IEA: Global gas demand growth to accelerate in 2026 after slowdown in 2025

Following an expected slowdown in 2025, global natural gas demand growth is forecast to accelerate in 2026, sending total demand to a new all-time high, the International Energy Agency (IEA) said in its latest quarterly Gas Market Report.

Global natural gas demand returned to structural growth in 2024 and continued to expand in first-half 2025, albeit at a markedly slower pace, the report noted. Overall, global natural gas demand growth is forecast to slow to about 1.3% in 2025 from 2.8% in 2024.

Growth was primarily concentrated in Europe and North America, with adverse weather leading to stronger gas use in the buildings and power sectors. In contrast, gas demand was subdued in Asia, with both China and India recording demand declines in first-half 2025, according to the report.

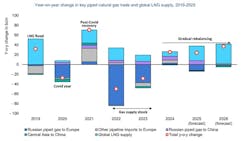

Market fundamentals remained tight in first-half 2025 due to a combination of lower Russian piped gas exports to the European Union (EU), slower growth in LNG output, and higher storage injection needs in Europe. This supported higher natural gas prices in key import markets and weighed on natural gas demand in Asia.

Meanwhile, geopolitical tensions continued to fuel price volatility. The conflict between Israel and Iran was a stark reminder that geopolitical factors can easily strain a fragile global gas balance, IEA said.

However, the report predicts that global demand growth will resume in 2026, accelerating to around 2%, driven by a significant rise in LNG supply that will improve market fundamentals and stimulate stronger demand growth in Asia. In 2026, LNG supply is set to rise by 7%, or 40 bcm—its largest increase since 2019—as new projects come online in the US, Canada, and Qatar.

Gas consumption by industry and by the energy sector is forecast to contribute to around half of incremental gas demand, IEA said. Gas-to-power demand is projected to account for 30% of demand growth in 2026, while gas use in the residential and commercial sectors is expected to increase by around 1%, assuming average weather conditions.

Driven by recovering gas use in both the power and industrial sectors amid rising overall energy needs, moderating prices and improving macroeconomic conditions, Asia’s gas demand is expected to rise by more than 4% in 2026, accounting for around half of global gas demand growth. “Consequently, the region’s LNG imports are projected to increase by 10% in 2026 following an expected decline in 2025,” IEA said.

In Eurasia, gas consumption is forecast to increase by 2%, while combined demand in Africa and the Middle East is forecast to increase by 3.5%. In North America, natural gas demand is expected to increase by less than 1%, primarily supported by the power sector.

In Central and South America, natural gas use is projected to marginally decline amid higher renewables output. Gas demand in Europe is set to decline by 2%, also amid stronger renewables output.

“However, our latest forecast is subject to unusually high levels of uncertainty over the global macroeconomic outlook and the volatile geopolitical environment,” said Keisuke Sadamori, IEA Director of Energy Markets and Security.