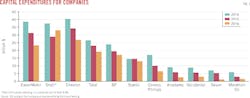

Oil companies are once again being forced to slash capital expenditures (capex) amid a prolonged price slump, with spending in North America bearing the brunt of the cuts. Total US capital spending for upstream, midstream, downstream, and corporate activities will fall 25.4% this year to $136 billion, following a 36.1% decline in spending during 2015. This year's steep cuts to upstream budgets will be partly offset by an increase in refining, petrochemicals, and pipeline outlays.

Canadian upstream spending will decline as severely as that in the US, with downstream and pipeline spending also expected to slide.

Worldwide exploration and production spending is again expected to hold up better than E&P spending in North America this year. It is important to note that the following forecasts, in particular upstream spending, are price-sensitive and assume oil prices of about $35/bbl for Brent and West Texas Intermediate.

US upstream spending

Huge losses posted last year, the expectation of reduced cash flows, and the prospect of tighter lending conditions have prompted US E&P companies to scale back investment programs and focus on strengthening balance sheets. Drilling activity remains low and cost concessions in some cases are greater than originally budgeted.

OGJ projects that 2016 spending in the US for upstream operations will fall 40% to $87.7 billion. This includes outlays for oil and gas exploration, drilling, production, and offshore lease payments to the US Bureau of Ocean Energy Management.

Spending on US exploration drilling this year is estimated at $73.3 billion, down 40% from last year. Outlays for production drilling this year will total $13.9 billion, down from $23.2 billion last year.

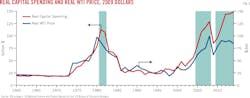

Notably, OGJ revised downward its historical upstream expenditures over the last 3 years, adjusting for improved drilling efficiencies and cost savings per well. According to the American Petroleum Institute's joint association survey on drilling costs, the cost per foot among shale wells had declined more than 43% since 2009.

Investment banking firm Cowen & Co. LLC tracked E&P capex announcements for 2016 and found that Lower 48 spending from a group of independent E&P firms will fall 53% this year. After factoring in the majors, Cowen & Co. expects Lower 48 capex to be down about 39% this year.

Lower onshore investment in 2016 is expected to cut rig counts and well completions. Completion spending will account for more of the total.

The focus of drilling and production activities will be on the core areas of major tight oil plays. Falling costs and ongoing technological and process improvements are anticipated to enhance the economic viability of these areas and to be adopted in other regions, according to the US Energy Information Administration.

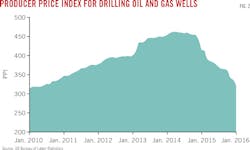

The Producer Price Index for Drilling Oil and Gas Wells (Fig. 2), which represents service fees for contractors to drill oil and gas wells, fell to an annual average of 363.4 in 2015 from 449.4 in 2014 and will continue to fall this year.

According to a Barclays survey, despite service pricing falling more than 30% in 2015, half of North America E&Ps expect a further decline of more than 20% in 2016.

Outer Continental Shelf lease bonus payments are expected to fall this year despite the fact that BOEM plans to hold three lease sales compared with two last year.

This year's lease sales are Sale 226, involving areas in the eastern Gulf of Mexico; Sale 241, involving the central gulf; and Sale 248, for tracts in the western gulf. Last year BOEM conducted two lease sales (235 and 246) and received $561 million in bonuses.

US firms' spending plans

EOG Resources Inc., Houston, reported planned capex for 2016 of $2.4-2.6 billion, a 45-50% year-over-year reduction. The firm in 2016 expects to complete 270 net wells-of which 150 will be in the Eagle Ford, 75 in the Delaware basin, and 35 in the Bakken and Rockies region-compared with 470 net wells total in 2015. Total company crude oil production is expected to decline 5% vs. that of 2015.

Chesapeake Energy Corp., Oklahoma City, reported planned total capex for 2016 of $1.3-1.8 billion, 57% lower than the 2015 level. The planned capital program will be dedicated to more completions and less drilling, with total completion spending representing 70% of the company's total drilling and completion program.

Apache Corp., Houston, has set a 2016 total capital spending program of $1.4-1.8 billion, a reduction of more than 60% from the 2015 level and more than 80% from the 2014 level. The new budget follows a 2015 net loss of $23.1 billion.

Apache expects total production volumes in 2016 to range 433,000-453,000 boe/d, a decline of 7-11% from the 2015 level. Production in North America onshore is projected to range 263,000-273,000 boe/d, which represents a decline of 12-15% compared with output in 2015.

Marathon Oil Corp., Houston, reported a 2016 capital spending program of $1.4 billion, down 50% from that of 2015 and 75% from that of 2014. During the year ahead, Marathon is allocating $1.15 billion to activity in North America with the majority focused on three US resource plays. On a divestiture-adjusted basis, total company production is expected to be 6-8% lower than output in 2015 due to the lower 2016 capital program.

