Is OPEC trying to defend price with 'just-in-time' production?

Is "just-in-time" production the new buzzword that defines's OPEC's approach to oil markets?

This now-hallowed management term has been bandied about for the industry before-incorrectly, as applied to refiners' evolving acceptance of lower crude inventory levels.

But it serves as a colorful moniker for a very real shift that has occurred in OPEC's stance on shaping supply in order to defend a desired price level.

Simply put, this term merely reflects OPEC's aggressive-to fall back on another overused buzzword, "proactive"-efforts to cut or hike production quotas in response to anticipated demand levels, not merely the lagging reactionary approach of the past. Others have called it "fine-tuning" or "micromanagement"-but not necessarily in approving tones.

To many observers, OPEC's latest agreement to cut production quotas-by 1 million b/d, at the high end of these observers' expectations-at this time seems not only counterintuitive but even self-destructive. Time will tell whether the lattern concern comes to fruition-i.e., whether such aggressive price defense ultimately saps the strength of what had been a fairly robust pattern of oil demand growth.

OPEC strategy

But is the move really counterintuitive in light of today's market, or is it merely a form of anticipatory-response supply "hedging" against the wild card that is Iraq today?

Certainly, oil markets did nothing to disabuse OPEC of the notion that its proactive approach is warranted. Even with crude and products inventories collectively at their lowest point since 1990, before the Persian Gulf crisis, markets responded to the OPEC cuts by dropping crude futures by more than $1/bbl since the OPEC meeting in Vienna adjourned last weekend.

That brought the OPEC marker basket of crudes to the low end of its official target price band of $22-28/bbl. But the unofficial (and real) target price for that basket is $25/bbl. Of this there can be little dispute, as the Saudis and others have, with uncharacteristically public aplomb, declared that to be the case.

The $25/bbl target may be threatened by the state of Iraqi production, which is not only excluded from any OPEC quota restrictions but also has proven a will-o'-the-wisp that has popped up from time to time to bolster or undermine prices. In this case, OPEC has been understandably nervous about Iraq's resurgent output coming onto the market in the second quarter, at a seasonally slack time for oil markets. Reports have been circulating that Iraqi output, which fled the market over another tiff with the UN in early December, is back with a vengeance-and possibly building to a new (recent) high of 3 million b/d.

So the current scene is like looking at a negative of oil markets in late 1997: OPEC then was banking on continually rising demand and jacking up its output quotas on the basis of that expectation; this accompanied the earlier return of Iraqi oil to markets and the steep and unexpected collapse in Asian oil demand stemming from the economic collapse in that region. (Well, perhaps not entirely negative, as the slowing economies of the US and Japan will attest today.)

Reading the tea leaves

In any event, OPEC feels it's doing a better job of reading the tea leaves this time around and is anticipating the demand slump and revival of Iraqi oil supplies. But is it getting a good read on oil demand and its sibling, economic growth?

"OPEC continues to assert that the world economy can handle $25/bbl oil prices and that, if there is any concern about where this puts end-user prices, then consumer governments should reduce the taxes they impose on oil," said UBS Warburg.

As long as the group believes that, it will continue to tailor supply to expected demand levels. Accordingly, more market observers see this emerging as a new market paradigm for OPEC and are beginning to ratchet up their near-term forecasts as a result.

UBS Warburg, for one, jumped its base-case forecast for oil prices to $26/bbl for Brent and $28.25/bbl for WTI this year and $22.50 Brent and $24/bbl WTI for next year. But it's sticking to a midterm forecast (2003 and after) of $17/bbl Brent and $18.50/WTI, so that would argue against long-term expectations of OPEC being able to sustain its defense of a target price.

But for the short-term, OPEC is bent on aggressively defending its target price-or at least the official price band, should the market conspire against OPEC by not fulfilling the group's expectations that demand will not unduly suffer.

Once the Feb. 1 and Apr. 1 OPEC quota cuts have been fully absorbed and demand starts to ramp up again in the second quarter, it will become apparent as to whether or not OPEC has overreached. If it has, markets are apt to very tight in the second half and oil prices of $30/bbl may be the norm.

If, in fact, Iraqi oil output really comes back strong, demand continues to slump with economic doldrums, and if OPEC compliance starts to soften again as quotabreaking proliferates, then OPEC might feel compelled to undertake yet a third cut this year. If the cumulative effects of these cuts do not keep OPEC's marker basket price well above $22/bbl, then look for yet a third cut, probably the result of an emergency meeting and consultations with the likes of Mexico, Oman, and Norway. This cut could come even before the next regularly scheduled ministerial meeting in June.

Defending price

There is ample evidence of this recent trend within OPEC toward aggressive defense of target prices on the downside vs. the upside. It is even structural in nature, as USB Warburg points out.

"The first small signs of this bias [toward defending against price declines] were apparent in mid-2000, when OPEC designed its price control mechanism," the analyst said. "This calls for a quota increase after the price has been above $28/bbl for 20 days and a quota decrease after it has been below $22/bbl for just 10 days.

"Even so, OPEC moved ahead with cuts at its Jan. 17 meeting, although the basket price had been below the bottom of the band for only 7 days and had already climbed back to $24.50/bbl. In 2000, in contrast, prices were above the top of the band continuously from Aug. 14 to Dec. 4."

Some might call that greed. Others might call it a bid to capture revenue in an anticipatory hedge against the market encroachment of Kyoto-inspired campaigns to reduce oil consumption; indeed, it could be argued that the larger target of such a bid might be the campaign against fossil fuels. Already in the US, the discussion of energy security vs. environmental goals is back on the table. Given the growing panic over California's energy crisis spreading, combined with the Bush administration's clear-eyed recognition of what OPEC is doing in tandem with efforts to relax air quality standards to quell the energy panic, the energy security side may not be winning yet, but it is clearly gaining ground.

OGJ Hotline Market Pulse

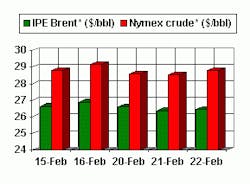

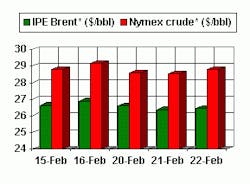

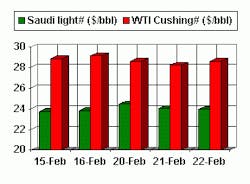

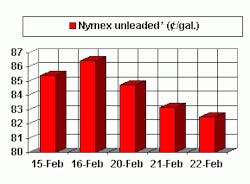

Latest Prices as of March 16, 2001

null

null

Nymex unleaded

null

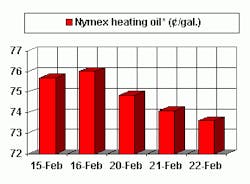

Nymex heating oil

null

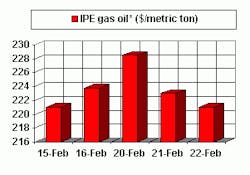

IPE Gas oil

null

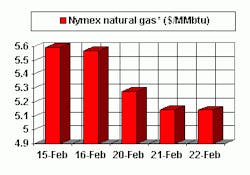

Nymex natural gas

null

*Futures price, next month delivery. #Spot price