Tariff deal raises oil prices despite inventory build

Oil, fundamental analysis

A pending US-China tariff deal sent equities higher this week with the economic optimism spilling over into oil markets despite a large crude inventory gain and optimism regarding US-Iran nuclear talks. Refined product draws also added some bullish sentiment.

WTI’s High for the week was Tuesday’s $63.90/bl. while the Low was Thursday’s $60.47. Brent North Sea crude, in similar fashion, had a High of $66.80 and a Low of $63.45 on Tuesday and Thursday, respectively. Both grades are higher week-on-week while the Brent/WTI spread is currently ($3.70).

Early in the week, trade discussions between the US and China resulted in a mutual 90-day suspension of the recently-imposed huge bi-lateral tariff increases. Global markets reacted favorably but remain wary until a definitive deal is worked out. Late week talks of progress being made in the on-again/off-again US/Iran nuclear talks reignited the prospect of increasing output there should the US lift the current sanctions. However, the US Treasury Department just imposed tighter sanctions on the sales of Iranian crude.

The International Energy Agency (IEA), for the first time in several months, increased projections for oil growth of 740,000 b/d this year from 726,000 b/d citing lower oil prices and a potentially less severe impact of US tariffs. However, IEA also is forecasting global oil supply to rise by 1.6 million b/d this year and by 970,000 b/d in 2026. While the agency foresees the increases coming from China, Brazil, and Canada, US shale is expected to decline next year due to lower prices. OPEC, meanwhile, is holding steady its demand growth forecast to +1.3 million b/d.

China did increase oil imports over the last 2 months, sending a possible demand increase signal to the market. However, the majority of the purchases were for inventory purposes as prices dipped and concerns regarding sanctions on Russian and Iranian crude led to supply worries. And it turns out, OPEC+’s actual output increase for April was a mere 25,000 b/d, far below the announced increase of over 110,000 b/d.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories last week increased while refined product levels decreased. The SPR gained 600,000 bbl to 399.7 million bbl. Total US oil production held at 13.4 million b/d vs. 13.1 last year at this time.

Inflation cooled last month to 2.3% on an annual basis and was in line with expectations as well as the lowest reading since 2021, which also helped spark the stock market rally. The number of applications for unemployment benefits was unchanged last week at 229,000. All three major US stock indexes have moved higher week-on-week mainly on the tariff pause. The USD is also higher, which could cap any gains made in crude prices.

Oil, technical analysis

June NYMEX WTI Futures have rebounded to above the 8- and 13- and 20-day Moving Averages this week. Volume is 65,000, which is much lower than the recent average as traders start to focus on the July contract as June expires next week. The Relative Strength Indicator (RSI), a momentum indicator, is “neutral” at ”51”. Resistance is now pegged at the critical $64.00 mark with near-term Support at $61.10 (20-day MA).

Looking ahead

At the moment, there appears to be more bullish sentiment in the market than bearish. The US-China temporary tariff reprieves, low refined product inventories heading into summer, tighter sanctions on Iranian oil, and OPEC+ not increasing output as expected, all point to supply issues. US refiners will need to up utilization factors soon to meet Memorial Day Weekend demand and to start to replenish stocks of refined products. The increase in product exports is making the latter more difficult.

Natural gas, fundamental analysis

Last week, June natural gas breached the Upper-Bollinger Band limit, a technical “Sell” signal. Without air-conditioning loads occurring in most of the country, and with a triple-digit storage injection, natural gas futures faltered this week, dropping lower each day.

The week’s High of $3.85/MMbtu occurred Monday with the week’s Low of $3.30 set Friday. Supply last week was +0.4 bcfd to 110.4 bcfd vs. 111.0 the prior week. Demand was -0.4 bcfd to 94.4 bcfd vs. 94.8 bcfd the week prior, with the biggest drop in residential consumption on milder weather.

Exports to Mexico were 7.0 bcfd (the highest in several months) vs. 6.8 the prior week. LNG exports were 15.9 bcfd vs. 15.1 bcfd the prior week. European gas prices were most recently higher at $10.20/MMbtu. The EU must now compete with Asian markets for US shipment of LNG. The EIA’s Weekly Natural Gas Storage Report indicated an injection of 110 bcf, above the forecasted +101 bcf. Total gas in storage is now 2.26 tcf, rising to 14.3% below last year and to 2.6% above the 5-year average.

Natural gas, technical analysis

June 2025 NYMEX Henry Hub Natural Gas futures have fallen below the 8- and 13-day Moving Averages to around the 20-day MA this week. Volume was 101,000 and lower than the recent average. The RSI has moved out of “neutral” territory to “42” on this week’s selling. Support is pegged at $3.30 (Friday’s Low) with Resistance at $3.50 (Thursday’s High).

Looking ahead

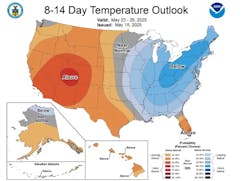

Demand for power generation looks weak over the next 2 weeks but storage refills should continue to grow. Additionally, global demand for LNG for storage should also provide support for pricing. Should the triple-digit storage injections continue in the US, prices could fall on the perception of surplus production.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.