Devon Energy Corp., Oklahoma City, plans capex in 2016 of $1.17-1.45 billion, down from $5.26 billion in 2015. That includes the firm's E&P capital investment for 2016, which is estimated to range $900 million-1.1 billion, also a 75% decrease from 2015.

Refining

OGJ forecasts total spending at US refineries this year at $14.6 billion, up 8% from last year. The growth is supported by delayed turnaround spending, and spending for meeting federal fuel regulations. As seen last year, most independent refiners are increasing or maintaining their budgets.

Dallas-based HollyFrontier Corp.'s 2016 capex would range $585-620 million, with about $220 million of this year's budget going toward compliance-oriented capital improvements.

In January, Valero's board approved the construction of a 130,000-b/d alkylation unit at its Houston refinery. The unit will upgrade low-cost natural gas liquids into alkylate.

Marathon Petroleum Corp. is expected to spend $1.145 billion on the refining and marketing business this year, flat with last year's spending. Of that total, $675 million will go toward refinery sustaining capital and $475 million will be spent on margin-enhancing developments.

Phillips 66 announced a 2016 capital budget of $3.6 billion, excluding its partners' capital program. Out of the total, Phillip 66 plans $1.2 billion for refining, with about 70% to be invested in reliability, safety, and environment projects, including compliance with the new Tier 3 gasoline specification.

ExxonMobil Corp. will increase US refining spending this year, it said, after curring spending in 2015.

Petrochemicals

Spending in the US petrochemical sector will rise 15%, putting 2016 petrochemical capital spending at $7.7 billion. Most of the spending goes to Texas.

The Gulf Coast's ongoing petrochemical and chemical boom is fueled by cheap and abundant gas from shale. Project economics remain sound for the foreseeable future.

According to OGJ's Worldwide Construction Database, there are 20 major new and expansion projects planned or under construction in the US in 2015, up from 14 in 2014.

Phillips 66's joint venture, Chevron Phillips Chemical Co., is in the middle of a $6-billion expansion in Baytown at its Cedar Bayou plant east of Houston. The joint venture has said additional expansion could follow.

Major petrochemical projects are also being built by Dow Chemical Co., ExxonMobil Corp., Sasol, Royal Dutch Shell PLC, among others.

France's Total SA is considering the construction of a $2-billion steam cracker in Port Arthur that would produce ethylene a top priority for its refining and petrochemicals business. The cracker would produce as much as 2.2 million lb/year of ethylene.

Pipelines, other transportation

Pipeline construction in the US this year will be strong, as activity picks up for crude and products lines as well as for gas lines.

Capital spending for crude and products pipelines in the US this year will increase, as plans call for the construction of 3,329 miles of these lines in 2016, according to OGJ's Worldwide Pipeline Construction report (OGJ, Feb. 1, 2016, p. 70).

Expenditures, which include spending for compressor stations, will reach $15 billion compared with outlays of $6 billion last year for the construction of 1,545 miles (OGJ, Feb. 3, 2015, p. 72).

The cost for these projects was $22.8 billion in 2014 for the construction of 3,357 miles, reflecting an unusually high land construction cost for the year.

This year's capex for gas pipelines in the US will be $5 billion, with plans for the construction of 974 miles this year. Last year's spending for US gas lines was $3 billion, when plans called for the construction of 667 miles of such lines.

Meanwhile, as a carrier finally set sail for Brazil this year with LNG from Cheniere Energy Inc.'s Sabine Pass terminal, US LNG and other associated transportation expenditures are expected to increase.

Canadian spending

All Canadian spending figures that follow are in Canadian dollars. According to OGJ's forecast, conventional exploration and drilling outlays in Canada will total $10.2 billion this year, down from $15.6 billion last year and $29.4 billion in 2014. Spending on production will decline to $6 billion from $9.3 billion last year.

The Canadian Association of Petroleum Producers reported that in 2015, there were 5,300 well completions in Canada, down 49% from a year ago. The Baker Hughes Inc. count shows a sharp decline in the average number of oil and gas rigs to 192 last year from 379 in 2014.

Oil sands capital spending, which includes funds for in-situ extraction, mining, and upgraders, will decrease 28% from a year ago to $17 billion. This follows an estimated decrease of 30.6% last year.

CAPP reported that oil sands capex totaled $33.86 billion in 2014-the latest year for which the association has reported such data.

In 2015, Suncor Inc. spent 20% less on E&P, but spent 9% more on oil sands. In 2016, Suncor's spending on oil sands will continue to be sizable, with the ongoing construction of the Fort Hills project.

