FPS deployment seen increasing

Over the next 5 years, 13-17 floating production systems (FPSs) will be ordered every year, says International Maritime Associates Inc., Washington, DC.

In its latest forecast of the outlook for floating production, storage, and offloading vessels; production semisubmersibles; tension-leg platforms; and spars, IMA says the fundamentals for the FPS sector look very strong. It believes companies will spend $16-21.9 billion on FPS orders over the next 5 years.

Strong global economic growth, growing oil demand, high oil prices, and increased operator capital spending have caused a "robust rebound" in the upstream sector.

"On top of this, the equipment needed to drill in deepwater fields is now coming on stream, and the technology to produce these fields has continued to evolve and mature to significantly reduce field breakeven costs," says the report.

There are 119 FPSs in operation or available worldwide at the present time (Fig. 1). They include 11 TLPs, 36 production semisubmersibles, 69 FPSO vessels, 3 production spars, and 62 floating storage and offloading (FSO) vessels. Of the 62 FSOs, 4 are used for LPG storage.

This represents an 86% increase over the floaters reported in IMA's September 1996 report, published when the company first started counting the number of units in operation. And the number is increasing.

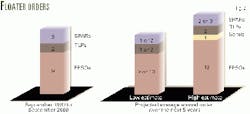

IMA said 22 production units are now on order, including 14 ordered within the last 12 months (Fig. 2). The 22 units include 14 purpose-built production systems, 7 production systems based on converted hulls, and 1 production unit relocation. The fleet breaks down as 1 large TLP, 2 mini-TLPs, 13 FPSOs (7 new, 5 conversion, and 1 relocation), 2 production semis (1 new, 1 conversion), 3 production spars, 1 mobile offshore production unit (a jack up conversion), and 6 FSOs.

The company noted six of these units are for use in the Gulf of Mexico, and three for offshore West Africa. Right now, the largest portion of FPUs in operation (28%) is working off Northern Europe.

Forecast

IMA's 5-year forecast assumes long-term crude prices in the range of $18-22/bbl. It also assumes that no floater catastrophes occur and technology continues to evolve solutions to produce in increasingly deeper water.

A higher average oil price would cause an upswing in floating production requirements, the company said.

"There has clearly been an uptick in floater planning activity, both in quantity and quality of projects," the report said. IMA has identified 133 offshore projects in the bidding, design, or planning stage where an FPS is being seriously considered as a development solution for the field. IMA said it only included the most promising projects on that list.

Off West Africa, 40 projects that are likely to use floating production systems are planned; in the Gulf of Mexico, 33 are planned. Southeast Asia ranks third, Brazil fourth, and Europe and Australia tied for fifth place.

The association predicted orders for 65-86 additional floating production systems over the next 5 years. "A higher ordering rate will occur in the earlier years of the 5-year forecast, tapering off in 2004-05 as relocations increase," the report says. It also predicts about 70% of units ordered will be FPSOs.

FPS types and order predictions

FPSO vessels can carry a large process plant and have storage capability. For conversions, there is wide availability of secondhand tanker hulls, plus low prices on new hulls from Asian yards, notes IMA.

FPSOs allow for relatively easy relocation from field to field. They are, however, unable to utilize dry wellheads.

Weathervaning FPSOs have limited riser capability, notes the firm. And finally, export of natural gas remains an unsolved problem.

Nevertheless, FPSOs remain the most popular choice. The company predicts 47-60 FPSOs will be ordered over the next 5 years, costing a combined $11.3-14.5 billion.

Semisubmersibles were long the platform of choice, IMA says, when a large number of surplus hulls was available for conversion to floating production units. Now that the inventory of surplus semi hulls has dried up, their use is likely to be curtailed.

"Their primary advantage was low initial cost by using surplus hulls and the ability to have a production unit in service relatively quickly," says IMA. No units have been ordered over the last year. The company predicts two to four semi production units will be ordered in the 5-year period, costing $0.8-1.6 billion.

TLPs are growing in popularity, especially the mini-TLPs, which are a cost-effective solution in smaller deepwater fields. TLPs can utilize dry trees, but do, however, lack storage, and are best used where pipeline infrastructure can be accessed. Tendon weight increases dramatically with water depth, which places limits on use of TLPs in deep water.

IMA expects 8-10 TLPs will be ordered over the next 5 years, of which 7-8 should be mini-TLPs and 1-2 large TLPs. They will cost $1.5-2.2 billion.

There has been increasing interest in production spars, says IMA, especially now that production capability of spar designs has significantly increased since their introduction. Spars can incorporate storage, although it has not been incorporated in the three spars now operating in the Gulf of Mexico or in the three currently on order for use there.

But because of the increasing interest in spars, IMA predicts 8-12 spars will be ordered over the next 5 years. They will cost $2.4-3.6 billion.

There are other new designs being marketed that may take their places in the pool of FPSs to be built, notes IMA. They include a Petroleum Geo-Services ASA-marketed "dry-tree semi" for benign ocean environments that incorporates a semisubmersible's flexibility with the surface-tree capability of TLPs and spars.

Aker Maritime AS is marketing an "oil box" concept that incorporates features of a semisubmersible and can support dry-tree production. And Single Buoy Moorings Inc. is marketing a tension-leg deck FPSO concept that combines the flexibility and low capital cost of an FPSO with the stability of a TLP. It also has the capability to support dry trees.