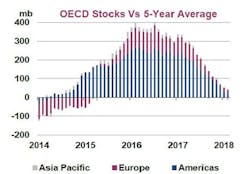

IEA: OECD stocks will possibly fall below 5-year average soon

With crude oil markets expected to tighten, commercial stocks of the Organization for Economic Cooperation and Development (OECD) will possibly have reached or even fallen below the 5-year average target when such data are available in the next month or so. This is according to the International Energy Agency’s monthly Oil Market Report for April.

According to IEA data, OECD stocks declined in February by 26 million bbl to stand at 2.84 billion bbl, higher than the 5-year average by just 30 million bbl. Preliminary data indicate that stockpiles will fall to the 5-year average level by May. Stockpiles of refined products already have fallen below the 5-year average.

“With under half of global oil supply subject to restraint and oil demand growing steadily, the impact on stocks has been substantial. The text of Vienna agreement notes that OECD and non-OECD stocks were above the 5-year average and states that they should fall to ‘normal’ levels…. It is not for us to declare on behalf of the Vienna agreement countries that it is ‘mission accomplished,’ but if our outlook is accurate, it certainly look very much like it,” IEA said.

Noticeably, uncertainty in Syria and Yemen have helped propel the price of Brent crude oil back above $70/bbl in recent days. In the meantime, IEA’s overall view of global demand and supply growth in 2018 is unchanged from last month.

IEA expects global oil demand to rise by 1.5 million b/d this year, supported by positive economic outlook and unchanged from last month’s report.

Early in 2018, stronger demand growth in the US was partially offset by weaker growth in China. India has seen a strong start to the year. However, the trade dispute between the US and China is introducing a downward risk to the forecast, IEA said.

On the supply side, according to IEA data, global crude supplies fell by 120,000 b/d in March to 97.8 million b/d. The modest decline was due to higher US production that offset a further cut to the production of the Organization of Petroleum Exporting Countries.

Scheduled maintenance, unplanned declines and tighter supply discipline cut OPEC crude oil production by 200,000 b/d in March to 31.83 million b/d, down 70,000 b/d on the previous year.

Further losses in Venezuela pushed crude oil supply 580,000 b/d blow its OPEC target. Saudi Arabia pushed output even further below its agreed supply target to 9.92 million b/d in March.

Non-OPEC oil supply inched up by 80,000 b/d in March to 59.1 million b/d, 1.4 million b/d higher than a year ago. Higher US supplies, and, to a lesser extent, increased output in Brazil, Peru and Ghana, offset declines in Canada and Mexico.

IEA expects 2018 supply growth from non-OPEC countries to rise by 1.8 million b/d, more than double the 700,000 b/d growth in 2017, as US LTO ramps up further and new projects come online in Brazil, Canada and the UK. US production is expected to surpass 10 million b/d this year.