IEA warns of mounting oil surplus as demand growth slows, supply surges

Key Highlights

- IEA has revised 2025 global oil demand growth downward mutiple times this year, cumulatively by 350,000 b/d.

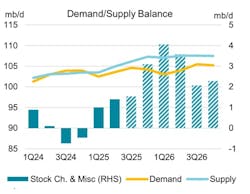

- Supply is expanding, with a potential record surplus next year.

- Sanctions on Russia and Iran are influencing supply dynamics.

- Refining activity remains strong, with global crude runs approaching record levels.

Global oil demand growth is losing momentum, with the International Energy Agency (IEA) projecting the weakest annual gain since 2019. At the same time, supply is expanding rapidly, setting the stage for a record surplus next year, with stock builds expected to outpace even the average accumulation seen during the 2020 pandemic, according to IEA.

Oil demand

Global demand growth for 2025 has been revised down multiple times this year, with a cumulative reduction of 350,000 b/d. Current projections call for increases of around 680,000 b/d for 2025 and 700,000 b/d in 2026.

Despite weaker-than-expected consumption in China, India, and Brazil in recent months, annual growth of 600,000 b/d in second-quarter 2025 occurred entirely in non-OECD countries. Consumption in the OECD was flat, with Japan’s demand sinking to multi-decade lows.

Oil supply

On the supply side, global oil output in July held steady at 105.6 million b/d, as a 230,000 b/d drop in OPEC+ production was offset by an equivalent increase in non-OPEC+ volumes. New higher OPEC+ targets set for September are expected to lift global supply growth to 2.5 million b/d in 2025 and 1.9 million b/d in 2026. Of that growth, non-OPEC+ producers will account for 1.3 million b/d and 1 million b/d, respectively.

Additional sanctions could yet curb output from the world’s third- and fifth-largest producers—Russia and Iran. At end-July, the US Department of the Treasury announced its most significant Iran-related sanctions since 2018, aimed at making it harder for Tehran to sell its oil. Washington is also pressing major buyers of Russian crude, particularly India, to scale back purchases.

The European Union (EU) has introduced a ban on imports of oil products refined from Russian crude starting in January 2026 and will lower the price cap for Russian oil on Sept. 3 as part of its 18th sanctions package against Moscow. In contrast, restrictions on Venezuela have been eased, with Chevron Corp. recently granted a new license to operate and export oil.

Refining activity remains robust. Global crude runs are set to approach a record 85.6 million b/d in August, with third-quarter annual growth of 1.6 million b/d far surpassing the first-half 2025 average increase of just 130,000 b/d. Throughputs have been revised up to 83.6 million b/d (+670,000 b/d year-on-year) for 2025 and 84 million b/d (+470,000 b/d) for 2026, supported by stronger-than-expected data from the OECD and China and buoyed by refining margins that reached 15-month highs in July.

Global observed oil inventories rose for the fifth straight month in June, increasing by 28.1 million bbl month-on-month (m-o-m), or almost 900,000 b/d, to reach a 46-month high of 7,836 million bbl. The build was driven by swelling oil-on-water volumes, along with higher Chinese crude and US gas liquids stocks, while most other inventories declined. OECD industry stocks fell by 28.8 million bbl in June, hovering near decade-lows of 2,758 million bbl, which is 88 million bbl below the same month a year earlier.

Oil prices

Benchmark crude prices held steady in July, with North Sea Dated crude trading around $70/bbl as easing trade tensions and tighter sanctions on Russia were balanced against expectations of a well-supplied market. By early August, however, prices fell by $3/bbl to $67/bbl following OPEC+’s announcement that it would fully unwind its 2.2 million b/d voluntary production cuts by September (OGJ Online, Aug. 5, 2025).