IEA: Global gas demand growth slowed in 2025 but set to rebound in 2026

Global natural gas demand growth has weakened significantly in the first 3 quarters of 2025 following a relatively strong rebound in 2024, weighed down by higher prices, tighter supply fundamentals, and a sluggish macroeconomic backdrop.

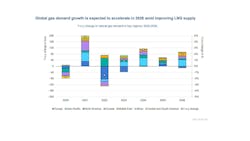

Despite the slowdown, consumption is expected to accelerate again in 2026, reaching a new all-time high as improving supply—driven by expanding LNG output—supports stronger global demand.

These are findings from International Energy Agency (IEA)’s Gas 2025 report.

Preliminary IEA data shows gas consumption in the markets covered by the update rose by just 0.5%—about 10 billion cu m (bcm)—year on year (y-o-y) in the first 9 months of 2025, with nearly all growth coming from Europe and North America.

Demand patterns shifted notably compared with previous years. Europe posted the strongest gains as industrial activity stabilized and gas-fired power generation increased, while Asia’s gas consumption remained broadly flat, showing virtually no y-o-y growth over the same period.

Supply conditions stayed tight despite a 5% increase in global LNG output—nearly 20 bcm—between January and September 2025. Rising LNG exports were partly offset by lower Russian and Norwegian pipeline deliveries to Europe, while the European Union (EU)’s storage injections further tightened the overall balance.

For full-year 2025, global gas demand is expected to expand by less than 1%, assuming normal winter weather in the fourth quarter. Regional trends vary.

Looking ahead, IEA forecasts global gas consumption to reach a new all-time high in 2026, with demand growth accelerating to 2% as supply conditions improve. Global LNG output is forecast to rise by a robust 7% (around 40 bcm) next year, led by new capacity in the US, Canada, and Qatar.

Strengthening supply is expected to stimulate demand, particularly in fast-growing, price-sensitive Asian markets, where consumption is projected to climb nearly 5%, accounting for about half of total global growth in 2026. North American demand is also expected to rise about 0.5%, mostly from the power sector.

In contrast, gas use in Central and South America is expected to fall almost 1.5% as renewable generation expands, while Europe is projected to see a 2% decline amid continued renewable buildout. Gas demand in Eurasia is forecast to increase by more than 3%, assuming a return to average weather, and consumption across Africa and the Middle East is set to grow 3% on industrial and power-sector strength.