The Opening Of Iraq: Post-Sanctions Iraqi Oil, Its Effects On World Oil Prices

The opportunities for investing in Iraq's oil sector after sanctions are lifted are very significant, indeed, but there are enormous consequences for oil markets when those opportunities are exploited.

Iraq is known to have great oil potential, but little is known about exactly how much there is (OGJ, July 29, 1996, p. 108).

The present estimate of recoverable reserves of 112 billion bbl probably represents only the smaller part of what could be the country's ultimate recoverable reserves.

Iraq, the least explored and developed of the major Middle East producers, has been underexplored for various political reasons-since 1961 mainly owing to problems with the Iraqi government or with the Iraq Petroleum Co. consortium. Since oil was discovered in Iraq (Kirkuk) in 1927, Iraq's oil industry went into long periods of stagnation, and the years of active exploration and development (1952-60 and 1973-81) were extremely limited.

During 1927-52, conflicts within the IPC consortium stalled E&D efforts. A brief revival of activity came during 1952-60, when a string of important discoveries in southern Iraq were tallied, including the giant (23 billion bbl) Rumaila oil field. But a deadlock over a number of issues between IPC and the government hindered further E&D activity during 1961-73, especially following the promulgation of Public Law No. 80, which unilaterally recovered 99.5% of the entire territories covered by the IPC group concessions. Under entirely different world conditions, the Iraq oil industry nationalized the companies' concessions in 1972.

Thereafter, an exploration and development renaissance occurred during 1973-81, when Iraq's reserves shot up to 112 billion bbl of oil from 35 billion bbl. But the war with Iran led to a halt in oil development, whereas the Persian Gulf war and United Nations embargo have brought Iraq's oil industry to its present lamentable state.

Prior to the war with Iran, Iraq's oil production capacity was about 3.8 million b/d. But the war had the effect of reducing capacity so that, prior to the invasion of Kuwait, actual production reached 3.3 million b/d. Its export capacity through pipelines and a deepwater terminal stood at 3.9 million b/d. Currently, Iraqi production averages about 2.8 million b/d-more than 1 million b/d from the north and about 1.8 million b/d from the south. Iraq's export capacity now stands at about 2.2 million b/d, from both the pipeline to Ceyhan, on Turkey's Mediterranean coast, and via the Al-Bakr deepwater terminal.

The present estimate of recoverable reserves include giant oil fields that were discovered during the 1970s but that were not developed because of the wars and the ensuing UN embargo. The Iraqi government has either concluded or negotiated a good number of contracts with European and Asian oil companies to develop those fields, which if implemeneted, could result in the installation of additional capacity of 2.85 million b/d. The general pattern of these agreements is the standard oil production-sharing agreement.1

The implementation of those contracts will depend on lifting the UN sanctions. Once those contracts come into force, it could be a matter of a few years before Iraq can add about 3 million b/d to its prewar capacity of 3.5 million b/d.

CGES estimates Iraq's technically feasible production capacity is 6-8 million b/d. The government's target is a production capacity of 6 million b/d to be reached within 6-8 years after sanctions have been lifted, at an estimated cost of $25-30 billion.

Lifting the UN sanctions on Iraq will depend on political factors and especially on the difference of viewpoints among the permanent members of the UN Security Council. According to the US and UK stance, Iraq should comply fully with the UN resolutions before the lifting of sanctions can be considered. In reality, this means that sanctions will be lifted only after a change of the present political regime in Iraq. By contrast, the French, Russian, and Chinese share the view that sanctions can be lifted now with the condition that strict monitoring should prevent Iraq's rearmament, as well as the monitoring of spending oil revenues.

