EIA: historical data revisions lead to higher oil consumption forecasts

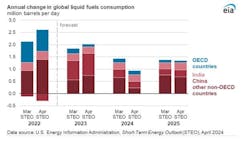

In the April issue Short-Term Energy Outlook (STEO), the US Energy Information Administration (EIA) revised the 2022 global liquid fuels consumption data in its International Energy Statistics, increasing its assessment of global oil consumption that year by nearly 800,000 b/d compared with last month’s STEO. Most of this change reflects non-OECD consumption that is higher than EIA previously estimated.

The higher baseline historical data for 2022 in turn increased EIA’s estimate of consumption in 2023 and forecasts for 2024 and 2025.

“We now estimate that global liquid fuels consumption averaged 102 million b/d in 2023, a 2 million b/d increase from 2022 and about 1 million b/d higher than in last month’s STEO. Global liquid fuels consumption in our forecast now averages 102.9 million b/d in 2024 and 104.3 million b/d in 2025, which is between 400,000 b/d and 500,000 b/d more in both years than in last month’s STEO. Year-over-year forecast consumption growth in 2025 is largely unchanged compared with the March STEO,” EIA said.

“Although the revisions to historical consumption resulted in more forecast petroleum consumption, they also decreased demand growth in 2024 compared with our previous STEO. However, the sources of growth remain the same; non-OECD Asian countries—particularly China and India—drive global liquid fuels demand growth in our forecast, although we also expect significant growth in the Middle East and the US," EIA added.

EIA now forecasts the Brent crude oil spot price will average $90/bbl in second-quarter 2024, $2/bbl more than the March STEO, and average $89/bbl in 2024. This increase reflects EIA’s expectation of strong global oil inventory draws during this quarter and ongoing geopolitical risks.

“Oil prices continued to increase in March as a result of heightened geopolitical risk related to the attacks targeting commercial ships transiting the Red Sea shipping channel and general elevated tensions around the region. In addition, the recent extension of OPEC+ voluntary production cuts add to upward price pressure right at a time of the year when oil demand typically increases because of the spring and summer driving seasons in the Northern Hemisphere,” EIA said.

EIA forecasts oil inventories will begin increasing in 2025 as OPEC+ production is assumed to increase when OPEC+ supply cuts expire. EIA forecasts global oil inventories to increase by an average 400,000 b/d in 2025, which will put downward pressure on prices.

Global production of liquid fuels is projected to rise by more than 800,000 b/d in 2024, a slowdown from the 1.8 million b/d increase seen in 2023. This deceleration is a result of OPEC+ voluntary production cuts, countered by supply expansion outside of OPEC+.

While OPEC+ crude oil production in 2024 is expected to drop by 900,000 b/d from the previous year, production outside of OPEC+ is set to increase by 1.8 million b/d, notably led by the US, Guyana, Brazil, and Canada. In 2025, global liquid fuels production in the projection is set to increase by 2 million b/d, reflecting the expiration of the OPEC+ production cuts and the ongoing supply growth outside of OPEC+.