EIA forecasts steep drop in Brent crude prices in coming months

Key Highlights

- Global oil inventories are expected to grow more than 2 million b/d in late 2025, leading to lower crude prices.

- OPEC+ and non-OPEC producers are likely to cut production in response to falling prices, moderating inventory growth.

- US gasoline prices are forecasted to decrease by about 6% in 2026, averaging less than $2.90/gal.

- US distillate inventories are projected to hit lowest levels since 2000, driven by higher exports and demand.

- Natural gas prices are set to increase due to stable production and rising LNG exports, reaching over $4.30/MMbtu in 2026.

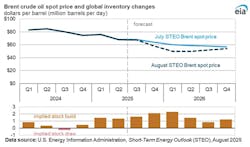

Global oil prices are set to fall sharply in the coming months, according to the Energy Information Administration’s (EIA) latest Short-Term Energy Outlook (STEO). The agency projects Brent crude oil will decline from $71/bbl in July to an average of $58/bbl in fourth-quarter 2025 and around $50/bbl in early 2026.

EIA said the price outlook is driven largely by more oil inventory builds following OPEC+ members’ decision to accelerate the pace of production increases. Global oil inventory builds are now expected to average more than 2 million b/d in fourth-quarter 2025 and first-quarter 2026—0.8 million b/d more than last month’s forecast.

The agency anticipates low early-2026 prices will prompt production cuts from both OPEC+ and some non-OPEC producers, moderating inventory growth later in the year. It now forecasts the Brent crude oil price will average $51/bbl in 2026, down from the $58/bbl projected in July’s STEO.

Meantime, US crude oil production is projected to hit a record near 13.6 million b/d in December 2025 due to gains in well productivity. However, EIA expects falling crude prices to accelerate ongoing reductions in drilling and completion activity, pushing production down to 13.1 million b/d by fourth-quarter 2026. On an annual basis, production is forecast to average 13.4 million b/d in 2025 and 13.3 million b/d in 2026.

Lower crude prices will also weigh on US gasoline prices, which are forecast to average less than $2.90/gal in 2026—about 6% less than in 2025.

EIA projects US distillate inventories will end 2025 at their lowest year-end level since 2000, falling 14% over the year amid stronger exports and higher demand for petroleum-based distillates. Reduced domestic production—tied to lower US refining capacity—and sustained export demand are expected to keep inventories low into 2026, supporting high refining margins throughout the period.

In natural gas markets, EIA expects the Henry Hub spot price to climb from $3.20/MMbtu in July to $3.90/MMbtu in fourth-quarter 2025 and $4.30/MMbtu in 2026. The increase reflects relatively flat production alongside higher US LNG exports.