OPEC quota rollover likely-but perhaps soon usurped by Iraq's actions

For those of you anticipating that the Organization of Petroleum Exporting Countries will do anything at its meeting next week to change the near-term outlook for oil prices, we offer this bit of advice: Don't hold your breath.

Why should it? The group has said repeatedly that its official policy is to manage its contribution to global oil supply in such a way as to maintain oil prices within its target price band of $22-28/bbl, for the OPEC marker basket of crudes. And it's done a pretty effective job of accomplishing just that. Oil prices have swung within this band-albeit with some volatility-consistently since early last November, save for a brief dip for a few weeks below the band's floor early this year.

Despite all the hand-wringing over the effects on the global economy and (perhaps because of) the speculation over the role of tight US gasoline markets in the direction of oil prices, no one can convince OPEC that there is a compelling need to change its strategy right now.

That isn't to say there won't be a compelling reason to do so sooner or later.

The sooner part comes with Iraq and the growing likelihood that Baghdad will halt its oil exports under the oil-for-aid program this month as a consequence of its inevitable fit of pique over the UK proposal to introduce "smart" sanctions that minimize effects on Iraqi civilians but tighten the vise on Saddam Hussein's ability to build weapons of mass destruction (The US plans its own review and consideration of such sanctions this month that not only will track the UK proposal but probably be a bit tougher, fanning the flames in Baghdad). The current and ninth phase of the oil-for-aid program expires this Sunday, but it's highly doubtful that Iraq will do anything that will compel an immediate reaction by the rest of OPEC in such a short timeframe; the group will certainly want to wait a few days at least to absorb any Iraqi move (mainly to see if Saddam is bluffing, which he probably won't be).

If it looks as if Iraqi oil exports will be taken off the market for a period of weeks or months, then it's just as likely that the Saudis will huddle with Venezuela, the UAE, and non-OPEC Mexico to consider a quick ramp up in production. An emergency meeting of OPEC ministers probably wouldn't accomplish as much to quell a panicked market, and the former would help stave off moves by the US and others to dip into strategic stocks. (But a quick whistlestop tour soon thereafter by OPEC Sec. Gen. Ali Rodriguez to line up the rest of OPEC will probably accommodate the political correctness needs of the moment.)

While the OPEC guidelines call for consideration of an automatic output increase should the OPEC basket price exceed $28/bbl for at least 20 days, the organization has not been as sanguine about taking this step with prices on the way up as it has been with prices on the way down (where the post-floor trigger is pulled after only 10 days). Still, the Saudis and others would prefer to see OPEC oil fill the supply void rather than stored US crude. After all, regardless of where OPEC compliance, there is still a bit of an overhang of crude stocks in the Atlantic Basin-a crucial debating point for OPEC responding to its critics. This overhang has been pegged at about 2 days of added forward demand cover beyond where the market was a year ago.

If that's the case, then why is upward pressure on oil prices stubbornly persisting? As was discussed in this space in recent months, while low gasoline stocks are certainly a factor, there seems to be something else at play here. Just as the Iran-Iraq tanker war did in the 1980s and the Desert Shield standoff did in 1990-91, the prolonged prospect of a reduction in oil supplies has eventually built a premium into the price of oil. During the tanker war, which dragged on for 8 years, the premium was about $2-3/bbl. During Desert Shield, it was perhaps five times that level, but the expectations were of a supply disruption much more imminent and extreme. Now we have the price premium of unprecedented OPEC cohesiveness (disregarding that little bit of quota cheating that continues with little effect) that has held for pretty much for almost 2 years now. Is the value of that premium simply the difference between the upper end of OPEC's target price band and the unofficial (read: Saudi) target price of $25/bbl for that OPEC basket? That's not an unreasonable estimate.

Now for the later part of this conundrum. If OPEC doesn't boost supply in the coming month or so, it will certainly have to in the second half. A simple rollover of OPEC quotas will leave the market short of crude in the second half, even if Iraq plays nice for a change (speaking of not holding your breath...). So the next scheduled OPEC ministerial meeting, on Sept. 26, will certainly mean another quota boost in that event, as the call on OPEC crude will be about 1 million b/d higher in the third quarter than where actual production is today.

US gas injection surge continues as prices break $4 floor

The sizzling pace of natural gas storage injection in the US continues, and the upshot is that the year-to-year storage deficit has now turned into a surplus.

The combination of cooler-than-expected weather and continued exploitation by gas marketers of attractive arbitrage spreads has furthered the deflation of gas price expectations.

Together, these two trends are driving near-record rates of storage injection. Looking at American Gas Association data, operators injected 99 bcf of natural gas into storage for the week ended May 25. That's the fifth week in a row in which injection rates approached or topped 100 bcf. It compares with 118 bcf the prior week, 56 bcf at this same time a year ago, 71 bcf the same week in 1999, and the record of 120 bcf set June 23, 1994.

Overall, the US gas storage level stands at 1.281 tcf, vs. 1.274 tcf at the same time a year ago. Consequently, the overall year-to-year storage deficit-seemingly insurmountable just a couple of months ago-has changed to a 7 bcf surplus. That compares with deficits of 36 bcf and 99 bcf in the preceding 2 weeks.

UBS Warburg noted that the industry has not experienced a year-to-year surplus since Jan. 14, 2000.

"Looking ahead," the analyst said, "despite the expectation for solid peak-period power demands in the south-central and southwestern US..., the impact of mild conditions throughout several other key regions of the country, favorable NYMEX spreads...should facilitate expansion well into June."

Given comparable-week injection rates of 65 bcf/week last year and the prior 6-year average for the same week of 68 bcf/week, it is easy to envision weekly injection rates of 67 bcf/week that would be needed to reach the minimal heating season level of 2.8 tcf come Nov. 1.

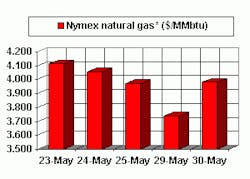

The abrupt turnaround in gas market expectations has knocked the wind out of the gas price sails, with spot prices falling below $4/MMbtu for the first time in many months and actually reaching a level a few cents below the same week a year ago.

OGJ Hotline Market Pulse

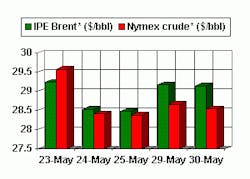

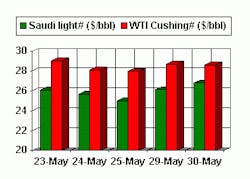

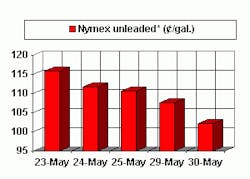

Latest Prices as of May 31, 2001

null

null

Nymex unleaded

null

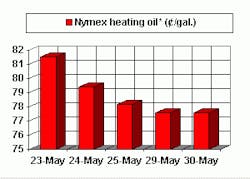

Nymex heating oil

null

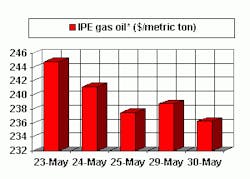

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price