EIA signals softer oil prices as inventories rise

Key Highlights

- Global oil inventory builds are expected to exceed 2 million b/d in 2026, similar to this year's increases.

- Crude prices are expected to decline to around $55/bbl in early 2026, influenced by rising production and inventory builds.

- OPEC+ plans to produce less than targeted, with strategic stockpiling in China supporting price stability despite surplus conditions.

- Non-OECD countries, especially China and India, will drive the majority of the increase in global oil demand in 2025 and 2026.

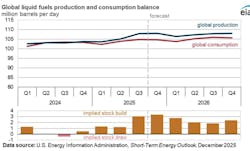

Global oil markets are expected to move into a surplus over the coming months as production growth outpaces consumption, according to the US Energy Information Administration (EIA)’s latest Short-Term Energy Outlook (STEO).

Oil price declines

Rising inventories and easing geopolitical risk premiums are projected to place downward pressure on crude prices.

In November, the average Brent crude oil spot price was $64/bbl, a decrease of $11/bbl from November 2024. The ongoing decline in crude oil prices is primarily driven by increasing production, which is outpacing the impact of rising drone attacks on Russia's oil infrastructure and the latest sanctions imposed on the country's oil sector.

“We forecast that growing global oil production and lower demand over the winter will accelerate the accumulation of oil inventories, resulting in further crude oil price declines in the coming months. We forecast that the Brent price will drop to an average of $55/bbl in the first quarter of 2026 and will stay near that price for the rest of the year,” EIA said.

EIA also forecasts that global oil inventory builds will exceed 2 million b/d in 2026, which is similar to this year’s increase. Persistent inventory accumulation may occupy commercial storage facilities on land, leading market participants to look for alternative, costlier storage solutions for crude oil, such as floating storage. Consequently, some of the declines in crude oil prices are likely to be attributed to the increased marginal costs associated with storage, EIA said.

Price decline limiters

However, although prices are expected to fall in 2026, both OPEC+ policy and China’s continued inventory builds will limit declines.

“Given our expectation of substantial global oil inventory builds, we forecast OPEC+ will produce about 1.3 million b/d less than targeted production in 2026. On Nov. 30, OPEC+ reaffirmed plans to keep production flat in the first quarter, but left open the potential for future adjustments. A large portion of oil inventory builds this year have been in strategic stockpiles in China, which has limited downward price pressures. We expect that China will continue building strategic stockpiles into 2026,” EIA said.

Global liquid fuels production in EIA’s forecast increases by 3.0 million b/d in 2025 and by more than 1.2 million b/d in 2026. Along with OPEC+, the US, Brazil, Guyana, and Canada drive production growth in the forecast.

On the demand side, EIA forecasts global liquid fuels consumption to increase by 1.1 million b/d in 2025 and by 1.2 million b/d in 2026. Global liquid fuels consumption growth is driven almost entirely by non-OECD countries.

According to EIA’s forecasts, China’s liquid fuels consumption increases by 250,000 b/d in 2025 and by an additional 300,000 b/d in 2026. EIA raised its forecast of 2026 oil consumption in China by 50,000 b/d from last month’s STEO due to upward revisions to expected GDP growth. India will increase its liquid fuels consumption by 70,000 b/d this year and 170,000 b/d next year.

Refining

In the refining sector, EIA anticipates that the US will experience lower crack spreads—an indicator of refining profitability—in December and first-quarter 2026, compared with earlier projections.

In November, crack spreads increased as a result of constrained global refinery output, which was attributed to the new sanctions on Russian petroleum in October 2025 and the fall maintenance in European and Middle Eastern refineries. However, as some global refinery maintenance wrapped up, refinery margins fell at the end of November and into early December.