Economics on Fischer-Tropsch coal-to-liquids method updated

Montana’s Crow Nation and Australian-American Energy Co. reported in August that they will jointly construct a $7 billion coal-to-liquid (CTL) fuels plant in southeastern Montana. Plans for the plant were unveiled Aug. 8, with 2016 announced as the likely date for the start of production at the plant.

CTL seems to present an ideal scenario for coal, utility, and petroleum companies to work together. Utility companies want to turn coal into electricity, while coal companies seek to expand their market from solely electric power generation to liquid hydrocarbon conversion, and petroleum companies can use the carbon dioxide (CO2) produced for enhanced oil recovery (EOR).

The economic incentives of using coal with green technology to make electricity and transportation fuel was explained in the OGJ, Feb. 26, 2007, article, “Fischer-Tropsch oil-from-coal promising as transport fuel.”1 Specifically, the method couples the integrated gasification combined cycle (IGCC) process with Fischer-Tropsch syngas conversion to develop an advantageous, green CTL system from pairing the two technologies.

New economic conditions

However, much has happened since that economic analysis. Crude oil prices ramped up to more than $140/bbl from about $60/bbl, while plant construction prices escalated greatly as well—although not quite to the degree of crude oil.

Furthermore, CO2 can now be valued higher because its use in EOR floats with the value of crude oil. Originally $1/Mcf, it recently commanded a price as high as $5/Mcf. IGCC investment costs also have risen—to $2,000-3,000/kw capacity from $1,400/kw capacity.

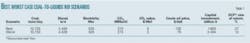

This article presents the best and worst-case scenarios for CTL based on recent economic conditions. The best-case scenario includes oil valued at $135/bbl, investment costs for IGCC increased to $2,000/kw capacity from $1,400, and CO2 valued at $5/Mcf. The worst-case scenario has oil valued at $75/bbl, investment costs at $3,000/kw capacity and CO2 valued at $2/Mcf. The cost for the Fischer-Tropsch section of the IGCC plant was scaled by the same amount.

The economics shown in Table 1 illustrate that a huge increase in capital costs was offset by higher crude oil prices. Specifically, the discounted cash flow (DCF) rate of return increased to 27% for the best-case scenario from the original 15% (Case 3 in the February 2007 article), and it dropped only slightly—to 12%—for the worst-case scenario.

The announcement of the Crow Nation-Australian-American Energy Co. Montana CTL project is evidence that this clean technology merits serious consideration for future energy projects, particularly when the coproduced CO2 can be used for EOR.

IGCC plant operations

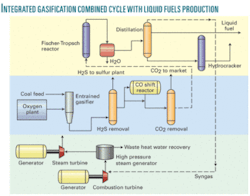

In a typical IGCC plant, coal is first gasified to synthesis gas—hydrogen and carbon monoxide (CO). The synthesis gas is scrubbed to remove acid gases and mercury. The synthesis gas is then burned in the combustion turbine, and the hot exhaust is used to raise steam to drive a second turbine. Both turbines produce electricity, with the thermal efficiency increasing to 40% for combined-cycle operation from 33% for a direct-fired coal unit.

If the synthesis gas is passed through a water gas shift converter before reaching the turbines, the CO converts to CO2 and hydrogen. The CO2 can then be scrubbed, providing a hydrogen-rich stream to the turbines. This is an “ultragreen” scenario because there is very little CO2 emitted from the power plant. CO2 cannot be eliminated entirely because some CO must be left in the feed to the power plant for flame stability. The figure shows the process flow for converting coal to electricity and liquid hydrocarbons.

With newer technologies, such as IGCC, coal conversion is an environmentally friendly process. Pollutants such as mercury, sulfur oxides (SOx), and oxides of nitrogen (NOx) are essentially eliminated because coal gasification instead makes hydrogen sulfide and ammonia, and these easily can be removed in acid gas scrubbers. CO2 also can be captured and sequestered. If oil fields are nearby and responsive to CO2 flooding for EOR, then CO2 can provide a significant income stream.

