Dallas Fed survey: Uncertainty climbs but E&P spending plans holding up

A survey tracking oil and gas activity and sentiment in Texas and adjoining areas ticked down this quarter but the mood among leaders remains relatively neutral—and the number of exploration and production (E&P) firms planning to ramp up spending in the coming year barely budged from late spring.

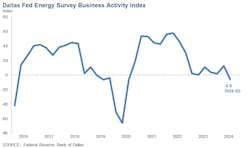

The Dallas Fed Energy’s headline index of business activity in its footprint (which covers parts of New Mexico and Louisiana as well as the Lone Star State) fell to -5.9 from 12.5 in the second quarter, retreating below the near-zero reading from early this year. The roughly 140 E&P and service-firm executives who responded to Fed researchers in mid-September also turned negative in their outlook and said uncertainty has picked up significantly since June (OGJ Online, June 26, 2024).

With 57% of respondents saying things have become more uncertain but only 9% indicating the opposite, that index doubled from the second quarter and is now at its highest since early 2023. As in several other industries, that rising level of uncertainty—about both the economic outlook and the upcoming presidential election—is leading some to put off certain investment decisions.

“Recent volatility has started to impact planning discussions for 2025,” one respondent told the Fed. “We have not adjusted our plan yet, but we are starting to work on potential drilling plans for a lower-commodity environment.”

Said another executive: “The oil community prefers to await the allocation of capital until after the election.”

Also trending down in this year's third-quarter report are employee hours worked, capital spending, and—more slightly—supplier delivery times. But noteworthy among E&P firms is that, despite some short-term delays, outlook for capex over the next year slipped only slightly and remains firmly in positive territory. About 36% of executives said they plan to increase spending over the next 12 months, in line with the second-quarter level, while the number of respondents saying they’ll spend less rose to 24% from 19%.

Three other takeaways from the report:

- Nearly 35% of respondents think the price for a bbl of West Texas Intermediate crude oil will be in the low $70s, barely changed from where it was trading during the survey window. Another roughly 30% expect the price to climb to between $75 and $80 by yearend.

- Cost pressures, whether from labor, leases or development costs, have been easing slightly for E&P companies.

- Likely as a result of easing cost pressures, leaders of support services firms are more pessimistic about the state of business today. Sentiments about equipment utilization and operating margins have taken notable dives since June.

To read the full third-quarter Dallas Fed Energy Survey, click here.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.