billion cu m/year) will be added in 2003.

LNG exports from Trinidad will increase by about 6 billion cu m/year in 2000-05.

LNG import activity

Asian import markets are set to dominate forward-trade developments, with strong growth in the emerging markets of India and China supported by growth in established import markets such as South Korea, Taiwan, and Japan.

The potential for LNG imports in India and China is enormous. OSC base-case projections put the two markets combined at more than 30% of overall LNG trade expansion in 1999-2010.

India will begin imports in 2001, supplying the Enron power station at Dabhol with a modest volume of about 0.7 billion cu m. The buildup in contract volumes for the Dabhol project, together with the construction of the Pipavav terminal, will increase LNG imports to around 3.5 billion cu m/year in 2003-04.

By 2005, India's LNG imports will reach 9.7 billion cu m, supported by imports into new Petronet terminals at Dahaj and Cochin. By 2010, LNG imports in India will reach 19.3 billion cu m/year.

China's first large-scale LNG import terminal, in southern Guangdong province, will start up in 2005 with an initial capacity of 3 million tonnes/year. Chinese imports are projected to climb to about 16 billion cu m/year by 2010.

Although Asia will create the most substantial LNG import growth in the coming decade, significant developments are also foreseen in the Atlantic Basin. European imports will climb sharply in the short term because of the buildup of exports from Nigeria and Trinidad under new contracts.

Long-term Nigerian LNG contracts with Italy, Spain, France, Turkey, and Portugal-based on two trains-total 7.2 billion cu m/year, compared with actual 1999 shipments of 0.7 billion cu m. The development of a third LNG train in Nigeria will raise exports into Europe by an additional 3.7 billion cu m/year.

Fleet requirements

Considering existing LNG vessels, current orders for new vessels, and predicted scrapping volumes, OSC analyzed the implied newbuilding requirements to meet forecast LNG demand. In the study, OSC examined "most likely" scenarios under a base case and strong and weak growth forecasts under high and low cases, respectively.

Under the base case, 22 new vessels, each with a capacity of 137,000 cu m, would be required to meet projected demand growth in 1999-2005. An additional 52 such vessels would be required during 2005-2010 (Table 2).

The high-case implication calls for 35 new vessels in 1999-2005 and an additional 68 in 2005-10. Under the low case, comparable fleet demand amounts to only 6 more vessels required in 1999-2005 and an additional 29 in 2005-2010.

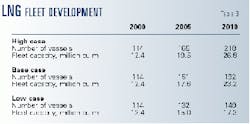

Under the base case, an 87% rise in fleet cargo-carrying capacity would occur in 2000-10, to 23.2 million cu m from 12.4 million cu m. In terms of vessel numbers, this implies an expansion from 114 vessels at the beginning of 2000 to 192 by 2010 (Table 3).

Short-term fleet growth will raise overall capacity by 42% (2.7 million cu m) to 17.6 million cu m by 2005, with stronger, longer-term growth adding an additional 5.6 million cu m in 2005-10.

Spot markets

While short-term LNG contracts have grown in recent years, a more permanent short-term market will depend on a number of sustained developments.

Among these are the availability of surplus LNG production over and above long-term contract volumes; vessel availability, including the more flexible use of long-term chartered tonnage; acceptable pricing mechanisms; and suitable downstream markets for incremental or short-term contracts.

In 1999, there were about 2 million tonnes (2.8 billion cu m) of short-term LNG trade, equivalent to about 2.4% of overall trade (or 62 cargoes).

Under OSC's base case, excess production capacity available for additional short-term contracts will decline as proposed and existing contracts build up to full volumes. By 2005, a global LNG production surplus totaling 21.4 billion cu m/year will develop, shrinking to around 18 billion cu m/year by 2010.

Vessel availability

In terms of vessel availability, transport logistics will become more flexible, although tightly controlled bilateral trades will characterize the majority of future developments.

Several new projects-notably in India and China-are forming on the basis of fob LNG contracts, with LNG buyers preferring to invest in carriers to service import contracts.

Buyer-controlled vessels will encourage more-flexible shipping practices, as owners would be anxious to maximize vessel efficiency while securing lowest-cost gas supplies, including incremental short-term contracts.

For the short term, most vessels that were used on spot trades in the late 1990s will be absorbed into longer-term LNG trades associated with projects in Trinidad and Nigeria. This leaves about eight vessels available for additional short-term contracts out of the fleet existing in early 2000 and a similar number of speculative orders joining the fleet before 2005.

The start-up of new projects may absorb vessels not under long-term charters, however, with the expectation that project-linked vessels will be used to transport incremental spot cargoes.

Meanwhile, traditional LNG trading pattern are still characterized by long-ballast voyages and bilateral trading between a single load port and a single discharge port.

Such practices build in inefficiencies and overcapacity. To offset these inefficiencies in the future, vessel owners will develop multiport load and discharge practices, backhaul cargoes, and triangular and inter-route trading patterns.