Geopolitical risk factor in crude oil markets continues to ebb and flow

Oil, fundamental analysis

Following last week’s Trump-Putin meeting in Alaska, the geopolitical risk factor in crude markets has ebbed and flowed. First reactions were positive, i.e., bearish for prices with the prospect of sanctions on Russian crude being lifted.

The Trump-Zelenski meeting this week was viewed in a similar fashion. However, with no ceasefire accomplished and a proposed Putin-Zelenski meeting up-in-the-air, it was back to 'risk on' for traders, although to a lesser extent.

An unexpectedly large drop in crude inventories helped boost prices. A new consolidation pattern has emerged which always signals market direction uncertainty. Friday’s WTI range for October 2025 was a scant $0.65 Hi/Lo. WTI’s High was $63.95/bbl on Friday, which was still lower than the prior week’s High. The Low of $62.20 hit on Monday.

In similar fashion, Brent crude marked its High of $67.50/bbl on Friday, hitting its weekly Low of $64.95 on Monday.

The WTI/Brent spread has widened to ($4.20). Both grades look to settle up slightly week-over-week.

Many conciliatory conversations have taken place among the presidents of the US, Ukraine, and Russia, but nothing concrete has yet emerged to signal a ceasefire or any semblance of a peace initiative. Both the US and European countries have pledged support and “security guarantees” for Ukraine; however, there have been no specific details.

Pres. Trump is pushing for a Putin-Zelenski summit where he may/may not be a participant. Meanwhile, Russia has indicated that any talks regarding such security guarantees for Ukraine must include them or those conversations will be useless.

But India continues to purchase Russian Urals despite the threats of increased tariffs of up to +25% on its exports to the US. In turn, Russia is now offering discounts to India to incentivize continued buying.

A new proposed trade pact between the US and the EU has added some element of positivism towards global economic growth which is also supportive of higher future energy demand. However, the new agreement with the EU will still retain the current 27.5% tariff on autos exported to the US.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week decreased while oil production held at 13.4 million b/d and a small amount was added to the Strategic Petroleum Reserve.

Oil, technical analysis

October 2025 WTI NYMEX futures moved into the “prompt” month this week as September settled. Prices are trading below the 20-day Moving Average but above the 8- and 10-day MAs.

Volume is below the recent average at 160,000. The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory at 50. Resistance is now pegged at $64.17 (20-day MA) while near-term critical Support is $63.50 (the next key level on the downside). The 8-day MA “crossing over” the 13-day MA is bullish.

Looking ahead

While the Russia-Ukraine war seemed to take center stage this week, traders have to still monitor the Israel/Hamas situation along with US/Iran. As a result, geopolitical risk will remain a factor. To what extent that impacts prices will depend on the progress or lack of progress, in all of these situations.

Next month will not only bring the end to the summer driving/vacation season but will also mark the return of 500,000 b/d of OPEC+ crude supply.

A new tropical wave 100 miles ENE of the Leeward Islands bears watching according to the National Hurricane Center with further development expected over the weekend and into next week as we enter the peak of hurricane season in September.

Natural gas, fundamental analysis

Despite the occasional rally, Henry Hub NYMEX Natural Gas Futures have been in a steady 2-month downtrend. Prices hit $4.15/MMbtu on June 23, 2025, and are currently at their lowest point since at $$2.70/MMbtu.

Above-average storage volumes and a cooler start to September continue to pressure prices. The week’s High was $2.92 /MMbtu on Monday with the week’s Low of $2.698 on Friday.

Supply last week was +0.5 bcfd to 112.6 bcfd vs. 112.1 the prior week. Demand was -1.3 bcfd to 106.1 bcf vs. 107.4 bcfd the week prior, with the biggest decrease in LNG exports.

Exports to Mexico were 7.3 bcfd vs. 7.5 the prior week. LNG exports were 15.5 bcfd vs. 16.8 bcfd the prior week. Dutch TTF prices, which fell in the days ahead of the Trump-Putin summit, have reversed course and are up about 4.0% this week to $9.85/MMbtu equivalent while Asia’s JKM was quoted at $11.55/MMbtu.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 13 bcf, below the forecasted +25 bcf and the 5-year average of +33 bcf. Total gas in storage is now 3.199 tcf, dipping to 2.9% below last year and to 5.8% above the 5-year average.

Some analysts are now calling for a season-ending total that will exceed 3.9 tcf while the EIA is projecting 3.87 tcf, which would be 2% above the 5-year average.

Thus far during the injection season, total volumes have consistently been above the 5-year averages.

Natural gas, technical analysis

September 2025 NYMEX Henry Hub Natural Gas futures are below the 8-, 13, and 20-day Moving Averages and approaching the Lower-Bollinger Band limit at $2.68. Volume was 55k and lower than the recent average as September closes next week. The RSI is oversold at 33. Critical Support is pegged at $2.68 with Resistance at $2.82 (8-day MA) as the next key area if prices are to rebound above that level.

Looking ahead

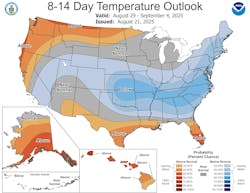

While the last week in August looks favorable for A/C power demand, the NOAA 8-14 day forecast indicates a large area of the country will experience below-normal temperatures for the first week in September. The Tropics bear watching for natural gas as well. If we continue to have a an above-average level of stored gas heading into the fall, prices will be hard to find support until winter.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.