Plains to acquire 55% interest in EPIC Crude from Diamondback, Kinetik

Key Highlights

- Plains agreed to acquire a 55% stake in EPIC Crude Holdings for about $1.57 billion, including debt.

- The deal includes a potential $193 million earnout if the pipeline expansion to 900,000 b/d is approved before end-2027.

- EPIC assets feature over 800 miles of pipeline, 7 million barrels of storage, and export capacity exceeding 200,000 b/d.

- Diamondback Energy will maintain its role as an anchor shipper on the EPIC pipeline post-transaction.

A Plains All American Pipeline LP and Plains GP Holdings subsidiary has agreed to acquire from subsidiaries of Diamondback Energy Inc. and Kinetik Holdings Inc. a 55% non-operated interest in EPIC Crude Holdings LP, the entity that owns and operates the EPIC crude oil pipeline, in a deal valued at about $1.57 billion, inclusive of about $600 million of debt.

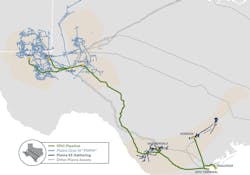

“By further linking our Permian and Eagle Ford gathering systems to Corpus Christi, we are enhancing market access and ensuring our customers have reliable, cost-effective routes to multiple demand centers,” said Plains chairman, chief executive officer, and president, Willie Chiang.

Plains also has agreed to a potential $193 million earnout payment should an expansion of the pipeline to a capacity of at least 900,000 b/d be formally sanctioned before yearend 2027.

Diamondback Energy and Kinetik Holdings each agreed to sell their respective 27.5% equity interest, which they reached with acquisitions in September 2024, for about $500 million in net upfront cash and a $96 million share of the total potential $193-million contingent cash payment related to the potential expansion.

Diamondback will maintain its commercial relationship with the EPIC Crude and Plains teams as an anchor shipper on the EPIC Crude pipeline, said Kaes Van’t Hof, chief executive officer and director of Diamondback Energy, in a separate release Sept. 2.

The remaining 45% interest in EPIC Crude Holdings is owned by a portfolio company of Ares Management Corp. (EPIC Management), which also serves as operator.

The EPIC assets include over 800 miles of long-haul crude oil takeaway from the Permian and Eagle Ford basins to the Gulf Coast market at Corpus Christi, Tex., with current operating capacity over 600,000 b/d. Other assets include total operational storage of about 7 million bbl and over 200,000 b/d of export capacity.

EPIC Crude includes terminals in Orla, Pecos, Saragosa, Crane, Wink, Midland, Helena, and Gardendale, with Port of Corpus Christi connectivity and export access.

The transaction is expected to be completed by early 2026, subject to customary closing conditions.