Clean coal benefits

Although most people deem coal to be a “dirty” fuel, it can easily be cleaned. Its bad reputation is grounded in its use for many years in direct-burning power plants. It is unfortunate that opposition to coal as part of the solution for US energy needs is based on this older, direct coal burning technology rather than IGCC, which makes an electric power generation facility more like a chemical plant than a coal-fired plant with a tall smoke stack.

With IGCC, coal conversion can be a green technology; the plant can easily capture CO2 from the oxygen-blown coal gasifier because the offgas is not diluted with nitrogen. The CO2 can then be injected into the ground and stored.

In addition, the CO2 produced in the CTL process has tremendous potential for EOR use if a mature, light-oil field is nearby. These synergies suggest that the coal and petroleum industries should cooperate to enable green coal technology to be exploited to increase oil production via EOR.

Benefits of this technology for the US can be enormous because US coal reserves are huge, representing 27% of the total world supply. Consequently this energy resource deserves serious consideration. Coal from the states of Montana, Illinois, and Wyoming alone could be converted, via Fischer-Tropsch syngas conversion, to 300 billion bbl of diesel fuel.

And CTL technology is already off the shelf. Sasol in South Africa is producing 160,000 b/d with this technology, so it is not an immature, undeveloped process.2

Enhanced oil recovery

In this economic analysis, CO2 production during the CTL process represents a major revenue stream that can offset some of the project’s investment costs. Currently CO2 for EOR commands a price of $1-5/Mcf. Because it takes roughly 5 Mcf of CO2 injection to produce 1 bbl of oil, the price of CO2 will continue to rise correspondingly as oil becomes more valuable.

Oil & Gas Journal’s most recent EOR survey shows EOR projects using CO2 injection increasing, with the 100 ongoing CO2 miscible injection projects accounting for 240,000 b/d of additional US oil production. Despite these advances, scant availability of CO2 currently limits the US petroleum industry’s ability to expand CO2 flooding.3

Because CO2 has become a viable product in its own right rather than simply a byproduct, CO2 handling today differs considerably from its handling during the energy crisis of the 1970s and 1980s when it was simply emitted into the atmosphere. As incentive to curtail CO2 emissions, the US Department of Energy has been funding CO2 sequestration partnerships around the country.

Updated economics

The updated economics are shown in Table 2 for the previous cases using Montana Rosebud subbituminous coal. The updated economics assigns diesel fuel a value of $3.90/gal for $135/bbl crude and $2.12/gal for $75/bbl crude vs. the old $1.80/gal. CO2 in the new scenario would cost $2/Mcf, and the capital investment costs for IGCC are updated to $2,000/kw capacity vs. the old $1,400/kw. The table shows the economics for four processes:

- Case 1—CTL transportation fuels using Fischer-Tropsch synthesis.

- Case 2—Coal-to-electric power using IGCC.

- Case 3—Coal to both liquid transportation fuels and electric power.

- Case 4—Ultragreen technology to eliminate CO2 emissions from the IGCC plant using hydrogen-rich gas for the combustion turbine. CO in the syngas is shifted to hydrogen in a water gas shift reactor, and the CO2 is removed and sold.

The good news is that the rate of return is now higher for all of the cases. They benefit from the increased price of diesel fuel and CO2 even with the higher investment costs. In fact, Case 4 for the ultragreen technology looks very attractive at a 30% DCF rate of return for $135/bbl crude and 26% for $75/bbl crude. The CO2 produced from Case 4, represents a major revenue stream and shows that plant location is important. The coal conversion plant needs to be within 100-450 miles of the oil field that will be using the CO2 for EOR. As one example, CO2 is transmitted via pipeline about 450 miles from Cortez in southwest Colorado to the Texas panhandle. Other examples are given in the OGJ EOR survey.3

Cost sensitivity studies

The impacts of higher capital costs and higher value for the CO2 in Case 3 are illustrated in Table 3. It shows the results of a cost sensitivity analysis of capital costs for Case 3, using the much higher value of $3,000/kw to show its impact on the DCF rate of return.

