Oil market to hold status quo: tight, volatile

A sampling of energy analysts' reports yields an emerging consensus that oil markets the rest of this year will remain tight and volatile. Sound familiar? It should.

At presstime days before the Organization of Petroleum Exporting Countries was to hold its latest extraordinary meeting in Vienna, there was no expectation that the group would doing anything more than reaffirm the status quo.

Right now, the status quo entails abnormally low inventories, oil demand growth that continues to be positive, and a strong likelihood for a supply disruption from a key exporter. And, of course, there's the perpetual Iraqi wild card, which of late has surprised on the price upside vs. expectations of a downside influence.

Rebuilding stocks, OPEC role

"Commercial oil inventories around the world need to be rebuilt at a rate of at least 1 million b/d over the next 6 months if forward stock cover is to be restored to a more comfortable level by the start of 2004," said London think tank Centre for Global Energy Studies. "The US alone needs to import oil at a record rate of 10 million b/d for the rest of the year to restore its on-land oil inventories to the middle of their historical range."

Accordingly, CGES called on OPEC to honor its pledge to ensure adequate global oil supply in light of the delicate market balance.

J. Marshall Adkins, with the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla., doesn't see that happening. He contends essentially that OPEC will hold to the view of: Why mess with success?

"Since 1999, OPEC's production performance has been nearly flawless, as crude oil prices have held right around the midpoint of its targeted OPEC basket price range of $22-28/bbl (or $24-30/bbl for US benchmark oil)," he said in a recent research note.

Adkins cites June OPEC production data and a "significant decline in tanker rates" in June-July as evidence of OPEC's latest production cuts, which kicked in June 1.

In fact, the RJA analyst predicts that OPEC will undertake further production cuts sometime in first half 2004 to keep oil prices from skidding back down to about $20/bbl.

Cuts coming sooner?

But those OPEC cuts could come sooner rather than later, if Merrill Lynch analysts Michael Rothman and Steven A. Pfeifer are divining the entrails correctly.

"While (market fundamentals) collectively suggest there are still material upside hazards for crude in the near term, we would look at current oil prices as having more downside risk than upside potential," they said in a recent research note. "The view is predicated largely on our sense that the key OPEC countries are uncomfortable with the price move back up towards $32/bbl (WTI crude) based on evident underlying concerns about the pace of global economic growth."

Rothman and Pfeifer see further evidence of price slippage in the months ahead in the actions of "commercial" energy commodities traders (which they see as the oil companies themselves) having built up a very large net short open-interest (futures or options contracts not yet exercised or fulfilled) position in New York Mercantile Exchange crude contracts. Historically, this development usually presages a "topping out" of oil prices.

So the Merrill Lynch analysts posit that, regardless of the outcome in Vienna, OPEC members with spare capacity, led by Saudi Arabia, will try to engineer a "soft landing" for oil prices.

Of course, there is the familiar litany this year of supply concerns regarding Venezuela and Nigeria. Those supply concerns aren't going away anytime soon.

But it is Iraq that has flummoxed the prognosticators who predicted a return to prewar production levels of 3 million b/d within a few months, perhaps by fall. And now expectations of even 1.5-2 million b/d by yearend are beginning to look overly optimistic.

In the longer term, many analysts concur that non-OPEC supply growth will eat away at OPEC's market share significantly. Put aside the demand outlook and more-transitory oil-geopolitical hotspots. Then consider that it is the timing of Iraq's resurgence that will determine the duration of OPEC's window of opportunity before it must grapple with ceding market share to the likes of Russia.

Why wouldn't OPEC want to cash in now? The Saudis, now being blasted by US politicians for alleged high-level complicity in the Sept. 11, 2001, terrorist attacks, might be pondering that as more than merely a rhetorical question right now.

(Author's e-mail: [email protected])

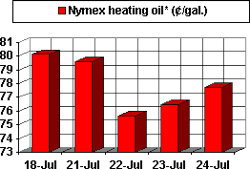

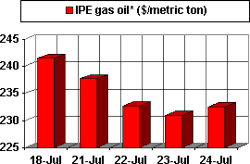

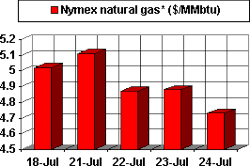

OGJ HOTLINE MARKET PULSE

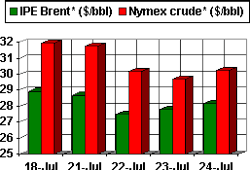

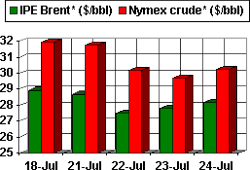

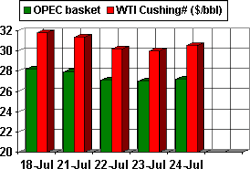

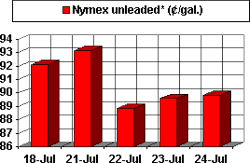

Latest Prices as of July 25, 2003

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price