Global Energy Investment Index: GEI index indicates global energy performance holding steady

This marks the fifth in a series of quarterly reports on the GEI index.

In the second quarter of 2000, energy performance indicators for 20 countries in the Global Energy Investment (GEI) index reached a plateau.

The average GEI score for the 20 countries tracked in the index held constant at 53, sustaining first quarter 2000's score despite a decline in those countries' oil consumption due to current high prices.

The GEI index tracks, on a quarterly basis, the energy activities and market conditions for a select group of countries. Gauges include 16 criteria in three categories-financial and economic indicators, energy volume (production and use), and energy assets and markets, including market liberalization and privatization measures.

Indicators include economic, financial, monetary, and investment characteristics; business climate; market openness to private investment in energy assets; price-setting; tariffs; corruption conditions; and oil production and consumption growth. Also included is the state of the country's transition from regulated to market mechanisms, where applicable. Oil, natural gas and electricity markets are analyzed separately.

Changes in the index indicate developments in the climate for energy investments and market activities. Global rankings such as the GEI reveal advances or reversals of financial, economic, and energy market conditions. They can inform market watchers about energy trends useful in making commercial assessments and in making investment decisions. This marks the fifth in a series of quarterly reports on the GEI index.

The GEI index was first published in Oil & Gas Journal in October 1999 to monitor trends in oil, gas, power, and economic and financial activities in a group of 20 selected countries. It first evaluated these countries' performance for second quarter 1999 (OGJ, Oct. 11, 1999, p. 42).

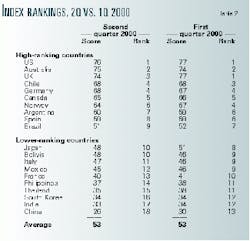

The historical average ratings of the index are shown in Table 1. Since start-up, the pace of gains has added 7 points to the average index, reaching a 53-point average at present from a 46 rating in second quarter 1999.

2Q 2000 results

Second quarter 2000 decreases in the index were largely offset by oil production gains in Australia, Brazil, Canada, and Mexico and gas production and market opening gains in Argentina, Australia, Bolivia, France, Germany, India, Italy, Japan, and the US.

US oil consumption increased 150,000 b/d in the second quarter, while decreases in oil and gas production trimmed the US score to 76 from 77 despite gains in merchant power plant activity. Canada, despite 200,000 b/d higher oil production, slipped to 65 from 66 on the basis of much lower gas production volumes. And Mexico dropped to 45 from 46 on gas production and oil use declines.

Australia scored its increases based on improving oil and gas production volumes. In Argentina, gains in its second quarter 2000 gas production were 60 bcf higher than in the prior quarter. Gains in gas contract volumes were evident in Bolivia, Italy, and Germany.

Table 2 shows the results of the second quarter 2000 survey compared with first quarter 2000.

- Europe. The UK's GEI decreased to 74 from 77 as a result of sharp oil and gas production declines. On the strength of oil use decreases that were partly offset by gas contract volume gains, France declined one point to a score of 40 points. Norway scored 64 points, down 3 points based on oil and gas production declines. Spain held constant at 59 points, but Italy increased to 47 from 46 points based on gas contracting gains and private power plant activity.

- Asia. Japan's oil use declined 500,000 b/d in second quarter 2000 and resulted in a decline in the index to 48 points despite higher electricity market contract volume gains. Thailand slipped to 35 points due to oil use declines, but South Korea held steady at 34 points. The Philippines oil use grew 100,000 b/d, but the country slipped in the index to 37 from 38 due to weaker economic indicators. China's oil use fell 200,000 b/d, and China decreased to 26 points in the index due to weaker economic fundamentals and lower gas production. India's oil use fell 200,000 b/d, and India fell to 33 points in the index.

- The Americas. Argentina moved up to 60 from 59 based on higher gas production and gas contracting gains. Chile held steady at 68 points, but Brazil slipped to 51 from 52 based on oil use declines.