Case 3a shows the result of changing the capital investment basis to $3,000/kw capacity from $2,000 while keeping CO2 valuation at $2/Mcf. The second sensitivity, illustrated as Case 3b, shows results of changing the CO2 valuation to $5/Mcf from $2/Mcf, and with everything else held constant from Case 3a. These new cases are shown in the Table 3 cost sensitivity study results.

Case 3a, using the higher capital investment of $2.4 billion, results in the return on investment dropping to15% from 20%. This rate of return is still attractive at the higher investment costs and gives some confidence that a potential investor in this project would not be subject to an economic failure, even if construction costs escalated during the 4-year construction period.

Case 3b shows that if CO2 is valued at $5/Mcf—equivalent to spending $25 in CO2 to get 1 bbl of oil production—the DCF rate of return for the project increases to 27% from 20%.

Changing coal’s image

It is hoped that the new clean coal-green technology will change the image of coal from being considered a “dirty” fuel. Although coal in the direct-fired utilities is problematic for emissions of SOx, NOx, mercury, and CO2, these emissions are either eliminated or greatly reduced when the coal is gasified to syngas followed by acid gas scrubbing, using clean coal technology. The technology will easily apply to petroleum coke, so rather than trying to market a large pile of delayed coke, the refiner can consider converting it to electricity and liquid hydrocarbons.

It also is important for the US government to take a comprehensive look at the overall energy picture and realize that coal has few environmental demerits when used in modern clean coal technology and that clean coal should hold an important place as a future source of energy in the US. It will take a clear government policy on energy and the environment to convince investors to move forward with these kinds of projects.

There are a number of ways the US government should take the lead in this effort:

- Organize a consortium of oil, coal, and power companies to design, build, and operate the plants. Production of electricity and CO2 for EOR will cushion the economic downside when crude prices drop.

- Continue the 80% loan guarantee for synfuels plants.

- Provide a price support for the product from the plants, perhaps guaranteeing to purchase the entire liquid product at a set price. This guarantee would not be substantial for the initial plants, which would produce 5,000-10,000 b/d of liquid fuels.

- Offer tax credits to corporations to build and operate “green” and “ultragreen” coal plants that produce either electricity or liquid fuels.

- Streamline environmental permitting so that construction can proceed in a timely manner.

These initiatives could pave the way for a new, robustly ample and clean domestic energy supply for the US.

References

- Robinson, Ken K., and Tatterson, David F., “Fischer-Tropsch oil-from-coal promising as transport fuel,” OGJ, Feb 26, 2007, p. 20.

- Barta, Patrick, “South Africa has a way to get more oil: Make it from coal,” Wall Street Journal, Aug. 6, 2006.

- OGJ, Apr. 21, 2008, p. 41.

The authors

Ken K. Robinson ([email protected]) is president of Mega-Carbon Co. He has several years of industrial experience working at Monsanto, Amoco, and Argonne National Laboratory where he held positions such as director of coal utilization; research associate; manager, technical university relations; and associate director, technology transfer. He also was associated with California Institute of Technology as associate director of corporate relations and taught chemical engineering courses for 10 years at Northwestern University. Robinson has published 20 articles and holds 9 patents. He is coinventor of the Robinson-Mahoney spinning basket reactor and, with Ralph Bertolacini, the Amocat coal liquefaction catalysts used at the H-Coal pilot plant in Catlettsburg, Ky. At Monsanto, Robinson was a member of the development team for the homogeneously catalyzed acetic acid process commercialized worldwide.

David F. Tatterson ([email protected]) is involved in businesses development for Mega-Carbon Co. He has 33 years of experience within the petroleum, alternative energy, and activated carbon industries. His expertise includes hydrocarbon process development, product development, marketing, marketing research, and business development. In the marketing area, he has extensive experience in global markets, including China, Russia, Mexico, Brazil, Turkey, Azerbaijan, and India. Tatterson holds eight US patents and has published a number of technical and marketing papers.