This latter position, if it is adopted, would allow oil companies to begin developing Iraq's oil potential. The reports that were submitted last year by the three UN panels on Iraq are more or less in line with the position outlined by those latter three countries.2

Development scenarios

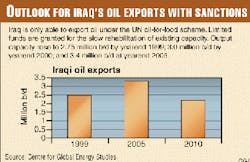

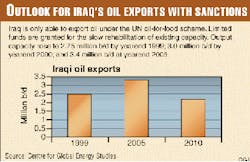

There are, therefore, two scenarios for Iraq's oil development prospects. The first envisions sanctions being maintained for a long time, in which case Iraq's oil industry cannot be fully developed, and the best Iraq can do is keep the oil-for-food arrangements going, which allows Iraq to sell oil to the value of $5.2 billion every 6 months.3

Under this scenario, limited funds are granted for the slow rehabilitation of existing capacity; output capacity then rises from 2.75 million b/d at yearend 1999 to 3.0 million b/d by yearend 2000 and 3.4 million b/d by yearend 2005.

The maximum that Iraq can achieve under this option is to improve its present capacity of 2.75 million b/d, with the UN helping to buy the necessary equipment and spare parts that are required for the rehabilitation of her industry.

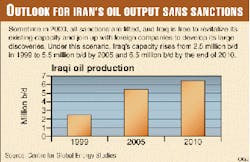

The second scenario, in which sanctions are lifted, provides a totally different picture: Foreign oil companies could help Iraq not only in investing in projects for new capacities but also in quickly restoring its dilapidated industry. With full rehabilitation of Iraq's oil sector and permission for foreign oil companies to help Iraq develop its large discoveries, it could add no less than 4.1 million b/d of capacity between now and 2010. Under this scenario, Iraq's capacity rises from 2.5 million b/d in early 1999 to 3.0 million b/d in 2000, 5.5 million b/d by 2005, and 6.5 million b/d by yearend 2010.

Iraq's production profile could be very high, and a capacity of 6 million b/d, which is the government's target, could be reached in a matter of 5-7 years, assuming sanctions are lifted this year.

It should be noted that Iraq's future oil production costs will be higher. Most new fields will require water injection. Its oil output per well in the past averaged 12,500 b/d, but in the future that figure will be about 1,750 b/d/well. Investment intensity for capacity expansion in Iraq will also rise. So far, the average has been about $1,500/bbl at peak production; in the future, this is likely to average $4,750/bbl.

On this basis, CGES estimates that total investment required to expand Iraq's production capacity will be about $25-30 billion.

Market effects

With either of these two scenarios, whatever happens to Iraq's oil will have enormous bearing on the world market and on world prices. However, this question cannot be dealt with independently from world supply-demand trends and the extent to which investments in the Persian Gulf-especially in low-cost areas such as Iraq-develop in comparison with other areas in the world.

World demand for oil in the coming years is not expected to grow at the very high or robust rates of 1987-97 for various reasons: slower growth of the world economy, environmental constraints against oil, technological advances, etc. What matters, therefore, is the amount of new supplies coming into production during this period. Over the previous 15 years, heavy investments were made outside the Organization of Petroleum Exporting Countries in high-cost areas, which became economically feasible because of the high-price policies pursued by OPEC. This relegated OPEC to the role of being a last-resort or residual producer, limiting its production only to the difference between demand and non-OPEC supplies. This has been systematically implemented since 1983 and-apart from very short periods such as in 1998 and early 1999-oil prices have been kept high through the reduction of OPEC production.

With technological progress, which has the effect of drastically reducing the cost of production, the high prices maintained by OPEC will allow investments to continue in high-cost areas, which has the effect of reducing the market share for OPEC and especially Persian Gulf oil. CGES estimates non-OPEC oil supply growth at 3.1 million b/d of additional capacity during 1996-2005.

In other words, if prices are kept high enough through OPEC policies of reducing production, there will be no real market to absorb the anticipated huge increase in oil production capacity in Iraq-and that does not include ambitious plans for similar increases in other OPEC countries.

Under these conditions, the additional huge oil supplies from Iraq would adversely affect the market, and prices are bound to fall. Companies investing their money in new Iraqi capacity will not adopt a restrictive production policy, which would hinder recovery of their investments. The result would be an excessive amount of oil (whether gulf or non-gulf) vs. weak growth in world oil demand.

