EIA: US natural gas storage levels exceed average through injection season

Key Highlights

- EIA projects US natural gas inventories to reach 3,872 bcf by October, about 2% above the 5-year average.

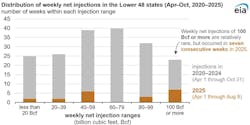

- 7 consecutive weeks of net injections exceeding 100 bcf mark a significant increase, the first since 2014.

- Production has outpaced consumption early in the 2025 injection season, boosting storage levels.

- Increased LNG exports and power generation demand are expected to reduce weekly injection volumes through October.

In its latest Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) forecasts that US working natural gas inventories will reach 3,872 bcf by end-October, about 2% more than the previous 5‑year average for that time of year.

US natural gas inventories increased rapidly from late April through early June—a period marked by 7 consecutive weeks of net injections exceeding 100 bcf each, the first time since 2014.

US natural gas production outpaced natural gas consumption during the start of the 2025 injection season. According to the Weekly Natural Gas Storage Report data, as of Aug. 8, total natural gas inventory was 7% above the 5‑year (2020–24) average. In contrast, at the beginning of this injection season—the week ending Mar. 28—inventory was 4% below average.

EIA notes that weekly net injections exceeding 100 bcf in the Lower 48 states usually occur in about 3 weeks/year, based on data for the previous 5 years (2020–24). In 2025, however, through Aug. 8, such injections occurred for 7 consecutive weeks.

Looking ahead, EIA anticipates smaller weekly injections through October, attributing this to increased natural gas use in power generation and greater exports of LNG.

EIA also states that the South Central, Midwest, and East storage regions contributed most to the storage volume increases in recent months. EIA forecasts that inventory in the South Central region will remain above the 5‑year average through October and end the season at the highest level since 2016. For all other regions, inventories are expected to end October near their 5‑year average levels.