Canadian Natural Resources Ltd. anticipates a 2016 capital program ranging $4.5-5 billion, with $2.1 billion allocated to Horizon Project Phase 2B and Phase 3 construction.

Cenovus Energy Inc. reduced its planned capital spending for 2016 by an additional 20% to $1.2-1.3 billion, down 27% from that of 2015 and 59% from that of 2014. Planned capital budget reductions for 2016 include lower spending at Foster Creek and Christina Lake oil sands projects, emerging oil sands assets, and the company's conventional oil business.

Imperial Oil Ltd.'s Nabiye expansion project at Cold Lake and the Kearl expansion project in Alberta were completed in 2015. The company's planned capex in the upstream segment is about $1.2 billion for 2016, down 62% from levels in 2015 and 76% from levels in 2014.

Oil sands producer MEG Energy Corp. has revised downward by half its 2016 capital budget to $170 million. MEG's capital investment in 2015 totaled $257 million.

Encana Corp. cut its planned capital budget for 2016 to $900 million-1 billion, down 40% from its initial budget for the year and 55% from its 2015 capital investment.

Expenditures for the refining and marketing segment in Canada is expected to be about flat or slightly up from a year ago. Petrochemical outlays in Canada are expected to decline because of the lack of any major projects. However, one or more major new project announcements could dramatically alter the outlook.

Notably, Alberta's government will award $500 million in royalty credits to new petrochemical facilities, a plan the government says has the potential to entice as much as $5 billion in new investment.

Based on plans outlined in OGJ's Worldwide Pipeline Construction report (OGJ, Feb. 1, 2016, p. 70), which calls for 370 miles of lines to be constructed in Canada this year, capex for these lines and associated compressor stations will be $2 billion. During 2015, such expenditures were $2.2 billion based on the construction of 433 miles.

Spending on other transportation will decline this year. Due to the plummet of LNG prices in Asia, the Shell-led LNG Canada project and the Petronas-led Pacific Northwest LNG project, both valued at more than $30 billion, have held off construction. AltaGas Ltd. is shelving the development of its Douglas Channel LNG plant near Kitimat.

International spending

According to the most recent Barclays E&P Capital Spending Survey, released in January, international upstream spending holds up much better than spending in North America and is expected to decline 11% in 2016, following a 17% decline in 2015.

Offshore spending, representing about 20% of global upstream spending, will decline 20-25% in 2016, as international oil companies slash exploration budgets and cut frontier programs. The decline also is led by a reduction in day rates and a reduced cost of services and subsea.

However, as budgets in this survey generally assumed oil prices will fetch $50/bbl for Brent crude and $45/bbl West Texas Intermediate vs. current oil prices of about $30/bbl for both, further downward revisions to budgets are expected.

The Middle East could be the lone source of strength in 2016, reflecting members of the Organization of Petroleum Exporting Countries' commitment to maintaining activity levels.

According to a Moody's report, Iran needs capital investment of $150-200 billion for modernization of the industry, about half in the upstream business. But low oil prices may have constrained investments in new projects.

Expenditures in the Middle East are benefiting from refinery additions and the boom of petrochemicals. According to the Gulf Petrochemicals & Chemicals Association, the Gulf Cooperation Council region's chemical capacities will rise 6% in 2016.

Expenditures in Latin America will impose a steep decrease, following a decline of more than 19% in 2015, with Petrobras and YPF each budgeting spending cuts of more than 20% this year. Mexican oil company Petroleos Mexicanos will cut its budget 2016 by almost $5.5 billion.

Norway's Statoil ASA is reducing its organic capex to $13 billion in 2016 from $14.7 billion in 2015. The company reported a 2015 full-year loss of $4.4 billion in accordance with international financial reporting standards.

Eni SPA's capex will fall 20% in 2016 after a 17% fall in 2015.

According to Oil & Gas UK's 2016 Activity Survey, the UK upstream segment is expected to approve fewer than £1 billion in spending on new North Sea projects compared with an average of £8 billion/year over the past 5 years (OGJ Online, Feb. 23, 2016).

OGUK notes that segment-wide action has pushed unit operating costs down by a third to an average of $20.95/boe in 2015 vs. the 2014 average, aided by a 10% rise in oil and gas production. Costs are expected to fall a further 20% this year to $17/boe, a 42% rise in just 2 years.

China National Offshore Oil Corp. plans to further cut its capital budget by almost 11% to below 60 billion yuan ($19.13 billion) this year from estimated spending of 67.2 billion yuan in 2015. Its total exploration expenditure this year will be reduced by as much as 25% from last year, with priority to its core offshore China projects.

US-based oil companies also reduced their capital budgets outside North America. Chevron Corp. is allotting $18.6 billion to international upstream compared with $23.53 billion last year and $28.32 billion in 2014.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.