Special Report: Midyear Forecast: US, Canada drilling sustains healthy increases in 2011

Alan Petzet

Chief Editor-Exploration

Meaningful increases in the number of wells drilled can be expected in the US and Canada in 2011 compared with 2010 as the shift toward oil drilling intensifies.

The disparity between oil and natural gas prices is supporting numerous drilling and leasing plays aimed at producing oil and also gas-condensate and liquid petroleum gas-rich natural gas formations. Leasing trends indicate that even more liquids-prone plays will be tested this year and next.

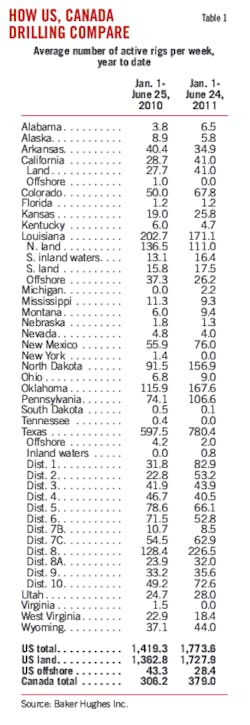

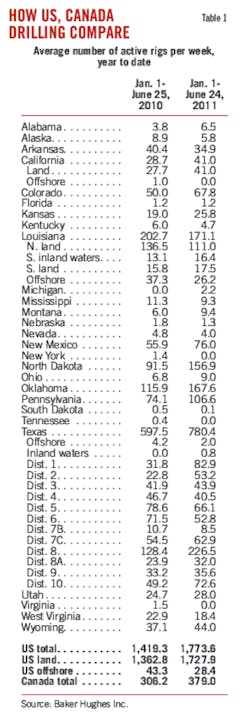

The Baker Hughes count of active US rigs has climbed better than 7% since January 2011, and Canadian contractors are seeing higher 2011 utilization than it looked like they would in late 2010.

Here are highlights of OGJ's midyear drilling forecast:

• Operators will drill 46,129 wells in the US, up from an OGJ-estimated 43,038 wells in 2010.

• All operators will drill 2,233 exploratory wells of all types, up from an estimated 2,063 last year.

• OGJ estimates that the Baker Hughes Inc. count of active US rotary rigs will average 1,775 rigs/week this year, up from 1,515 in 2010.

• Operators will drill 13,151 wells in Canada, up from an OGJ-estimated 11,020 wells in 2010.

First half changes

Oil prices running at $90-110/bbl in this year's first half resulted in a mid-June rig count of 1,860 units, 7% higher than at the start of this year and up 20% from mid-2010.

The Bakken play boosted the North Dakota count to 163 rigs from 154 in January. A greater expansion might have occurred except for one of the worst winters on record in the Williston basin, and flood water is expected to hamper drillers as the summer progresses. Road use limitations and availability of frac crews and other services also affect the play's pace.

The active fleet in the liquids-prone portions of the Eagle Ford shale play, mainly in South Texas Dists. 1 and 2, grew to more than 150 rigs in June from 110 in early 2011. The rig count fell slightly in the gas-prone Eagle Ford in Dist. 4.

West Texas' rig counts sustained large gains in Dists. 7C, 8, and 8A. The Permian and Delaware basin area fielded 365 rigs in June compared with 290 in January.

Availability of water has been a growing concern in the Eagle Ford and West Texas plays because of the volumes required for drilling and hydraulic fracturing.

Oklahoma, with a building Mississippian oil play on the northern Anadarko basin shelf, Anadarko granite wash plays, and shale plays in the Anadarko, Ardmore, and Arkoma basins, held its own with 160-170 active rigs in the first half.

Gas area rig counts were steady to slightly lower. They include Pennsylvania (Marcellus shale), North Louisiana-East Texas Dist. 6 (Haynesville shale), and Arkansas (Fayetteville shale).

Baker Hughes showed 984 rigs drilling for oil in June or 21% more than in January, while the 870 rigs drilling for gas were nearly 5% fewer than in January.

The 35 offshore rigs working compared with 26 in January.

Canada, non-North America

Western Canada is heading for a brisk drilling year, although manpower issues are stunting rig counts in some areas.

The Canadian Association of Oilwell Drilling Contractors in June 2011 boosted its well forecast to 13,128, 11% more wells than it projected for 2011 in October 2010. CAODC foresees 20% more operating days this year and assumes 11.8 drilling days/well compared with 10.8 drilling days/well in its October 2010 forecast.

The association said first quarter 2011 rig utilization in Canada was 11% higher than it earlier expected and that it looks for drilling to be 24% higher in the last three quarters of this year.

Spring break-up shrinks the number of operating days in the second quarter to about 40% of the suitable work period in the other three quarters.

In late April, the Petroleum Services Association of Canada forecast that 12,950 wells will be rig-released in Canada in 2011. Trends in the PSAC outlook include fewer total wells, more footage and more complex completions in horizontal wells and deeper wells, and an ongoing labor shortage.

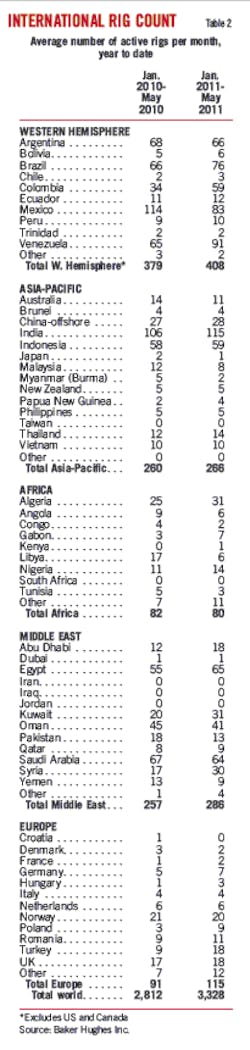

Outside the US and Canada, Baker Hughes indicated that drilling was 19% higher year on year in the first half. Europe was up 26% to 115 rigs/month, Latin America was up 23% to 408 rigs, and Middle East was up 10% to 286 rigs. Africa was down slightly to 80 rigs.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com