Quantitative analysis of regulatory data keys risk management

Chip Moldenhauer

LawIQ LLC

Washington

Recent developments in the oil and gas sector have increased industry awareness of the need to mitigate exposure to various regulatory and legal risks. Unlike traditional fundamental analysis of financial, economic, and other qualitative information, quantitative analysis of regulatory and legal data offers unique and differentiated information that can improve company performance, identify catalyst events, and mitigate the risks important to the management of natural gas pipeline development. In particular, data analytics and statistical modeling can help recognize opportunities associated with:

• Permitting delays.

• Regulatory denials and project viability.

• Unanticipated changes in government regulations or regulatory policy.

Pipeline-permitting delays

Though permitting projects is just one step in the process of developing natural gas pipeline infrastructure, it is critical to the timing of investments. The gas pipeline industry is concerned about the need to reduce both natural gas pipeline permitting delays and the degree to which capital costs vary, particularly in geographically constrained areas of the country, such as the Northeast, where costs are already high

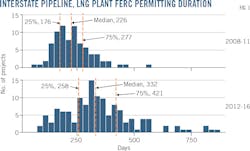

Constitution Pipeline LLC's primary owners, Williams Partners LP and Cabot Oil & Gas, in March revised their expected in-service date for a sixth time. Constitution is an outlier case from both a regulatory timing standpoint and because of the unprecedented denial of its New York State Clean Water Act, Section 401 permit. Analysis of data compiled from all completed new construction, expansion, and LNG projects, however, shows that the time from the date a developer files an application with FERC for a Certificate of Public Convenience and Necessity to the date FERC makes a decision on the certificate has increased dramatically. When comparing projects from 2008-2011 to those from 2012-2016, the top quartile of projects from 2012-2016 took 52% longer to obtain a FERC decision. As a whole, projects from 2012-2016 took 47% more time than projects from 2008-2011 (Fig. 1), according to data current as of Aug. 12, 2016.

The average time required to obtain FERC approval for projects facing significant protests is 7.5 months (84%) longer than the time required when no major public interest groups filed a protest. Pipeline opponents have made an average of 139 protest filings/project during the past 4 years. Although protests by environmental groups may not lead to FERC dismissal of a project, such protests often lead to greater consideration of a multitude of environmental issues, including pipeline routing.

FERC proceedings involve a docket, typically comprised of thousands of filings, which creates a dataset with which to conduct descriptive and predictive modeling. Analyzing the data associated with these submissions, in conjunction with the statistical analysis of similar projects already completed and placed in-service, can allow analyses of specific future projects' review completion timelines.

Rare denials

FERC on Mar. 11, 2016, denied project applications for Veresen Inc.'s Jordan Cove LNG Terminal and the Pacific Connector Pipeline, a 232-mile natural gas line jointly owned by Veresen and Williams Partners LP dedicated solely to transporting gas to Jordan Cove LNG. The decision could be altered by FERC either during the pending rehearing or later on judicial appeal, but there is no required timeframe for FERC to issue another decision and the $6-billion project is in danger of being cancelled outright.

In denying the Jordan Cove and Pacific Connector applications FERC found that the applicants' generalized assertions of need did not outweigh the potential for adverse impact on landowners and communities. FERC noted that the Pacific Connector application presented little or no evidence of need, as it had neither entered into any precedent agreements for its project, nor conducted an open season. Both projects also faced protestors, numerous data requests, and state permitting issues.

The submission of precedent agreements or other evidence of committed shipper contracts, while not officially required, is a significant factor weighed by FERC in assessing the need for a project. Natural gas pipeline companies must establish the details of a pipeline project well before it's filed with FERC. Companies seeking to build a natural gas pipeline typically will provide natural gas shippers with the terms of a potential project and solicit bids to gauge the need for natural gas transportation in the project area. In the case of Jordan Cove and Pacific Connector, the lack of precedent agreements appears to have prompted FERC's denial of the applications.

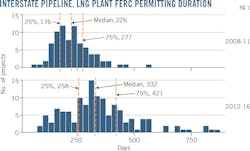

While FERC approves the vast majority of projects put before it (Fig. 2), in the past 10 years, 6% of pipeline and LNG projects have been dismissed or withdrawn. In 2011 FERC denied an application to construct and operate a gas storage facility under similar rationale to those used regarding Jordan Cove. And in 2012 FERC dismissed, rather than denied, the Calais LNG and pipeline projects for failing to secure project financing and legal access to the project site.

Current oil and gas pricing and the resulting restricted access to capital markets have led to increases in the number of denied or withdrawn projects, including Kinder Morgan Inc.'s $3-billion Northeast Energy Direct Project. Of the 16 project denials, dismissals, or withdrawals since 2008, 11 took place in 2015-16.

Metrics and measurements of related precedent agreement terms and other competitive landscape features can help assess relevant risk factors. Data analytics and predictive modeling can then assess these risk factors for pending natural gas pipeline and LNG projects, determining how far projects are from regulatory permitting milestones, providing statistics to inform precise milestone and approval expectations, and evaluating project need based on factors used by the regulator to make a decision.

Taxes, shipping rates

The DC Circuit Court's early-July opinion in United Airlines v. FERC raised the possibility of a sweeping change to FERC's longstanding tax allowance policy. The court agreed with shippers on SFPP LP's pipeline alleging that FERC's discounted cash-flow ratemaking model, coupled with its grant of an income tax allowance to the pipeline's owners, allowed for a double recovery of taxes for the owners of partnership pipelines. The court noted that granting a tax allowance to partnership pipelines resulted in inequitable returns for the pipeline partnership owners, such that partners in a partnership pipeline received "a windfall compared to shareholders in a corporate pipeline."

The court did not strike down FERC's tax allowance policy, but chose instead to remand the case back to FERC, to allow it to demonstrate how application of its tax allocation policy would ensure parity between equity owners in partnership and corporate pipelines. FERC has not publicly commented on the decision or its plan to address the court's remand.

The court's opinion noted two possible courses of action for FERC: it could revise its return-on-equity model to remove any duplicative tax recovery for partnership pipelines, or it could remove all income tax allowances from its ratemaking methodology and set rates based on pre-tax returns. FERC, however, is not constrained by these two options and it's unclear how the agency will proceed.

FERC last revised its tax allowance policy in response to a remand from the DC Circuit when the court held that FERC had failed to justify its policy concerning the eligibility of partnerships for income tax allowances. FERC published a Notice of Inquiry soliciting comments from stakeholders and issued a revised tax allowance policy 10 months after remand. If FERC follows a similar pattern this time, a revised tax allowance policy statement could be issued early to mid-2017.

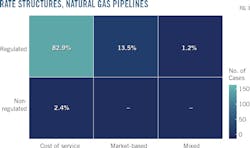

Analysis of pipeline companies' rate structures, including cost-of-service, market-based, indexed, settlement, or mixed (hybrid services), shows that liquids pipelines largely adopt the FERC's indexed rate structure but natural gas lines are much more exposed to the risk of a change in FERC's tax allowance policy (Fig. 3).

FERC disallowing or otherwise restricting or reducing the tax allowance would most greatly affect cost of service pipelines in the master limited partnership (MLP) sector, including pipelines at least partially owned by MLPs.

The author

Chip Moldenhauer ([email protected]) is founder and chief executive officer of LawIQ, a data analytics and advisory company with a focus on oil and gas energy regulatory proceedings. Moldenhauer previously practiced law in the energy group at Morgan, Lewis & Bockius LLP. He holds a BS from the US Naval Academy and a JD degree from the Columbus School of Law at The Catholic University of America, Washington, DC.