Oil, fundamental analysis

Bearish sentiment continues to dominate crude markets this week despite some otherwise bullish signals such as a huge crude inventory draw and the long-awaited US Federal Reserve rate cut. WTI was as low as $62.50/bbl on Monday with its high on Tuesday at $64.75/bbl.

Brent crude hit its low on Friday at $66.45/bbl with its high of $68.70/bbl occurring Tuesday. While Brent has settled lower than the prior week, WTI looks to settle near last week. The WTI/Brent spread has tightened to ($4.20).

Ukraine continues to attack Russian oil-related infrastructure, largely refiners, but also export infrastructure such as the Primorsk terminal. Meanwhile, the EU issued a new package of sanctions on Russia that includes a price cap of $47.60/bbl, a target on 'shadow fleet' vessels. While the former simply lowers the price at which China and India can continue to buy Urals, the latter would have a physical impact on curtailing exports themselves.

Normally, a Federal Reserve rate cut translates into an outlook for future economic growth which cannot happen without an increase in energy consumption, and those markets respond positively. However, thus far, that has not happened with NYMEX crude, natural gas, heating oil, or unleaded gasoline. Weak employment numbers apparently outweighed the positive impact of the Fed’s rate cut this week.

Recent data and analysts’ forecasts portend a crude surplus well into next year.

Additionally, OPEC+ delegates met this week to quantify the group’s production capabilities as they lay out their plans for 2027. Most market observers believe the group will continue to increase output should they determine that production can consistently grow from current levels. Meanwhile, the EIA in its latest Short-Term Energy Outlook (STEO), estimates that total global petroleum and other liquid fuels production will average 105.5 million b/d this year and 106.6 million b/d in 2026 while consumption will average 103.8 million b/d and 105.1 million b/d each year, respectively.

The Trump administration is pressuring NATO members Turkey, Hungary, and Slovakia to end imports of Russian crude. Turkey is the 3rd-largest buyer of Urals after China and India.

The Iraqi government has given preliminary approval for the 230,000 b/d of oil exports from Kurdistan to start flowing again. Final approval would allow the oil to flow after being shut-in since March 2023.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week unexpectedly decreased by 9.3 million bbl to a total of 415 million bbl and 5% below the 5-year average. The SPR was up 500,000 bbl to 405.7 million bbl.

Total US oil production was 13.4 million b/d vs. 13.2 million b/d last year at this time.

Oil, technical analysis

October 2025 WTI NYMEX futures prices are trading right around the 8-, 13- and 20-day Moving Averages. Volume is below the recent average at 40,000 as October settles on Monday and traders turn their focus to November.

The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory at 47. Resistance is now pegged at $63.60 while near-term critical Support is $62.60 (week’s Low). WTI has been in a $4.30/bbl range for 3 weeks now.

Looking ahead

If the US stock market continues its gains, energy prices will get pulled along. Refinery utilization is already declining and will continue to do so as the October turn-around period approaches. Refiners reduce production during the lower consumption periods to perform routine maintenance and switch the seasonal blends.

Traders will be looking for the responses of countries still importing Russian crude as well as, the effectiveness of the new EU sanctions.

Tropical Storm Gabrielle has moved north toward the open waters of the Central Atlantic, removing any threat to the oil and gas infrastructure of the Gulf of Mexico. High pressure systems continue to move down from the mainland and so far, are steering these tropical systems away from the Gulf of Mexico.

Natural gas, fundamental analysis

October NYMEX natural gas futures got a boost early this week on lingering summer heat in areas of the country. However, a larger-than-expected storage injection and the anticipation of fall weather sent prices lower.

Once again, the key $3.00/MMbtu failed to hold. The week’s High was $3.16/MMbtu on Wednesday, the day of the Fed rate cut announcement. The week’s Low was $2.86 on Friday.

Supply last week was -0.4 bcfd to 111.8 bcfd vs. 112.4 the prior week. Demand was -1.1 bcfd to 98.6 bcfd vs. 99.6 bcfd the week prior, with the biggest decreases in the residential sector and exports to Mexico. The power sector was up on the latent summer heat. Exports to Mexico were 7.1 bcfd vs. 7.4 the prior week. LNG exports were 16.0 bcfd vs. 16.1 bcfd the prior week.

Dutch TTF prices dipped slightly to $9.40/MMbtu equivalent on increased wind power and storage levels that are at 80% while Asia’s JKM was quoted at $11.365/MMbtu. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 90 bcf, above the forecasted +78 bcf. Total gas in storage is now 3.433 tcf, rising to just 0.1% below last year and to 6.3% above the 5-year average.

Theoretically, there are just 5 weeks left in the injection season. To achieve a season-ending volume of 3.9 tcf, injections would have to average 93 bcf per week and 113 bcf to reach 4.0 tcf. Given this week’s injection volume, 3.9 tcf looks achievable.

Natural gas, technical analysis

October 2025 NYMEX Henry Hub Natural Gas futures are hovering around the 8-, 13- & 20-day Moving Averages. Volume was 145,000, about equal to the recent average. The RSI is neutral at 44. Support is pegged at $2.90 (Week’s Low) with critical Resistance at $3.00.

Looking ahead

Japan’s leading utility company JERA is reportedly in advanced negotiations with Blackstone-backed GeoSouthern Energy and pipeline firm Williams Companies to buy $1.7 billion worth of natural gas producing assets in the Haynesville basin. This comes on the heels of their announcement last week to back the Alaska LNG project.

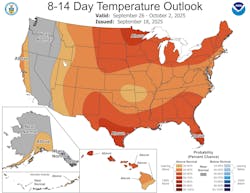

The NOAA 8–14-day forecast indicates a large area of the country will experience above-normal temperatures which could result in A/C demand for gas fired-generation. A similar pattern exists at this time for 3 weeks out. The storage spread for natural gas still exists as October is trading around $2.89/MMbtu while December is $3.80, and January is $4.15.

Those with remaining capacity may take advantage of this spread which will provide price support even with cooler temperatures.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.