In the event of gulf countries opting for more competitive production policies that cause oil prices to drop below $12/bbl, there is a very strong possibility that oil companies would show immediate interest in investing in low-cost areas (especially Iraq, Saudi Arabia, and Kuwait) and, correspondingly, in reducing their investments in high-cost areas. The reason for this is principally that, with low costs, companies can make good profit margins, even given a low-price scenario. With this state of affairs, supplies from outside the gulf would decline, and the market for investment in the gulf states would expand. In this way, the entry of Iraq into a situation of enormously increasing quantities would not have a disturbing effect on the market.

OPEC's success in 1999 and 2000 at reining production in order to shore up oil prices (a decision taken mainly as a result of financial pressures on the oil-exporting countries) may suggest that the process that started in the 1980s of the major producers cutting their production in order to shore up prices would continue at the cost of losing their market shares to the benefit of other high-cost production. Although detrimental to their long-term interest of securing a bigger market share commensurate with their large reserves and low-cost oil, these policies may continue under the pressure of short-term financial considerations as well as external pressures on the part of higher-cost producers.

In conclusion, the potential of rapid expansion of Iraqi oil production capacity and its consequential effects on the world market, will depend first on the policies of the UN Security Council concerning the economic sanctions on Iraq. It will depend also on the production policies of the other gulf countries in encouraging or discouraging investments in high-cost production areas outside OPEC through higher (or lower) price regimes that could be achieved by restricting producing levels (or otherwise).

Much will also depend on OPEC-led price policies, technological change, and political developments.

With a possible increase in the call on Persian Gulf oil by the time Iraq's oil industry expands, the industry's fear that a fully rehabilitated Iraq would lead to a further oil price collapse may be exaggerated.

However, unforeseen developments in technology and regional politics may affect both supply and demand, and hence the prospects for Iraq's oil development in that balance.

Notes

- Recently, it seems that the Iraqi government has had some second thoughts about the pattern of oil investments, reportedly preferring the buy-back arrangements as implemented in Iran (see related article, p. 44).

- The latest development in this respect was the adoption of Resolution 1286, which essentially provides for suspending the sanctions against, as a quid pro quo, the full cooperation of the Iraqi government with the inspection teams for the total elimination of mass-destruction weaponry, especially chemical and biological weapons. The significance of this resolution as far as oil is concerned is that, in case everything goes well, Iraq will be allowed to open the industry to foreign investors and implement the contracts and agreements that were either reached or negotiated by the government with a number of foreign oil companies from France, other European countries, Russia, Malaysia, etc.

- According to the latest resolution, the cap on the value of Iraqi oil exports is lifted.

The Author

Fadhil Chalabi was born in Baghdad, Iraq, in September 1929. After graduating with a BA in law from Baghdad University in 1951, he took up a post with the Iraqi Ministry of National Economy and during 1956-58 obtained two postgraduate diplomas in political economy from the Université de Politiers in France. He later obtained a PhD in economics from Paris University with a dissertation in oil economics. Chalabi's professional involvement in oil begain early in 1968, when he was appointed Director of Oil Affairs at the Ministry of Oil in Baghdad. He was appointed to the office of Permanent Undersecretary of Oil in 1973, leaving after 3 years to join the Organization of Petroleum Exporting Countries as Assistant Secretary General. He also served in oil-related policy-making roles in Iraq through his membership on the boards of directors of Iraq National Oil Co. and the Central Bank of Iraq during 1968-76 and 1971-76, respectively. In 1976, Chalabi held the office of Deputy Secretary of OPEC in Vienna, later serving as OPEC's Secretary General from July 1983 to June 1988. In 1989, he assumed his present position of Executive Director of the newly established Centre for Global Energy Studies in London. Chalabi is the author of two new books, has written several articles on energy and oil economics, and is a speaker at numerous worldwide energy and oil seminars and colloquia. He received the British Institute of Energy Economics Award for Distinction in 1988.