Natural gas price outlook to test new limits for short cycle times

Hello, $2/Mcf gas: How long do you plan to stick around?

To which it might respond: Hello, demand elasticity: How low (or high) do you plan to go?

This scenario may be an even more worrisome prospect for many US and Canadian producers than the outlook for oil prices.

The concern for natural gas producers now is not merely how far down gas prices have to go-especially now that spot and futures prices have already pierced the key threshold floor of $2/Mcf on occasion in recent weeks. The real concern is how close to $2/Mcf will the market clearing price of natural gas remain in North America in the coming year or so.

The emerging consensus is pretty simple, gauging from much of the analysis coming forth these days: $4/Mcf is self-destructive because it brings so much supply on line so quickly and squelches demand; $2/Mcf encourages too much demand while it discourages supply development; and $3/Mcf seems to be a happy medium that never seems to hold.

Even that latter price level isn't such a happy medium when it concerns critical long-term supplies, such as Alaskan North Slope gas and many new LNG projects.

What seems to be emerging is yet another new market paradigm (like we needed another) that suggests that $2-4/Mcf may be the logical price range for US natural gas, but the path between the two is likely to be marked by short, violent spikes-much like an EKG of a patient getting defibrillated.

And it seems that the very nature of gas production in the US today, marked as it is by its maturity and an unprecedented level of productive efficiency, is mainly to blame for the problem. And the economic doldrums we're weathering are just exacerbating the problem.

Gas supply spikes

Lest one doubt the viability of this thesis, just take a look at the price path of natural gas in the past 15 months or so.

Natural gas prices were cruising along at a fairly comfortable level in first quarter 2000, registering a fairly respectable level for the end of the heating season at near the mid-$2/Mcf mark. Then the combination of weakening drilling activity owing to the previous industry downturn, strengthening demand thanks to a still-strong economy and booming power demand growth, and the growing tendency of US gas wells depleting faster than ever put the props under gas prices. That set the stage for last winter's wild rollercoaster ride to unprecedented sustained gas price levels. Which, in turn, set the stage for a demand collapse aggravated by the approaching heavy footfall of recession. And last year's price spikes encouraged a level of storage injection this year that turned around an inventory level seen as (theoretically, if impossible physically) a potential negative into a a bulging surplus that has collapsed gas prices in the matter of months.

And the analysts must now feel like plotting their price projections, for all their durability, on an Etch-a-Sketch.

UBS Warburg reckons US spot gas prices will average only $3.80/MMbtu for the year, down from a recent forecast of $4.10/MMbtu (of course, one must recall that this projection includes a first quarter average price of $6.45/Mmbtu, leaving the projected fourth quarter average at a mere $1.92/MMbtu.

And though you really didn't need to hear it, UBS Warburg avers that this forecast might prove "aggressive" if the normal winter temperatures don't materialize and the economy worsens.

UBS Warburg expects demand to contine to be weak heading into 2002-despite a growing opportunity for a reversal of the fuel-switching trend back to natural gas. Given brimming inventory levels and increased hydro and coal use, plus slightly higher levels of US LNG imports, it is hardly surprising that UBS Warburg analyst Ron Barone projects a spot price level of $2.70/MMbtu, down from an earlier projection of $3.40/MMbtu.

The main reason this price projection is closer to $3 than to $2 is that the slump in drilling that has followed the plunge in prices, in tandem with the continuing high wellhead decline rates, is whittling away at supply on both sides of the US-Canada border. Another key factor is incremental demand growth as more gas-fired power comes on stream. Still another is the likelihood of an economic rebound in second half 2002.

Longer term

As Barone notes in a recent research note, "Though long-term prices north of $4/MMbtu are likely not sustainable, we reiterate that demand issues have caused the recent collapse in prices and that composite levels below $2.50/MMbtu are also not sustainable."

He points to the rapid fall-off in drilling activity even though the industry has yet to produce a significant increase in deliverability from record drilling activity and growth in Canadian and LNG imports.

"Overall, prices have not remained above $2.50 long enough to trigger exploration in high-impact frontiers or to bring on material new LNG capacity," Barone said. "Rather the recent flurry of activity has been focused primarily on the development of marginal plays that have very high depletion rates.

In other words, the elasticity of supply is working as well as the elasticity of demand is. Overall, UBS Warburg sees gas prices in 2003-05 at $3-3.25/MMbtu.

Absent unusual economic or weather conditions, that will be enough to spur the development of frontier gas supplies and growth in LNG projects.

But some analysts see the slump in supply happening as soon as this winter, with gas prices bouncing back into the $3s again. With those prices, will the next ramp-up in drilling then be as quick? Or will operators hesitate enough to tighten markets again next year?

Here's a clue: Remember what helped aggravate the most recent downturn in wellhead deliverability? Right, the squeeze on cash flow and capital availability owing to depressed oil prices.

Or, rather, the next upturn on the rollercoaster just ahead of this coming dip.

OGJ Hotline Market Pulse

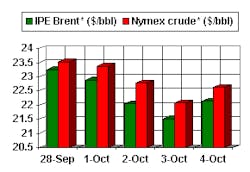

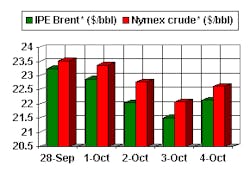

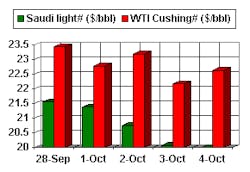

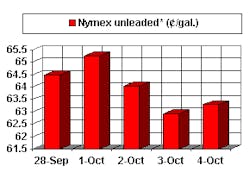

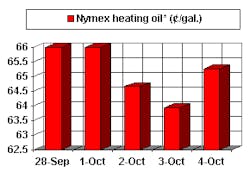

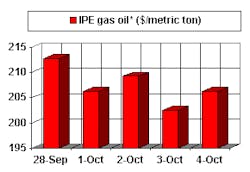

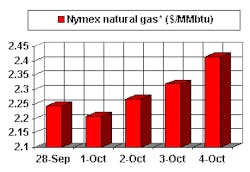

Latest Prices as of Oct. 5, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price