Mixed signals lead to consolidated oil price range

Oil, fundamental analysis

Multiple factors over the past 2 weeks of crude trading have resulted in a $4.00/bbl Hi/Lo price range. Increased oil demand forecasts, along with the existing sanctions on Iran’s exports, provided some upward support while inventory gains, OPEC+’s possible July output increase, and US President Trump’s new tariff threat aimed at the EU, all resulted in lower prices at week’s end.

NYMEX July WTI futures contracts have wavered between $60/bbl and $64/bbl for the past 10 trading sessions. Such consolidation indicates an uncertainty as to market direction. WTI’s High for the week was Wednesday’s $64.20/bbl which stopped just below the Upper-Bollinger Band limit. The Low was Friday’s $60.02. Brent North Sea crude, in similar fashion, had a High of $66.65 and a Low of $63.30 on Wednesday and Friday, respectively. Both grades are lower week-on-week while the Brent/WTI spread is currently ($3.20).

The US-Iran talks appear to have reached an impasse this week despite a more optimistic outlook last week. Iran is adamant about continuing its nuclear fuel enrichment program. The sanctions on Iranian oil exports are providing some support for crude prices although, minimal. Rumors of a pending Israeli attack on Iran spiked oil prices briefly on Wednesday but the rally was quickly subdued on news of across-the-board inventory builds in the US.

Citing a lack of progress in trade talks, President Trump is threatening the EU with new tariffs of up to 50% on imports. Equity markets fell on the news, dragging oil lower with them as his comments spurred a new round of macroeconomic concerns. Additionally, conflicting signals regarding Venezuela’s oil production are coming out of the administration. US Special Envoy Richard Grenell announced a 60-day extension for Chevron’s operating license while Secretary of State Marco Rubio stated the sanctions waiver will expire on May 27. On another note, the US has told the EU it does not support the further lowering of the price cap on Russian Urals to $50/bbl from the current $60/bbl level. India has been the largest importer of Russian crude.

Goldman Sachs analysts raised their global oil demand forecasts by 600,000 b/d this year and +400,000 in 2026. Meanwhile, OPEC+ will meet on June 1 to consider another output increase of 411,000k b/d beginning in July.

The National Oceanic and Atmospheric Administration issued its preliminary forecast for the upcoming US hurricane season, indicating 13-19 named storms, 6-10 to become hurricane force, with 3-5 of those resulting in major hurricanes. The annual hurricane season begins June 1 and ends Nov. 20.

The Energy Information Administration (EIA)’s Weekly Petroleum Status Report indicated that commercial crude oil inventories and refined products stocks both increased last week. The SPR gained 1.3 million bbl to 400.5 million bbl.

The Conference Board’s Leading Economic Indicator fell by 1.0% last month, the fifth monthly decline and the steepest drop since March 2023. Additionally, the Consumer Sentiment Index dropped to 50.8 in April. It was also the fifth-consecutive monthly drop and was the second-lowest reading on record. All 3 major US stock indexes have moved lower week-on-week mainly on the tariff threats against the EU and Apple. The USD was also lower but did not provide support for oil prices.

Oil, technical analysis

July NYMEX WTI Futures are hovering around the 8- and 13- and 20-day Moving Averages this week. A movement above the Upper-Bollinger Band limit failed, sending prices lower. Volume, is about average at 250,000. The Relative Strength Indicator (RSI), a momentum indicator, is neutral at 50. Resistance is now pegged at the critical $61.80 (8-day MA) mark with near-term Support at $60.40 (20-day MA).

Looking ahead

A lot of bullish sentiment exited the markets this week on the prospect of the OPEC+ pending output increased as well as the newfound concerns over Pres. Trump’s latest salvo in the global trade wars. Refined product inventory gains this week were minute and US refiners will need to up their utilization factors to replenish stocks of refined products. Memorial Day Weekend, the official kick-off for the summer driving season is upon us. It has yet to be seen what the vacation travel preferences are for the majority of Americans in terms of flying or driving. With gasoline prices down from last year at this time, many may choose the latter. It is time to start watching tropical forecasts for the potential for any developing systems to enter the Gulf of Mexico.

Natural gas, fundamental analysis

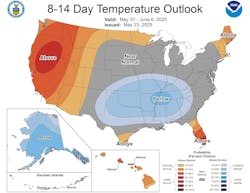

June natural gas futures spiked on Tuesday when forecasts called for warming temperatures moving into a large section of the country. However, another triple-digit storage injection took the air out of that rally. The week’s High of $3.51/MMbtu occurred Wednesday with the week’s Low of $3.10 set Monday.

Supply last week was up 1.4 bcfd to 111.8 bcfd vs. 110.4 the prior week. Demand was up 4.0 bcfd to 98.2 bcfd vs. 94.2 bcfd the week prior, with the biggest gains in power and residential consumption.

Exports to Mexico were 7.5 bcfd (the highest in several months) vs. 7.1 the prior week. LNG exports were 15.6 bcfd vs. 15.9 bcfd the prior week. European gas prices were most recently higher at $10.75/MMbtu as the EU must now compete with Asian markets for US shipment of LNG.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 120 bcf, above the forecasted 119 bcf increase and a 5-year average of +87 bcf. Total gas in storage is now 2.375 tcf, rising to 12.3% below last year and to 3.9% above the 5-year average.

Natural gas, technical analysis

June 2025 NYMEX Henry Hub Natural Gas futures have fallen below the 8- and 13-day Moving Averages to around the 20-day MA this week. Volume was 60,000 and lower than the recent average as the June contract expires next Wednesday. The RSI is neutral at 47. Support is pegged at $3.20 with Resistance at $3.45 (convergence of 13- and 20-day MAs).

Looking ahead

Egypt is soliciting bids for up to 60 cargoes of LNG to prepare for summer power generation loads. As the most populous Arab country, Egypt became a net importer of natural gas last year. Rolling blackouts have plagued their grid over the past few summers. Natural gas prices in Europe were most recently quoted at $10.75/MMbtu. Demand for US power generation looks very weak over the next two weeks except for areas in the SW and NW but storage refills should continue to grow. Should the triple-digit storage injections continue in the US, prices could fall on the perception of surplus production.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.