Oil, fundamental analysis

Crude prices hovered in a tight $2.30/bbl range this week as indecision on direction led to consolidation. The market ebbed and flowed with bearish fundamentals pitted against bullish geopolitical events. Attacks, and threats of more sanctions, were pitted against output increases and an across-the-board crude and product inventory build in establishing price direction. Ultimately, the bulls won out.

WTI was as low as $61.70/bbl on Friday with its high on Wednesday at $64.10. Brent crude also hit its high on Friday at $68.15/bbl but its low was Monday at $65.50/bbl. Both grades settled higher than last week’s levels while the WTI/Brent spread has widened to ($4.55).

Prices fell Monday after the OPEC+ group’s Sunday decision to increase output by 137,000 b/d next month. However, given the smaller volume than the previous increases and, the fact that historically, the group has failed to meet the new quotas, the market actually closed higher than the previous Friday.

Tuesday’s Israeli attack on Hamas targets in the heart of Qatar sent prices rallying while Russia’s violation of Poland’s airspace only added more geopolitical drama to the week. The drones were shot down by NATO planes.

This week, the UK put sanctions on those who are shipping Russian crude to effectuate an actual curtailment of the flow of Urals to other countries. While Ukraine has attacked various oil 'infrastructure' sites in Russia, they have thus far not impacted supply or demand to a great extent. However, the recent drone attack on the Baltic Sea port of Primorsk, a key oil tanker loading facility, could hamper Russian exports.

The International Energy Agency (IEA) in Paris raised its forecast for the growth in global oil demand by 60,000 b/d to 740,000 b/d this year. However, the agency also increased its supply forecast for this year by 200,000 b/d to 2.7 million b/d and to 2.1 million b/d next year.

Always 'talking its book,' Saudi Arabia believes global demand will increase by 2.0 million b/d in second-half 2025. The Kingdom is also projected to increase its September exports by as much as 500,000 b/d since its own summer demand has lessened.

The consumer price index (CPI) for August came in at 2.9%, up from July’s 2.7%. It was within expectations as analysts expected it to show that businesses are passing on the increased costs of import tariffs. Core inflation, removing energy and food, rose 3.1% alone (grocery prices rose 0.6% from August). Filings for unemployment benefits rose last week to the highest level since October 2021.

Again, the numbers leave the Federal Reserve with a dilemma. Leave interest rates where they are with this sign of increasing inflation or look at the labor numbers and lower rates in the hopes of stimulating growth. Oil prices will gain support with the former choice whereas, economic concerns with the latter could send prices lower.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased while total US oil production was 13.5 million b/d vs. 13.3 last year at this time. The Strategic Petroleum Reserve was up 780,0000 bbl to 404 million bbl.

The inflation report and employment numbers were weighing on the three major US stock indexes Friday after the record highs posted Thursday. However, all three are higher week-on-week. The USD is lower on the week which supportive for crude.

Oil, technical analysis

October 2025 WTI NYMEX futures prices are trading above and below the 8-, 13- and 20-day Moving Averages. Volume is around the recent average at 280,000. The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory at 46. Resistance is now pegged at $64.00 while near-term critical Support is $62.85 (8-day MA).

Looking ahead

The US is said to be pressuring the EU to impose sanctions on China and India for their continued purchases of Russian oil. Israel’s attack in Doha is only adding to the geopolitical unrest in the region as it spills into yet another country. We are starting to see inventory builds as a result of the end of the driving season. Traders will be watching for the financial market’s reaction to the inflation report. Another tropical system has moved off of the west coast of Africa and is being monitored for further development.

Natural gas, fundamental analysis

October NYMEX natural gas futures moved lower this week on a daily basis and failed to hold above the key $3.00/MMbtu level despite the rise in European LNG prices after the Israeli attack on Qatar, the world’s No 3 LNG exporter. Another healthy injection pressured prices as we head into the fall shoulder demand period.

The week’s High was $3.20 /MMbtu on Monday, descending to the week’s Low of $2.90 by Friday. Supply last week was -0.1 bcfd to 112.3 bcfd vs. 112.4 the prior week. Demand was -0.4 bcfd to 99.5 bcfd vs. 99.9 bcfd the week prior, with the biggest decrease in the power sector. Exports to Mexico were 7.1 bcfd vs. 7.4 the prior week. LNG exports were 16.0 bcfd vs. 16.1 bcfd the prior week. Dutch TTF prices have risen slightly to $9.60/MMbtu equivalent while Asia’s JKM was quoted at $11.35/MMbtu which also rose on the Qatari situation.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 71 bcf, above the forecasted +69 bcf. Total gas in storage is now 3.343 tcf, dipping to -1.1% below last year and to +6.0% above the 5-year average. Theoretically, there are just six weeks left in the injection season. To achieve a season-ending volume of 3.9 tcf, injections would have to average 93 bcf/week to hit 3.9 tcf and +109 bcf to reach 4.0 tcf.

Natural gas, technical analysis

October 2025 NYMEX Henry Hub Natural Gas futures are hovering around the 8-, 13- & 20-day Moving Averages. Volume was 145,000 and about the recent average. The RSI is neutral at 44. Support is pegged at $2.90 (Week’s Low) with critical Resistance at $3.00.

Looking ahead

US Energy Secretary Chris Wright is encouraging the EU to phase out its use of Russian natural gas supplies stating this could be accomplished within 6 to 12 months with the help of US LNG exporters. The only issue is whether or not the US will have the additional export capacity online within that timeframe as it is currently 'maxed-out.

Japanese power company, JERA, signed a 20-year agreement to purchase LNG from the proposed $44-billion Alaska LNG project despite the controversy surrounding its cost.

Meanwhile, Canada’s new leadership wants to fast-track LNG projects including Phase 2 of LNG Canada which would result in the world’s seond-largest LNG plant.

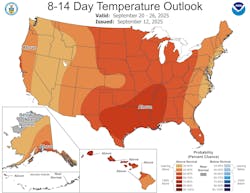

The NOAA 8-14 day forecast indicates a large area of the country will experience below-normal temperatures for much of the Eastern Seaboard in the near-term. Two weeks out, however, a large section of the country could see above-normal temperatures that could result in A/C demand for gas fired-generation.

The Tropics bear watching for natural gas as well. The 'storage spread' for natural gas still exists as October is trading around $2.95/MMbtu while December is $3.80, and January is $4.10. Those with remaining capacity may take advantage of this spread which will provide price support even with cooler temperatures.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.