Oil, fundamental analysis

Crude prices started the holiday-shortened trade week higher but slipped by week’s end despite ongoing, and potentially expanding, geopolitical risks. A large draw in oil feedstocks was offset by even larger gains in refined product inventory. The $60.00/bbl level was broken Dec. 8, 2025, and hasn’t been reached since.

WTI’s weekly high of $58.55/bbl occurred Wednesday while the low of $56.60 was on Friday. Brent followed a similar pattern but hit its high of $63.30/bbl on Tuesday with its weekly low of $60.00 also on Friday. WTI settled higher vs. last week while Brent was higher. The WTI/Brent spread has tightened to ($3.60). Oil prices ended 2025 19% lower year-over-year representing the largest annual slide percentage-wise since 2020 and the third straight year of decline.

There appears to be no progress in the Russia/Ukraine peace process as Ukraine continues to attack key Russian oil infrastructure while Russian President Putin made a false claim of an attack on one of his many vacation homes while on a call with US President Trump.

Meanwhile, the US CIA reportedly attacked an onshore Venezuelan oil plant, putting more pressure on Maduro. The US has also imposed more sanctions on Venezuelan tankers which now include some ULCCs. Additionally, tensions are rising between the UAE and Saudi Arabia as each country’s proxies are clashing in Yemen with a recent strike at an oil port increasing export risk.

Adding more uncertainty, Pres. Trump, in an early morning social media post, expressed outrage at the suppression of Iranian protestors in Tehran and hinted at possible action to protect them.

This expansion of geopolitical risk directly involves global oil supplies coming from 4 different countries, yet those clinging to a bearish outlook have dominated the market this week as the International Energy Agency (IEA) is projecting a surplus of as much as 4.0 million b/d. However, OPEC still sees a more balanced market this year and is holding output levels for the first quarter. The OPEC+ group will meet this weekend but there are no expectations of any change in current policy.

The latest Dallas Federal Reserve survey of oil and gas executives indicated 2026 upstream capital spending would range from “decrease slightly” (19%) to “increase slightly” (26%) depending on the size of the firm. Oil and gas service companies were more pessimistic, with 48% expecting a decrease in spending based upon a lower level of activity.

The Energy Information Administration (EIA)'s Weekly Petroleum Status Report indicated total US oil production was steady at 13.8 million b/d vs. 13.6 last year at this time while the Strategic Petroleum Reserve (SPR) was up 250,000 bbl. to 413 million bbl.

The New Year has started off on a roller coaster for stocks as the Dow is higher this week while the S&P and NASDAQ are lower. There were lower claims for unemployment last week, but Pres. Trump’s on-again/off-again tariff strategies are creating mixed signals for investors. The President recently threatened to increase tariffs on the EU while postponing import tariffs on furniture and cabinetry for a year. Meanwhile, the Fed does not seem poised to initiate another rate cut this month when it meets. The USD is higher which is also aiding in suppressing crude prices.

Oil, technical analysis

February 2026 WTI NYMEX futures are now trading around their 8-, 10- and 20-day Moving Averages. Volume is around the recent average at 135,000. The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory at 46. Resistance is now pegged at $57.95 while near-term critical Support is $57.15 (13-day MA).

Looking ahead

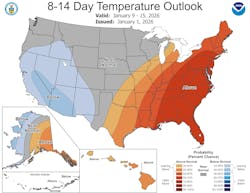

Crude markets will be looking in several different directions next week as the Russia/Ukraine situation appears to be deteriorating and as Pres. Trump seems set on invading Venezuela while making comments about the situation in Iran. The 8-14-day temperature outlook is bearish for heating oil demand as above-normal conditions are forecasted for the entire Eastern Seaboard.

Natural gas, fundamental analysis

January 2026 NYMEX natural gas futures expired this past Monday and February took center-stage Friday. After rising on the forecast for an above-normal storage withdrawal, prices fell late week on the warmer temperature outlook and despite an actual withdrawal which turned total inventory into a deficit vs. the 5-year average. The week’s High was $4.18/MMbtu on Tuesday while the week’s Low was $3.56 on Friday.

Supply last week was 111.0 bcfd while demand was 125.5 bcfd with LNG at 18.3 bcfd. In the UK, natural gas prices at the NBP were most recently lower at $10.45/MMbtu while Dutch TTF futures were $9.90 and Asia’s JKM was quoted at $9.70/MMbtu.

The EIA’s Weekly Natural Gas Storage Report for the week ending Dec. 9, 2025 (Dec. 26, 2025, is delayed) indicated a withdrawal of 166 bcf vs. a forecast of a withdrawal of 169 bcf. Total gas in storage is now 3.413 tcf, now at 0.7% below last year and .04% below the 5-year average.

Natural gas, technical analysis

February 2026 NYMEX Henry Hub Natural Gas futures have now fallen below the 8-, 13- & 20-day Moving Averages this week. Volume was about average at 120,000. The RSI is moving into oversold territory at 40 on the late week sell-off. Support is $3.60 with key Resistance at $3.76 (13-day MA).

Looking ahead

As with heating oil, the 8-14-day forecast is bearish for natural gas demand. LNG exports continue to remain strong, however. And January has just begun. Some analysts foresee much colder weather in the latter half of the month.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.