Falling Saudi oil demand highlights power generation progress

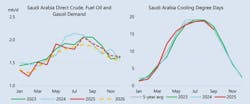

Saudi Arabia’s demand for key oil-based power generation fuels—crude oil, fuel oil, and gasoil—fell by an average of 270,000 b/d during June and July this year, according to data reported to OPEC and published by Joint Organizations Data Initiative (JODI), as cited by the International Energy Agency (IEA) in its October Oil Market Report.

The soft start to the 2025 summer cooling season suggests early progress toward the Kingdom’s long-term goal of curbing oil use in power generation, utilities, and agriculture. Under the government’s Liquid Fuels Displacement Program, Saudi Arabia aims to eliminate about 1 million b/d of domestic oil consumption by 2030, mainly through expanded gas-fired and renewable power capacity.

During the first 7 months of 2025, combined demand for direct crude burn, fuel oil, and gasoil declined by nearly 100,000 b/d year on year, most noticeably in the summer months, when electricity demand typically peaks. The reduction came despite a 1.6% rise in cooling degree days (CDDs) and continued demographic pressures, with the working-age population expected to grow by roughly 6% this year.

“While the availability of prompt data relating to electricity and natural gas is comparatively limited, the most likely driver of the fall in oil use is rising power output from other sources, especially gas. Increasing natural gas supply and utilization has long been a focus for the Saudi energy sector and the Jafurah project, with production beginning later this year, is expected to significantly boost gas (and NGLs) output during the rest of this decade,” IEA said.

IEA expects this to enable a major reduction in oil use for electricity production, in a resumption of the substantial declines achieved during the late 2010s. “While monthly data can be volatile, the figures reported for June and July suggest that this progress may be outpacing the medium-term trajectory included in our Oil 2025 report, which already saw Saudi Arabian oil demand dropping by more than any country by 2030.”

August and September temperatures were broadly consistent with recent seasonal norms, and CDDs were essentially flat year on year. In recent years, use of power plant input products has been less than half as responsive to underlying cooling requirements than it was during 2010-2016, and ‘base load’ winter deliveries appear to have fallen by more than 100,000 b/d since the pandemic.

“Barring an unusually hot October and November, it is likely that total 2025 Saudi oil consumption will drop slightly, despite strong rises in GDP and population. With accelerating improvements in gas availability and renewable deployment expected, national oil demand has likely already achieved a plateau. This pathway may serve as a template for other countries in the region that currently depend on oil in their power generation mix,” IEA said.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.