EIA sees lower oil prices in latest outlook

Key Highlights

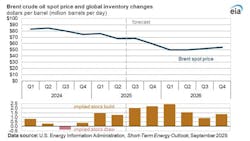

- Oil prices are expected to decline to around $51/bbl in 2026 due to increased inventories and global supply growth.

- Natural gas prices are forecasted to rise to over $4.30/MMbtu by 2026 from $2.91/MMbtu (August), driven by flat production and increased exports.

- US renewable energy's share of electricity generation will continue expanding, while gasoline prices are projected to fall below $3.00/gal in 2026.

- Global oil inventories are expected to grow, with the highest build in late 2025 and early 2026, reflecting oversupply and strategic stockpiling.

- US oil production outside OPEC+ is anticipated to drive most of the global supply increase, with key contributions from Brazil, Canada, Guyana, and the US.

In its latest Short-Term Energy Outlook (STEO), the US Energy Information Administration’s (EIA) projects Brent crude oil prices will decline from about $68/bbl in August to an average of $59/bbl in fourth-quarter 2025, before falling further to about $49/bbl in March and April 2026. For all of 2026, Brent is forecast to average $51/bbl, compared with an average of $68/bbl in 2025.

The price decline reflects a significant build in inventories, which are expected to average more than 2 million b/d in second-half 2025, and levels are expected to remain elevated through 2026, according to EIA. EIA noted that its forecasts were finalized before OPEC+ announced a new production increase of 137,000 b/d in October, which could add further pressure on prices.

“Despite our assessment that global oil production has been much higher than demand this summer, we have yet to see a significant increase in observable oil inventories. Some third-party data sources that track non-OECD inventories do not show as significant of a stock build as our estimates suggest. This disconnect is likely the result of some of the excess production ending up in observable strategic reserves, particularly China, or other stockpiles used by countries for domestic consumption. However, OECD inventories have recently moved above their seasonal average range from 2018–24 (excluding 2020 and 2021) on a days-of-supply basis. Recent growth in OECD inventories suggest some excess supply is beginning to show up in observable oil inventories,” EIA said.

“As temperatures begin to cool and summer driving demand wanes, we expect strong oil supply growth to be reflected in OECD inventory levels, which we see exceeding to the upper bound of their recent five-year average by the end of our forecast in 2026,” EIA added.

EIA estimates that global oil inventories will increase by an average of 1.6 million b/d in 2026, compared with an average annual increase of 1.7 million b/d in 2025. EIA expects inventory builds will be highest in fourth-quarter 2025 and first-quarter 2026, averaging 2.3 million b/d over that time.

Global oil supply, demand

EIA’s forecast indicates that the anticipated increases in OPEC+ production, alongside robust supply growth from non-OPEC+ nations, will continue to fuel global liquid fuels production.

EIA projects an increase of 2.3 million b/d in global liquid fuels production in 2025, followed by an additional rise of 1.1 million b/d in 2026. Most of this growth is expected to come from countries outside of OPEC+, which we estimate will contribute 1.7 million b/d in 2025 and 0.6 million b/d in 2026. Notably, Brazil, Canada, Guyana, and the US are anticipated to be key drivers of this production increase.

In contrast, OPEC+ crude oil production is projected to rise by 0.6 million b/d in 2025 and by 0.5 million b/d in 2026. This increase is based on the assumption that OPEC+ plans to moderate output growth to avoid excessive inventory accumulation and prevent a further drop in oil prices.

On the consumption side, global liquid fuels consumption is forecasted to grow by 0.9 million b/d in 2025 and 1.3 million b/d in 2026. This growth is predominantly driven by non-OECD countries, which are expected to see increases of 1.0 million b/d in 2025 and 1.1 million b/d in 2026. Conversely, OECD consumption is predicted to decrease by 0.1 million b/d in 2025 before experiencing a growth of 0.2 million b/d in 2026. Most of the growth in non-OECD countries will be concentrated in Asia, with liquid fuels consumption in India and China each projected to increase by 0.4 to 0.5 million b/d from 2024 to 2026.

US gasoline

EIA's forecast of declining oil prices is expected to result in lower gasoline prices. EIA expects the US average retail price for regular-grade gasoline will be around $3.10/gal this year, down $0.20/gal from last year. Looking ahead to 2026, retail gasoline prices are projected to drop further to an average of $2.90/gal, with annual averages falling below $3.00/gal in all regions except the West Coast.

Driven by falling gasoline prices, US drivers’ gasoline expenditures as a share of disposable personal income are likely to be the lowest since at least 2005—excluding the pandemic-affected year of 2020. EIA estimates expenditures will average less than 2% of disposable income this year, down from an average of 2.4% over the previous decade. EIA forecasts a slight increase in US gasoline consumption next year.

“The forecast for rising gasoline consumption is driven by an upward revision to the number of people of working age compared with our previous forecasts, and lower gasoline prices compared with our forecasts from earlier this year,” EIA said.

US natural gas

EIA expects the Henry Hub natural gas spot price will rise from an average of $2.91/MMbtu in August to $3.70/MMbtu in fourth-quarter 2025 and $4.30/MMbtu next year. Rising natural gas prices reflect relatively flat natural gas production amid an increase in US LNG exports.

Due to rising natural gas prices and falling oil prices in 2026, EIA forecasts that crude oil will trade at its lowest premium to natural gas since 2005.

“As a result, we expect drilling activity in the US to be more centered in natural gas-intensive producing regions in 2026. We expect US natural gas production will be relatively flat next year compared with 2025, while we expect crude oil production will decline by about 1%,” EIA said.