EIA further cuts oil price forecast

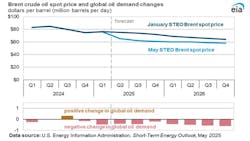

In its May issue Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) expects crude oil prices to fall over much of the forecast period.

Brent crude oil spot prices averaged $68/bbl in April, down $5 from March, marking the third consecutive monthly decline. The drop was largely driven by weakening global demand expectations following the introduction of new tariffs from the US and its major trading partners. Adding further pressure, OPEC+ reaffirmed and accelerated its planned production increases in April, fueling concerns about rising global inventories.

In EIA’s forecast, increasing oil production outpaces annual oil demand growth, which rises by around 1.0 million b/d in both 2025 and 2026, leading to the accumulation of oil inventories globally. The rising inventories will result in the Brent price averaging $62/bbl in second-half 2025 and falling to $59/bbl next year. That compares with last month's forecast for an average oil price of $68/bbl in 2025 and $61/bbl in 2026.

“We anticipate that global oil inventories will start to increase in 2025, growing 0.5 million b/d on average in second-quarter 2025 before increasing by 0.7 million b/d in fourth-quarter 25. We expect global oil inventories to grow on average by 0.4 million b/d in 2025 and accelerate to 0.8 million b/d on average in 2026,” EIA said.

However, significant uncertainty remains in EIA’s price forecast. “The effect that new or additional tariffs will have on global economic activity and associated oil demand is still highly uncertain and could weigh heavily on oil prices going forward. The implementation of energy-sector sanctions on Russia and Iran as well as the wind down of Chevron’s Venezuela oil exports have increased uncertainty in the short term while markets and trade patterns adjust. In addition, the pace at which OPEC+ decides to unwind production cuts and the level of adherence to announced production targets continues to evolve," EIA said.

Global oil supply, consumption

EIA forecasts global liquid fuels production will increase by 1.3-1.4 million b/d in both 2025 and 2026 led by production growth in countries outside of OPEC+.

EIA noted modeling and analysis for this forecast was completed before OPEC+ announced May 3 that it would raise production in June. “Although we expect OPEC+ to increase production somewhat in the coming months, we expect OPEC+ production to remain below the current target path,” EIA said.

EIA expect crude oil production growth of 0.1 million b/d in 2025 from OPEC+, compared with a decrease of 1.4 million b/d in 2024, before increasing by 0.6 million b/d in 2026.

Production growth in the forecast is to be led by countries outside of OPEC+, increasing by 1.2 million b/d in 2025 and by 0.6 million b/d in 2026. EIA expects the US, Canada, Brazil, and Guyana will drive production growth over the forecast period.

Forecast global liquid fuels consumption is expected to increase by 1.0 million b/d in 2025 and 0.9 million b/d in 2026, 0.4 million b/d and 0.1 million b/d lower than forecast in EIA’s January STEO, respectively.

“We expect India will increase its consumption of liquid fuels by 0.2 million b/d in 2025 and 0.3 million b/d in 2026, compared with an increase of 0.2 million in 2024, driven by rising demand for transportation fuels. We forecast China’s liquid fuels consumption will grow by 0.2 million b/d in both 2025 and 2026," EIA said.

US ethane markets

In late April, China waived a retaliatory 125% tariff on imports of US ethane that had been levied earlier in the month.

“With that tariff no longer in place, we continue to expect strong growth in US ethane production and exports in our forecast. We forecast the US will produce 2.9 million b/d of ethane this year and 3.1 million b/d next year, up from 2.8 million b/d in 2024. Most of this growth in ethane production will be exported to supply growing international demand,” EIA said.

US natural gas

The Henry Hub spot price fell to $3.44/MMbtu in April, down 68¢/MMbtu from the March average. The price decrease was primarily driven by relatively warm weather in March and early April, which led to higher-than-expected levels of natural gas injections into storage.

“We expect natural gas prices will rise in the coming months as the US exports more LNG and demand for natural gas from the electric power sector increases seasonally. We forecast the Henry Hub spot price will average nearly $4.20/MMbtu in the third quarter of 2025,” EIA said.

High natural gas prices are contributing to EIA’s expectation of less natural gas use in the electric power sector on average this year compared with last year.