Oil price outlook may be more resilient than expected

Is the oil market emulating Chicken Little with regards to the Organization of Petroleum Exporting Countries and oil prices? Every day lately, it seems that OPEC officials find themselves spin-doctoring the latest bobble in oil prices as a sign that the group may or may not cut production at its upcoming ministerial meeting.

A recent column in this space quoted an analyst commenting on OPEC's new-found adeptness at "talking up the market." Now is seems as though the market is talking itself up or down, as each new prognositication about what OPEC can or cannot do on production levels immediately becomes a self-fulfilling prophecy.

The bandwagon effect is well under way now, and some kind of consensus is trying to rear its ugly head that OPEC is helpless to prevent a price collapse. Chew on this, though: Given where projections of oil demand have fallen in recent months and the level of existing OPEC production that is in excess of quota now, why haven't oil prices collapsed already?

The fundamentals of the market today would suggest a $25/bbl price (for OPEC's marker basket of crude) would seem unsustainable.

The International Energy Agency last week added to the growing list of forecasts that call for oil demand growth in 2001 and 2002 to remain below 1% as the global economy worsens in the wake of the Sept. 11 terrorist attacks on the US and the ensuing US-led military campaign against terrorism. This helps set the stage for another oil price collapse, the thinking goes, because OPEC would not undertake a production cut in the current economic and geopolitical climate for fear of being seen in the US as profiteering.

That now seems like a pretty superficial view of the current situtation, given the geopolitical complexities that are unfolding.

We've dealt at length in this space on what might happen if the military campaign spreads to include Iraq. There is no doubt that this would result in a substantial supply disruption by Baghdad, and oil prices would indeed spike.

But even setting this scenario aside for the moment, consider the news coverage of Pakistan's role in the war on terror. The Pakistani government has thrown in its lot with the US in efforts to bring Osama bin Laden and the Taliban to justice, despite the massive opposition with that country to the campaign (and to the US in general). The American public is getting a crash course in Islamic geopolitics, and they can see the price a moderate Islamic government pays for cooperating with the US.

At the same time, the Bush administration is going to great lengths to mitigate the anger of Muslims by demonstrating extensive humanitarian gestures to the Afghan people and by reiterating its cautionary notes about ethnic profiling of Muslims. And the American people are trying to come to terms with a complete change in their personal behavior (try boarding a plane today), so they should be able to accommodate a a concept that gives moderate Islamic allies of the US a bit more latitude on the issue of allowing a $25/bbl oil price-even with resulting higher products prices. In short, given where gasoline and diesel prices are now, after marching south steadily for weeks, OPEC need only to cut output by 500,000 b/d in order to sustaig its targeted $22-28/bbl.

Even if Iraq were to cut off supplies tomorrow, oil markets already would have begun discounting the "war premium" of interminably continuing pressure on Persian Gulf oil exporters. With oil demand remaining stagnant, no prospect of a strong reconomic recovery in the near term, and contuing incremental growth in non-OPEC supply, oil prices probably would have collapsed already without the war premium.

This war premium isn't a big one-it doesn't have to be-but that's the nature of the function of oil commedities. As the likelihood grows that this will be a very long military campaign, then watch for increasingly volatile prices being sustained at fairly high levels.

Remember the Iran-Iraq tanker war? That one lasted 8 years, and there is ample evidence that the war premium added up to at least several dollars extra in the price of crude oil during the 1980s. The last thing the US needs is a friendly government in the Middle East falling to homegrown militants, and everyone in the Bush administration knows that.

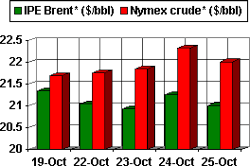

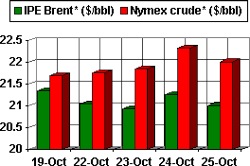

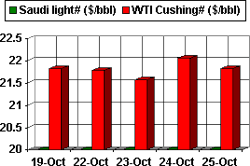

OGJ Hotline Market Pulse

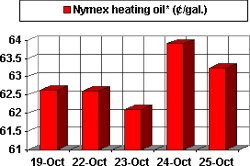

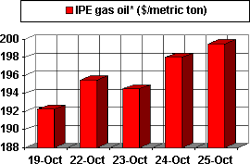

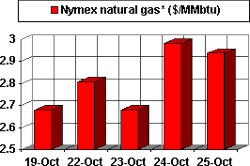

Latest Prices as of Oct 26, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null