EIA: Transportation fuel demand still lags behind pre-pandemic levels

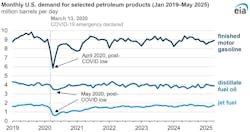

Five years after the declaration of the COVID-19 national emergency, US consumption of key transportation fuels—including gasoline, distillate fuel oil, and jet fuel—continues to fall short of pre-pandemic benchmarks, according to the US Energy Information Administration (EIA).

In April 2025, average US gasoline demand reached 8.9 million b/d—a marked improvement over the historic low of 5.9 million b/d seen in April 2020 (the month following the Mar. 13 emergency declaration). Yet, demand remains shy of April 2019’s average of 9.4 million b/d, and falls below the 2016–2019 average of 9.3 million b/d.

Though demand rebounded from 2020’s slump (8.0 million b/d), the more recent years of 2023 and 2024 saw a standstill at around 8.9 million b/d.

The disconnect between rising travel and stagnating fuel consumption is largely attributed to improved vehicle fuel efficiency and wider adoption of electric vehicles—even as vehicle miles traveled (VMT) reached a record 9.0 billion miles/day in 2024, up from the 8.8 billion daily average in the 2016–2019 period.

Demand for petroleum distillate fuel oil, primarily used for shipping and industrial operations, reached 3.8 million b/d in May 2025—around 10% higher than the May 2020 low, yet still below the 2019 average of 4.1 million b/d.

However, inclusion of biofuels—including renewable diesel and biodiesel—brings total distillate demand in 2024 was closest to pre-pandemic levels, at only 1% below 2019 distillate demand. Renewable diesel and biodiesel use grew from 110,000 b/d in 2019 to 310,000 b/d in 2024, significantly contributing to this recovery.

Jet fuel demand also remains under pre-pandemic levels. In May 2025, demand averaged 1.8 million b/d, well above the pandemic-era low of 597,000 b/d in May 2020—but still short of 2019 averages.

In 2024, jet fuel demand was about 3% below 2019, even as US Bureau of Transportation Statistics data show that passenger numbers and available seat miles rose compared with 2019, while the total number of flights declined.

Efficiency gains and changing flight patterns, among other factors, have contributed to jet fuel consumption remaining slightly lower than pre-pandemic levels, according to EIA.