Peru's Camisea project faces new possibilities, significant questions

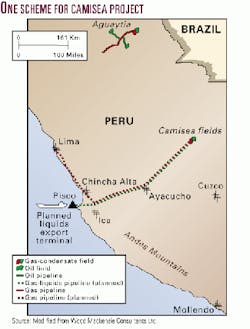

The long, checkered past of Peru's Camisea natural gas exploration and development project-regarded to be of critical importance to that country's economic future-may be entering into a "new era of possibility," according to Wood Mackenzie Consultants Ltd., Edinburgh, in a recent report. However, a "significant" number of questions surround the viability of Camisea development, the analyst noted.

Chief among these questions is the status of Peru's overall demand for gas, despite the country's intentions to build at least 10 new gas-fired power projects before 2005, said the analyst.

Additionally, Wood Mackenzie draws at least one similarity between the situation in Peru and that in Brazil, despite the countries' drastically different economies of scale: "Both countries are trying to preferentially install gas into the energy matrix with a relatively high citygate price," the analyst said.

Economic growth, gas demand

After 2000, Wood Mackenzie expects Peru's economy to experience a period of growth, with its gross domestic product to increase an average 4%/year during 2005-15. "This economic upturn," said the analyst, "will lead to stronger energy demand growth in the longer termellipsethe timing and size of this growth is of paramount importance to the Camisea development."

Industrial demand in Peru is 2.4 million tonnes of oil equivalent, of which 38% is oil, according to the analyst.

Long-term development of the industrial gas market will depend upon "the provision of a low-cost alternative to existing fuel types, in particular oil," Wood Mackenzie said.

Residential demand is seen as having an even slower rate of growth, said the analyst, with growth expected to build gradually around 2005. "Peru has a far lower potential for developing a [residential] market base, with a population of 5.7 million in the largest city, Lima," Wood Mackenzie said. Also, Lima has no infrastructure and would have to prove a significant potential for future demand to attract the investment needed to develop its residential market, the analyst said.

Another source noted that there has been some discussion of a larger Camisea project design that would incorporate gas-to-liquids technology, but without such conversion, gas demand may be insufficient to attract financing for the pipelines.

Upstream issues, economics

Concerns exist about the "degree of uncertainty surrounding the efficiency of the recycling process with regard to the potentially fractured nature of the reservoir," the analyst said. Also, the project's economics remain sensitive to variations in liquids production, as the project is viewed by the analyst as "liquids driven."

"In addition, the project will be sensitive to operating expenditure," said Wood Mackenzie, despite Pluspetrol's experience in operating in the Peruvian jungle. Given these environmental requirements, the analyst said, costs remain particularly difficult to predict.

"It is considered that the economics of the project are relatively marginal and several major uncertainties still surround the future of the development," said Wood Mackenzie. "Any attempt to renegotiate the terms of the contract is sure to be met with public hostility. A well-structured financing deal may be required to make the economics of the project more attractive."

Pipeline tender

Peru has proposed tender for the second stage of the Camisea project June 22, said Jorge Chamot, minister of energy and mines (OGJ, May 29, 2000, Newsletter, p. 8).

The tender has been postponed numerous times (OGJ, Mar. 6, 2000, Newslet- ter). However, other sources told OGJ that bidding on the transport and distribution phase of the project will likely be postponed until early August, when the new Peruvian government is installed. Peru's president-elect is inaugurated on July 28, the country's independence day.

The first stage of the project, which covers the exploitation of existing gas fields, was awarded Feb. 16 to a consortium comprising Pluspetrol Resources Corp. 40%, Hunt Oil Co. 40%, and SK Corp. 20% (OGJ, Feb. 21, 2000, p. 26). This Pluspetrol-led consortium expects to invest around $1.6 billion over the next 40 years. It estimates the first stage of the contract at $400 million.

Main fields in the Camisea project are giant Cashiriari and San Martin fields, with mainly Cretaceous reservoirs, and smaller Mipaya field with Permian reservoirs. Cashiriari and San Martin also have minor reserves in Permian Ene sandstones, according to AAPG Memoir 62.