Oil, fundamental analysis

Oversupply concerns dominated crude markets this week as prices fell more than -7% week-on-week, reversing what had been an over-buying situation into one of over-selling.

The OPEC+ group’s decision to continue to increase output coupled with an across-the-board build in inventories weighed on prices. After starting the week as high as $65.40/bbl Monday, WTI fell to a low of $60.40/bbl Thursday, ending the week at $60.82 on Friday.

In a similar pattern, Brent crude hit its high on Monday at $69.90/bbl with its low of $64.00/bbl occurring Thursday as well. Prices haven’t been this low since the end of May. Both grades settled lower week-on-week. The WTI/Brent spread has tightened to ($4.00).

At its next coordination meeting, the OPEC+ group is expected to not only agree to increase output but may do so at even higher levels as it seeks to restore the second tranche of cuts which totaled 1.6 million b/d. As a result, the daily output increases could double or triple current levels. It should be noted that analysts continue to monitor the real production levels which the group has historically not met. Meanwhile, Iraq has restarted about 150,000-160,000 b/d from the Kurdish region.

Additionally, the furloughing of thousands of federal employees tied to a US government shutdown are negative for energy consumption at all levels.

One supportive sign is China’s buying of oil for its strategic reserves mostly due to the lower market prices.

The Energy Information Administration (EIA)'s Weekly Petroleum Status Report (released despite the government shut-down) indicated that commercial crude oil inventories for last week increased by 1.8 million bbl while production remained constant at 13.5 million b/d vs. 13.2 at this time last year. The Strategic Petroleum Reserve was up 740,000 bbl to 406.7 million bbl.

The ISM’s purchasing index rose last month to 49.1 from August’s 48.7. While higher, readings below 50 indicate contraction in the sector although it’s occurring at a slower rate. Despite this and the government shutdown, all 3 major US stock indexes set new Highs this week, but the NASDAQ settled lower week-on-week. The USD Is lower which may have helped crude late week gains.

Oil, technical analysis

November 2025 WTI NYMEX futures prices retreated rapidly after having breached the Upper-Bollinger Band limit the prior week. They are now trading below the 8-, 13- and 20-day Moving Averages this week and managed to breach the Lower-Bollinger Band limit, a Buy signal. Small gains occurred Friday on this technical buying.

Volume is around the recent average at 208,000. The Relative Strength Indicator (RSI), a momentum indicator, is now in oversold territory at 41, another potential Buy signal. Resistance is now pegged at $61.50 while near-term critical Support is $60.35 (Lower-Bollinger Band).

Looking ahead

Traders will enter next week with the prospect of OPEC+ output increases baked into prices after this week’s declines. Hard data as to the actual increases achieved with these decisions will set the tone going forward but the current bear market for oil will be hard to shake as we’ve exited the driving season.

The Tropics continue to show no real threat to the Gulf of Mexico as we move towards the end of the peak of the hurricane season on Oct. 15.

A prolonged government shutdown will set a negative tone for the US economy which is always negative for energy demand.

Natural gas, fundamental analysis

NYMEX natural gas futures got a boost this week on the change from October to November, the first winter month on the energy calendar. Additionally, 90-degree temperatures remained for much of the southern tier of states. A lower-than-forecasted storage injection added some bullish sentiment midweek as well.

The week’s High was $3.585 /MMbtu on Thursday while the week’s Low was $3.13 on Monday. Supply/demand data was not available this week due to the government shutdown.

Dutch TTF prices fell slightly to $10.92/MMbtu while Asia’s JKM was quoted at $11.05/MMbtu.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 53 bcf, below the forecasted +71 bcf. Total gas in storage is now 3.561 tcf, holding at just 0.6% above last year and to 5.0% above the 5-year average. Theoretically, there are just 4 weeks left in the injection season. To achieve a season-ending volume of 3.9 tcf, injections would have to average 85 bcf per week and 110 bcf to reach 4.0 tcf.

Natural gas, technical analysis

November 2025 NYMEX Henry Hub Natural Gas futures are trading above the 8-, 13- & 20-day Moving Averages. Volume was 203,000, around the recent average The RSI is neutral at 52. Critical Support is pegged at $3.29 (8-day MA) with key Resistance at $3.45.

Looking ahead

The US Department of Energy’s decision to encourage new coal drilling on federal lands while providing incentives for coal plants to run will only steal from the natural gas market share of power generation.

Storage volumes heading into the winter season are above-average at this point however, there are still robust spreads from November to December, January, and February which may encourage more injections.

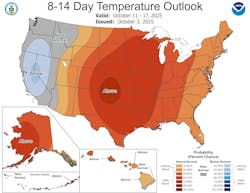

The NOAA 8–14-day forecast indicates continuing above-normal temperatures for a large area of the country which could result in A/C demand for gas fired-generation. The storage spread for natural gas still exists with November trading around $3.35/MMbtu while December is $4.05, and January is $4.15.

Those with remaining capacity may take advantage of this spread which will provide price support even with cooler temperatures.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.