OPEC opts to defend price vs. market share-for now

The Organization of Petroleum Exporting Countries is about to face up to its Hobson's choice right now by opting to defend price rather than market share.

How long that choice remains in effect will depend to a great degree to which non-OPEC oil exporters step up to help that effort.

It is clear now that there remains little prospect of significant recovery in oil demand growth this year. After the Sept. 11 terrorist attacks on the US, prospects for global recession have deepened, taking oil demand with them.

After seeing oil prices hover below the lower end of its targeted oil price band ($22-28/bbl for the OPEC basket of crudes) for several weeks, OPEC has sent clear signals to the market that it intends to cut production again in order to bolster sagging prices. That accord is likely to be hammered out ahead of the ministerial meeting in Vienna Nov. 14, so what emerges from OPEC then won't be a surprise. Neither is the size of the impending cut, likely to be 1 million b/d.

However, OPEC has sent a similarly clear signal to its counterpart oil exporters outside the organization: You are expected to do your part as well. While not stated overtly, the unmistakeable subtext of this message is this addendum: ...Or face a market share war later.

So far, there has been little indication of support among non-OPEC oil exporters for participating in OPEC's round of cuts. Only stalwart Oman (which might as well be a member of the group, given its unfailingly lockstep actions) has volunteered to join in the cuts. Even Mexico, co-architect of the seminal agreements with Saudi Arabia and Venezuela a few years ago that rescued oil prices from the cellar and spawned the OPEC cohesion that brought about the high oil prices that persisted until recently, has taken an initial pass.

These two countries and other oil exporters outside OPEC are likely to attend the Nov. 14 Vienna meeting as well, and there will certainly be a lot of jawboning between now and then.

Even after the post-Sept. 11 collapse in demand, markets are bound to tighten somewhat, as the approach of winter weather inevitably boosts oil demand and as supply starts to diminish. OPEC managed to cut output closer to quota levels in September, and the cuts to follow will only shrink that pie further.

Demand outlook

So the prospect for oil prices being sustained now hinges on how demand in 2002 will be affected by the state of the world economy.

Embodied in this outlook is the critical risk that OPEC faces: Propping up oil prices also could delay the economic recovery that could sustain oil demand growth again, creating longer-term problems for OPEC.

According to London-based Centre for Global Energy Studies, the outlook for 2002 economic growth is either optimistic or pessimistic:

"The optimistic view sees a US-led recovery in the second half of the year, with global economic growth averaging 1.5-2.0%/year in 2002 and oil demand rising by some 750,000 b/d," CGES said. "Implicit in this view, however, is an economic stimulus in the form of lower oil prices-perhaps below $20/bbl.

A more pessimistic view, CGES maintains, sees no growth in the US economy next year and the global economy growting my only 1%.

"The global economy is clearly too big to be affected by just OPEC, but the organization's oil price policy over the coming 12 months could have some influence on the course the global economy takes," the think tank said.

CGES also noted that non-OPEC production is expected to increase by about 700,000 b/d in 2002, which will absorb all the demand growth-"even in the most optimistic of scenarios"-and thus squeeze OPEC's market share if demand growth fails to come about.

The worrisome aspect of this scenario is that the price point at which non-OPEC producers are forced to make noticeable cuts is well below OPEC's trigger point. So OPEC is likely to go it alone for now. The market is pretty well at that point now.

Again OPEC-mainly Saudi Arabia finds itself acting as swing producer in a difficult market. The trick for the Saudis now is to navigate these treacherous market waters expertly enough to keep from losing too much market share, while keeping oil revenues up enough to satisfy local constituencies of concern yet keep oil prices from getting so high that the market is crippled for everyone.

Will there come a point when the Saudis have decided that a low oil price is more in its interests than a high oil prices? The International Energy Agency last week revealed a study on future oil supply that, among other things, demonstrated that, in the long run, OPEC revenues would benefit more from a moderate price than from a high or low price.

The Saudis may well recognize that a low oil price for a couple of years-a la 1986-might be the best transition to that moderate price scenario. After all, $30/bbl does the kingdom no good when its market share shrinks to, say, 5% in order to defend that price.

So economic recovery next year may well determine the course of oil markets for years to come.

OGJ Hotline Market Pulse

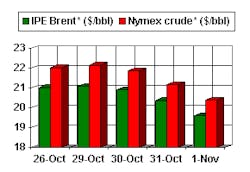

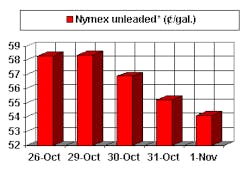

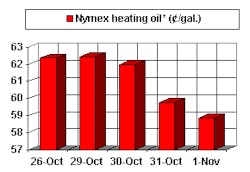

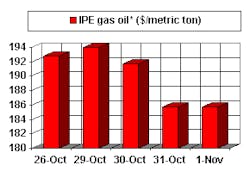

Latest Prices as of Nov. 2, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

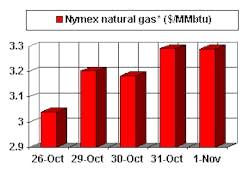

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price