Oil, fundamental analysis

Crude prices were up-and-down this week as traders eyed both optimistic and pessimistic signs regarding the proposed US/Iran talks held Friday. A large drop in crude and distillate inventories were the main fundamental factors noticed. Despite the rollercoaster ride, US prices remained above the key $60/bbl level. WTI had a High of $65.55/bbl on Wednesday with a weekly Low of $61.10 on Tuesday. Brent crude’s High was $69.75/bbl on Wednesday while its Low was $65.75 Monday. Both grades settled lower week-on-week. The WTI/Brent spread has tightened to ($4.50).

The week started with a bearish tone as US President Trump spoke with optimism about the upcoming US/Iran talks. However, later in the week, the Iranian government objected to the specific topics the US wants to discuss beyond their nuclear developments and the meeting appeared doomed. The two sides did decide to follow through with the planned meeting Friday with Iranian officials labeling the meeting as a 'very good start.'

Meanwhile, the Iranian Revolutionary Guard Corps (IRGCC) attempted to stop a US-flagged vessel in the Strait of Hormuz and sent drones to a US Navy ship in the area. Both attempts were thwarted by US naval forces. Some Very Large Crude Carriers (VLCC) are said to have been increasing their normal speeds for faster passage through the Strait of Hormuz while it’s still open. It is estimate that slightly more than 25% of global oil supplies move through the Strait.

Russia is now relying heavily on its relationship with China to buy its oil exports after the US offered India a deal whereby tariffs could be cut if India halts buying Russian Urals. Additionally, Indian refiners would have access to Venezuelan exports. No official action has yet to be taken by the Indian government in terms of such a ban. One of the buyers of Venezuelan oil from the US, Vitol, has supposedly sold 2.0 million bbl to some Indian refineries. Venezuela’s exports for January averaged about 800,000 b/d, up from December’s 500,000 b/d. US refiners are having a hard time taking all of the volumes of Venezuelan heavy crude.

Meanwhile, Mexico’s Pemex has vowed to continue to supply Cuba with oil despite pressure from the Trump administration to cease sending oil there. Trump has threatened punitive tariffs against any country that supplies oil to the isolated island nation.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week declined while total US oil production was 13.2 million b/d last week vs. 13.5 last year at this time. The Strategic PetroleuM Reserve (SPR) was up 200,000 bbl to 415.2 million bbl.

The US Labor Department reported this week that job openings in December unexpectedly fell to their lowest level since mid-2020 during the heart of the pandemic. Additionally, layoff announcements last month amounted to over 100,000 planned and private payroll firm ADP shows only 22,000 jobs were added in January. All 3 major US stock indexes rallied last this week despite the jobs report as tech stocks, other than Amazon, were up on less AI 'doom and gloom.' The Dow pushed past the 50,000 mark for the first time ever and was higher week-on-week while the S&P and NASDAQ were lower. The USD was higher which could put a cap on oil prices. Gold has come off from its recent highs and is back below the $5,000/oz. level but higher on the week.

Oil, technical analysis

March 2026 WTI NYMEX futures moved back towards their 8-, 10-, and 20-day Moving Averages. Volume is around the recent average at 390,000. The Relative Strength Indicator (RSI), a momentum indicator, is in back into neutral territory at 57. Resistance is now pegged at $64.00 while near-term Support is $63.40 (8-day MA).

Looking ahead

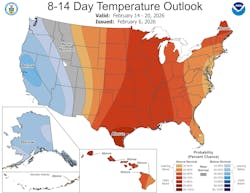

For months now, US/Iran nuclear talks have come and gone without any permanent agreement. Will this time be different? We may see a repeat of last week over the coming weeks as 'saber-rattling' occurs and both sides give status updates on the talks. Traders will be anxious to see if India does decide to cut-off Russian oil imports. The 8-14-day forecast is not bullish for heating oil demand at this point.

Natural gas, fundamental analysis

Winter Storm Fern resulted in the largest weekly natural gas storage withdrawal ever yet prices this week were less than 50% of the hyped-up pre-storm levels. Stored volumes still remain higher than last year at this time. The week’s High and Low occurred Monday at $3.74/MMbtu and $3.155, respectively.

Natural gas demand this week has been estimated at up to 114 bcfd while production was thought to be 113 bcfd. In the UK, natural gas prices at the NBP were most recently higher at $11.65/MMbtu while Dutch TTF futures were $12.25. Europe still receives about 25% of its natural gas from Russia while US LNG imports represent about 55% of supply. Storage levels in Europe were most recently at 29% vs. a 5-year average 56%. Asia’s JKM was quoted at $11.10/MMbtu.

The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 360 bcf vs. a forecast of -375 and a 5-year average of -190 bcf. Total gas in storage is now 2.463 tcf, now 1.7% above last year and 1.1% below the 5-year average.

Natural gas, technical analysis

March 2026 NYMEX Henry Hub Natural Gas futures stair-stepped higher this week and are now bounded by the 8-, 13-, and 20-day Moving Averages. Volume was below average at 175k. The RSI has moved into neutral territory at 50. Support is $3.25 (20-day MA) with key Resistance at $3.65 (8-day MA).

Looking ahead

Most of the regions impacted by Fern and the more recent 'bomb cyclone' have rebounded and are expected to have above-normal temperatures one week out. Next week’s natural gas storage report will include the impacts of the 'bomb cyclone' that hit the Southeast as it will reflect withdrawals for the current week. If we get to a deficit vs. year-ago levels, look for March and April futures to climb as the former represents any prolonged winter demand while the latter is the first month of storage refills for next winter. As with heating oil, the 8-to-14-day forecast looks bearish for natural gas demand.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.