OPEC draws line in the sand with non-OPEC; market war ahead?

If it seemed before as if oil market volatility could not be greater, we have now entered whiplash country.

Just as markets seemed poised to rebound in response to another OPEC meeting resulting in yet another production cut, we are now faced with the prospect of a possible production war that could see an oil price collapse early next year. But instead of reflecting another schism within OPEC, it reflects a standoff between OPEC and non-OPEC exporting nations-specifically Saudi Arabia and Russia.

That prospect triggered a stunning plunge of almost $4/bbl within a week's time.

Yet concurrent with the prospect of a production war is a less-apparent prospect: that of another major supply disruption looming with virtual certainty in the weeks to come. Even if the US-led campaign against terrorism doesn't target Iraq, there is a growing likelihood that Iraq will pull its supplies off the market later this year.

Whether that supply disruption enables a cooling off of what some analysts have called the oil market equivalent of the 1960 Cuban missile crisis between Russia and the US remains to be seen.

It is easy to speculate that oil prices will rebound in the days to come-probably as early as today-because a drop to less than $18/bbl seems unwarranted, given the current physical fundamentals of oil markets. NYMEX December crude sliding to $17.45/bbl, as it did yesterday, seems an overcorrection of perhaps overly zealous market bullishness ahead of the OPEC meeting.

But will the non-OPEC/OPEC war worsen, precipitating a price collapse next year?

Or will the US-led war on terrorism expand to the point that anger within Islamic countries derails the OPEC market share grab?

Market war

The Saudis made it abundantly clear this week that the OPEC meeting result was a shot across the bow of Russia.

Markets rallied somewhat last week with the news that Russia would participate with Mexico, Oman, and perhaps Norway in a non-OPEC bid of solidarity with OPEC to bolster oil prices. But the subsequent word from Moscow that its proposed cut would be a negligible 30,000 b/d weakened oil prices early this week and no doubt ruffled some OPEC feathers.

Then when OPEC announced Nov. 13 that its members had agreed to cut production by another 1.5 million b/d effective Jan. 1-but with a huge qualifier: only if non-OPEC oil exporters would agree to join it by cutting their collective output by 500,000 b/d. Never before has OPEC called for a specific cut by non-OPEC exporters in quid pro quo bid to enforce a production cut to bolster prices. Such agreements in the past have allowed non-OPEC exporters to voluntarily trim output under a "gentlemen's agreement" that did not call for specific volume cuts. Consequently, some non-OPEC exporters have responded with only token cuts, even rolling them back unilaterally if it suited them; others ignored them altogether.

But tokenism won't be tolerated this time, warns OPEC.

Lest there be any doubt over who the primary combatants in this market war are, Saudi Oil Minister Ali al-Naimi said OPEC would "absolutely not" cut production unless Russia agrees to also cut its production.

Just as Venezuela was the overachiever in production growth that precipitated the last market share grab by Saudi Arabia, Russia has fallen within the Saudis' crosshairs. Perhaps recalling that it was once the world's largest producer of crude oil for a number of years (when still the Soviet Union), Russia's emerging new giant oil companies have aggressively ramped up production of crude oil-almost 500,000 b/d/year in 2000-01.

Early indications are that the Russians are already digging in their heels. And even if Moscow did agree to bigger output cuts, it would not necessarily be a fait accompli as it was in the past-when a centrally controlled government would simply issue an edict. The chiefs of Russia's new oil majors are powerful political figures in their own right now and not to be taken lightly.

Is it a coincidence that Russia's new willingness to take on the Saudis comes at the same time that President Vladimir Putin is visiting President George W. Bush in Texas? Or that this summit is emanating the sort of chumminess unprecedented for these two nations, with comments focusing on US investment in Russia's oil and gas sector?

Some speculate that the Russian stance on oil reflects a desire by Moscow to be fully embraced by the major developed economies as an equal. Why else would Russia be willing to risk the damage to its economy from an oil price collapse? Moscow already is anxious about making massive debt repayments next year, and giving the struggling global economy a gift of low oil prices could buy a lot of forbearance, contends the Calgary-based Canadian Energy Research Institute.

CERI doesn't think Russia will cave in to OPEC's demand, setting the stage for the country to position itself as a secure source of oil and gas demand supply to the West in the long term.

As a result, CERI thinks WTI will average $20/bbl in the fourth quarter and will "fall off the cliff in 2002, averaging $14/bbl.

"Even if Russia comes around and agrees to cut, given its [and other major non-OPEC exporters'] dismal track record in keeping...promises, it is only a matter of time before the oil price war begins in earnest."

Yet other analysts think that OPEC is again being underestimated, as it once before it continually surprised markets with a remarkably long-lived display of cohesion.

Raymond James & Associates notes that OPEC compliance with its pledged output cuts of 3.5 million b/d to date averaged 76% as of October. And RJA sees that cohesion holding up while the prospect of an oil supply disruption grows, supporting an oil price of $26/bbl next year. Next week's column will focus on that scenario in greater depth.

OGJ Hotline Market Pulse

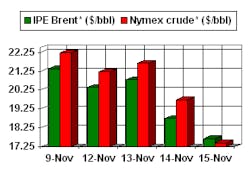

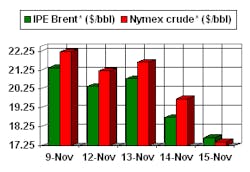

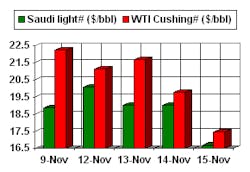

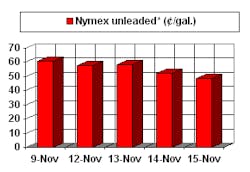

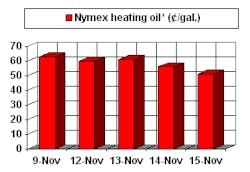

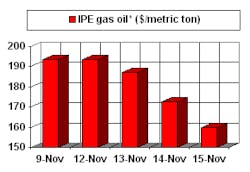

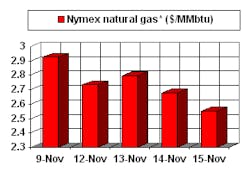

Latest Prices as of Nov. 16, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price