Oil, fundamental analysis

Crude prices were already poised for a technically-driven rebound, but across-the-board inventory draws, and new sanctions placed on Russian energy entities led to a $5.00+ rally this week. The US grade started the week as low as $56.35/bbl but pushed as high as $62.60/bbl by Friday.

Brent followed a similar pattern, hitting its low of $60.35/bbl on Monday and its weekly high of $66.80 on Friday. Both grades settled much higher week-on-week with gains exceeding $5.00/bbl. The WTI/Brent spread has widened to ($4.40).

Political risk premium entered oil markets again this week in the form of new US sanctions on Russia’s two largest oil companies, Rosneft and Lukoil, which represent about 50% of the country’s exports. The sanctions will preclude both companies from doing business with US banks and other financial institutions. The EU had imposed a new sanction package on the two last week along with some Chinese refiners.

From the start of the Russia/Ukraine war, Russia’s crude exports of about 3.0 million b/d have been the target for sanctions. Yet, to date, most sanctions have proved ineffective or have been circumvented. However, oil markets still react bullishly to such announcements.

But this time around, India’s largest refiner, Reliance, is agreeing to halt the purchases of oil from Rosneft that were taking place under a long-term agreement which will impact the physical sales of Urals.

China remains Russia’s No. 1 importer of oil. China is now also the No. 1 purchaser of Canadian bitumen, taking up to 70% of the 3.5 million b/d of the oil sands production being delivered to British Columbia ports via the expanded Trans Mountain pipeline.

The Energy Information Administration (EIA)’s Weekly Petroleum Status Report (still released despite the government shut-down) indicated that commercial crude oil and refined product inventories for last week all decreased. The Strategic Petroleum Reserve (SPR) was up 820,000 bbl to 408.5 million bbl. Total US oil production was 13.6 million b/d vs. 13.5 last year at this time. The US Department of Energy (DOE) is soliciting bids for January delivery of 1.0 million bbl for the SPR.

There appears to be a shift among the major exploration and production (E&P) companies back to offshore development as onshore plays have matured. About 10 years ago, these same companies had shifted from the highly expensive, mega-projects to deploying capital onshore in 'known' plays. With emerging discoveries in Guyana, Suriname, and Brazil, IOCs are finding solid returns again.

Inflation in September rose 3.0% year-on-year and was slightly higher than August’s +2.9%. Some key data included a 15% increase in price of beef and 19% increase for coffee. Moving away from the Fed’s 2.0% target only serves to present the agency with a dilemma. Fighting inflation by raising interest rates could stifle growth while relaxing rates could lead to more spending and a further rise in inflation. New claims for unemployment benefits rose last week to 232,000, up from the prior week’s 220,000 and above estimates of 227,000-229,000. All three US stock market indexes are up on the week as the CPI report was viewed as a moderate increase which will not stop the Fed from another rate decrease. The USD is higher also which may serve to cap crude’s rally.

Oil, technical analysis

November 2025 WTI NYMEX futures expired this week, and December became the new prompt month. Prices raced through and beyond their 8-, 10- and 20-day Moving Averages this week. Volume Friday is at the recent average at 335,000 after Thursday’s 712,000, the most ever for this contract.

The Relative Strength Indicator (RSI), a momentum indicator, also screamed higher into neutral territory at 55, up from last Friday’s 33. Resistance is now pegged at $62.60 while near-term critical Support is $62.00.

Looking ahead

The question for traders revolves around the actual physical curtailment of Russian Urals exports as a result of yet another round of sanctions. And will India and China cut-back on importing Russian crude? Sanctions won’t be lifted until Russia shows signs of at least agreeing to a ceasefire in Ukraine, something that has yet to happen. Markets will still be watching to see if the Trump/Jinping meeting goes forward as announced and what, if any, positive agreements on trade result.

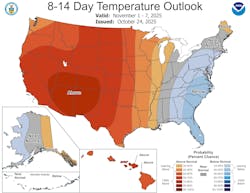

The temperature outlook for 2 weeks from now calls for below-normal conditions for a good portion of the Northeast region which consumes a lot of heating oil during winter.

Natural gas, fundamental analysis

November NYMEX natural gas futures did not get much momentum out of the rally in crude but saw some support on cooler forecasts for the end of October and early November. An above-forecasted storage injection led to lower prices at week’s end.

The week’s High was $3.57/MMbtu on Wednesday while the week’s Low was $3.14 on Monday. Supply/demand data was not available this week due to the shutdown.

Dutch TTF prices are holding at around $10.95/MMbtu while Asia’s JKM was quoted at 11.20/MMtu. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 87 bcf, above the forecasted +81 bcf. Total gas in storage is now 3.808 tcf, rising to 0.9% above last year and down to +4.5% above the 5-year average.

Theoretically, there are just 2 weeks left in the official injection season. To achieve a season-ending volume of 3.9 tcf, injections would only have to average +46 bcf per week and +96 bcf to reach 4.0 tcf.

If we factor in the possibility of injections during the first 2 weeks of November, 4.0 tcf could be reached with only an average injection of 48 bcf per week.

Natural gas, tecchnical analysis

November 2025 NYMEX Henry Hub Natural Gas futures also shot past their 8-, 13- & 20-day Moving Averages early in the week only to settle back around them late. Volume was 100,000, below the recent average. The RSI is back to neutral at 54. Critical support is pegged at $3.20 (8-day MA) with key Resistance at $3.35.

Looking ahead

The 8–14-day forecast indicates some demand for natural gas-fired generation and space heating. However, continued gains in storage will be bearish for prices. Look for that trend to continue until sustained colder seasonal weather emerges.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.