Macquarie: China’s oil demand outlook improves heading into 2026

In a quarterly commodities compendium, Macquarie strategists note that China’s oil demand is set for a stronger trajectory in 2026, as robust refining activity and a push toward petrochemical expansion offset structural challenges in fuel consumption.

After a heavy spring maintenance season, Chinese refiners saw throughput rise steadily through September, supported by strong refining margins, favorable export opportunities, and easing macroeconomic pressures from the extended US-China trade truce. However, by late September, domestic margins had normalized to their 5-year average as tighter clean product export quotas constrained profitability—a development that could temper refinery operating rates heading into year-end.

Despite this, crude processing levels are expected to remain above historical averages through late 2025 and into 2026, according to Macquarie. The increase will be driven largely by integrated refineries boosting petrochemical feedstock production as part of China’s fuel-to-chemicals transition strategy.

Analysts also anticipate a growing divergence in operations: independent 'teapot' refineries may face restrictions from limited crude import quotas and higher fuel oil prices, while state-owned enterprises (SOEs) are likely to sustain high utilization to meet seasonal peaks in domestic demand.

On the policy front, Beijing’s 'anti-involution' campaign—aimed at curbing overcapacity—is expected to have limited immediate impact. More than 40% of China’s crude distillation units were commissioned 2 decades ago, but most have since been upgraded and remain competitive.

In the chemicals sector, new polypropylene and polyethylene capacity will more than offset potential plant closures, with low utilization rates offering additional resilience. Market sentiment, however, could strengthen if Beijing unveils more detailed anti-involution measures later this year.

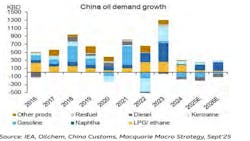

In Macquarie’ s latest note, China’s oil demand forecasts have been revised slightly lower for 2025, with projected growth at 42,000 b/d, down from a previous estimate of 54,000 b/d, reflecting weaker steam cracker margins and softer naphtha demand. Nonetheless, the launch of new naphtha-fed ethylene units is expected to lift naphtha demand by more than 200,000 b/d next year, providing crucial support for overall consumption.

Diesel demand, while structurally pressured by rising LNG and electric truck adoption, is projected to contract at a slower pace in 2026. Analysts expect fewer spring maintenance shutdowns, thanks to this year’s unexpectedly strong refining margins, which could cushion the decline.

Overall, chemical sector expansion is set to remain the key growth driver. According to Macquarie, China’s oil demand is forecast to rise by 179,000 b/d in 2026 under baseline assumptions, absent a major housing stimulus. This contrasts with the International Energy Agency's most recent projection of 141,000 b/d for China's oil demand growth in 2026.