Crude oil prices stair-stepped lower for the sixth-straight day Apr. 8, 2025, on the heels of the OPEC+ announcement to increase output in September by more than 500,000 b/d and as traders ignore Pres. Trump’s threats of secondary tariffs on entities that purchase Russian oil. Across-the-board declines in crude and refined product inventories could not offset the bearish mindset. WTI’s high was $67.75/bbl Monday, with the low of $62.75 hitting Friday. Brent crude also stayed below $70/bbl, starting at Monday’s high of $69.40/bbl and descending to the weekly low of $65.50 by Friday. The WTI/Brent spread tightened to $3.50. Both grades looked to settle lower week-over-week.

The trade week started on a down note Sunday evening following the OPEC+ announcement that it would increase output next month by 547,000 b/d, more than expected, and finishing the return of the 2.2 million b/d cuts from 2 years ago. Prices saw some support when President Trump demanded that Russia agree to a ceasefire by week’s end or he would order “secondary” tariffs on those buying Russian oil including, India. Given the President’s tendency not to fully follow through with his threats, the market pushed that risk aside. Meanwhile, India has steadfastly committed to continue to buy Urals crude as an important source of energy for their rising economy despite Trump’s imposition of an additional 25% tariff on their imports to the US. However, India’s state-owned refiner, India Oil Co., bought spot cargoes this week from the US, Brazil, and Libya in the event they will have to cut Russian supply. Of course, the flip side of increased tariffs is one of concern regarding economic contraction that the increased costs could cause which is bearish for energy demand.

Reuters is reporting that Chevron has three tankers heading for Venezuela as they have been given permission to restart crude purchases there. The Venezuelan grade is preferred by US refiners who are geared for heavier feedstocks. Meanwhile, Mexico has lifted its ban on hydrofracturing in an effort to combat declining production rates. Argentina’s Vaca Muerta shale play continues to increase the country’s output, which reached 770,000 b/d last month. Nigeria reached 1.8 million b/d in July. And, in a letter to shareholders, Diamondback Energy stated that, at current oil price levels, US shale oil production has likely peaked, and the Permian-focused producer trimmed its 2025 capital expenditures by $100 million.

The US Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude and refined product inventories both fell last week while US production held flat. Refineries ran at their highest level yet this summer.

Initial claims for unemployment benefits were 226,000 last week, higher than expected. Meanwhile, US continuing jobless claims rose 37,000 in the last week of July to 1.97 million, the highest level since November 2021. Orders from US factories fell 4.8% in June, less than the forecasted 4.9%. Despite mostly weak US economic data, all three major US stock indexes were higher on the week as investors eyed interest rate cuts by global central banks which have increased overall monetary supply. The US dollar is lower week-on-week, providing somewhat of a floor for oil prices.

Oil technical analysis

September NYMEX WTI Futures prices are trading below the 8- and 13- and 20-day Moving Averages which have essentially converged with the week’s Low touching on the Lower-Bollinger Band. Volume, shown in the second box, is below the recent average at 230k. The Relative Strength Indicator (RSI), a momentum indicator shown in the 3rd box, is in “slightly-oversold” territory at ”44”. Resistance is now pegged at $64.60 while near-term critical Support is $62.80 (Lower-Bollinger Band limit). The 8-day MA “crossing over” the 13- and 21-day MA is bearish.

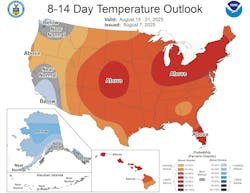

The market will be monitoring developments coming out of a planned meeting between Trump and Vladimir Putin next week. Such talks in the past spurred short-term optimism regarding progress towards peace in the Russia-Ukraine war. Any positive signs emerging from the talks would be bearish for oil in the short-term especially, especially if any tariffs are reduced or lifted. But each day we move closer and closer to the end of the peak driving season demand concerns will reemerge. The National Oceanic and Atmospheric Administration has released its final forecast for the 2025 hurricane season. The agency expects between 13 and 18 named storms of which 5-9 will develop into hurricanes with 2-5 becoming major storms (Cat 3-5). Hurricane season officially ends on Nov. 30, with the peak normally occurring between mid-September and mid-October.

Natural gas

Europe and the UK are experiencing record heat which is driving demand for air conditioning-related power generation and subsequently, higher natural gas consumption. European natural gas prices were most recently quoted at $9.45/MMbtu equivalent as Norway resumed LNG exports from the Hammerfest plant. In the US, September NYMEX Henry Hub futures moved higher early week but slipped later as weather forecasts called for milder temperatures for the latter part of August while demand dropped significantly even as LNG receipts increased. The week’s high of $3.15/MMbtu occurred Thursday with the low of $2.90 on Monday.

US supply last week was down 1.2 bcfd to 111.9 bcfd. Demand fell 7.1 bcfd to 102.5 bcfd, with the biggest decrease coming from power generation. Exports to Mexico were 7.1 bcfd vs. 6.8 bcfd a week earlier. LNG exports were 16.3 bcfd vs. 15.4 bcfd the prior week. The EIA’s Weekly Natural Gas Storage Report indicated an injection of just 7 bcf, below the forecasted 18 bcf and the 5-year average of 29 bcf. Total gas in storage is now 3.13 tcf, 4.2% below last year and 5.9% above the 5-year average. Some analysts are now calling for a season-ending total that will exceed 3.9 tcf.

September 2025 NYMEX Henry Hub Natural Gas futures are around the 8- and 13-day moving averages (MA) but below the 20-day MA. Volume was 98,000 and lower than the recent average. The RSI is “oversold” at 36. Support is pegged at $2.95/MMbtu with resistance at $3.00/MMbtu the next key area if prices are to rebound above that level.

Egypt, which has experienced natural gas shortages recently, has entered into a purchase agreement with one of the partners in Israel’s Leviathan gas field. The deal is estimated to be worth up to $65 billion with a volume of 130 billion cu m to be delivered through 2040. Equinor’s Hammerfest LNG plant, Europe’s largest, is back in operation after a 3-month outage which could lower the continent’s demand for US LNG. Meanwhile, the practicality of the European Union’s (EU) pledge to buy $750 billion of US energy exports over a 3-year span continues to be questioned. The European Commission is soliciting buyers to fulfill this pledge made by the EU on behalf of its members. In the US, near-term weather forecasts look bullish for natural gas-fired generation.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.